TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, January 23, 2023

TAKE PROFIT WHEN AVAILABLE!

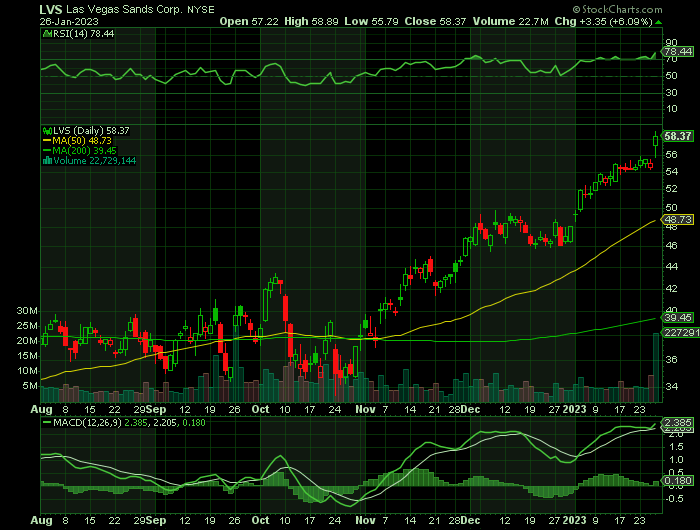

Weekly Options Trade – Las Vegas Sands Corp. (NYSE: LVS) CALLS

Friday, January 27, 2023

** OPTION TRADE: Buy LVS FEB 10 2023 58.000 CALLS - price at last close was $1.39 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Las Vegas Sands Corp. (NYSE: LVS) reported fourth-quarter 2022

results, with earnings and revenues missing the Consensus Estimate. However,

the top and the bottom line improved on a year-over-year basis.

Following the announcement, the company’s shares increased in the after-hour

trading session on Jan 25. Positive investor sentiments were witnessed as the

company reported significant improvement in property visitation, gaming

volumes, retail sales and hotel occupancy in the Macao region. Also, the

relaxation of travel restrictions (of a wider region) and improved airlift

capacity added to the positives.

Robert G. Goldstein, chairman and CEO, stated, "While travel restrictions

and reduced visitation continued to impact our financial performance during the

quarter, we remain confident in a robust recovery in travel and tourism

spending across our markets and deeply enthusiastic about the opportunity to

welcome more guests back to our properties throughout 2023 and in the years

ahead."

About Las Vegas Sands.....

Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Asia and the United States.

It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore. The company also owns and operates The Venetian Resort Hotel Casino on the Las Vegas Strip; and the Sands Expo and Convention Center in Las Vegas, Nevada.

Its integrated resorts feature accommodations, gaming, entertainment and retail malls, convention and exhibition facilities, celebrity chef restaurants, and other amenities.

Las Vegas Sands Corp. was founded in 1988 and is based in Las Vegas, Nevada.

Further Catalysts for the LVS Weekly Options Trade…..

Earnings.....

Las Vegas Sands Corp on Wednesday reported a wider-than-expected quarterly loss and its revenue fell short of Wall Street estimates as travel restrictions and fewer trips to its casinos in Asia hit results.

The Las Vegas-based casino operator sees a recovery in future demand, pointing to the return of traffic to its locations following the Lunar New Year. Its property in Macau saw 71,000 visitors on Monday, the highest single day since the pandemic.

The casino operator said it remains confident in a robust recovery in travel and tourism spending across its markets, the company's chief executive officer, Robert G. Goldstein said in a statement.

Las Vegas Sands posted an adjusted fourth-quarter loss of 19 cents per share missing analysts' expectations for a loss of 9 cents a share, according to Refinitiv data.

The casino operator's revenue rose to $1.12 billion in the fourth quarter from $1.01 billion a year earlier, but missed analysts' average estimate of $1.18 billion.

Singapore Market.....

Emphasis on increasing investments in the Singapore market bodes well. During the previous quarter, the company emphasized on its $1-billion capital investment program at Marina Bay Sands, thereby initiating new suite products in premium segment-focused amenities of the resort. The company reported a solid response with respect to the same. Also, it stated additional offerings, including spacious new suite products, are in the pipeline. Given the relaxation of virus-related restrictions in Singapore and other source markets coupled with the improvement in airlift activities, the recovery momentum has continued.

Commentary.....

Robert G Goldstein, chairman and chief executive officer, said that the lessening of travel restrictions will help Las Vegas Sands to broaden its horizons after the pandemic.

“In Singapore, we were pleased to see the robust recovery continue at Marina Bay Sands during the quarter, with the property delivering record levels of performance in both mass gaming and retail revenue,” said Goldstein.

“We are excited to have the opportunity to introduce our new suite product to more customers as airlift capacity improves and growth in visitation from China and the wider region is enabled by the relaxing of travel restrictions.”

He added that development in Macau would further enhance Las Vegas Sands’ presence in the region, particularly as the operator received a concession to continue operating there in December 2022.

“In Macau, we were gratified to receive a new gaming concession during the quarter, which will enable us to continue our decades-long commitment to making investments that enhance the business and leisure tourism appeal of Macau and support its development as a world centre of business and leisure tourism,” he continued. “We remain deeply confident in the future of Macau and consider Macau an ideal market for additional capital investment.”.

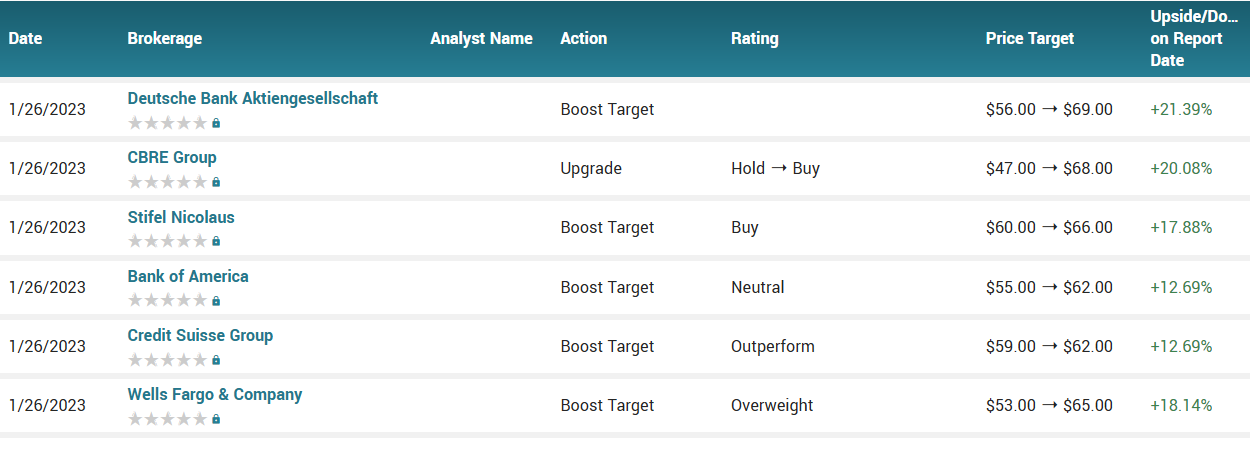

Analysts.....

Morgan Stanley analyst Stephen W.Grambling reiterated an Overweight rating on the shares of Las Vegas Sands Corp and a price target of $53.

The company also outlined $3.8 billion in concession-related spend over the next 10 years, with $2.7 billion allocated to capital projects and $1.1 billion to operating commitments, the analyst cited.

LVS is now generating positive EBITDA in Macau and management highlighted visitation trends in their properties are outpacing the market, cited the analyst.

Importantly, if stronger spend / visitor holds as visitation comes back, flow through could push margins higher than pre-COVID, added the analyst.

The analyst specified that when combined with sustained momentum in Singapore, fundamentals are trending toward the Bull case within the risk-reward framework.

Also, Las Vegas Sands had its price target raised by Barclays from $57.00 to $58.00 in a research report released on Tuesday. They currently have an overweight rating on the casino operator’s stock.

According to the issued ratings of 12 analysts in the last year, the consensus rating for Las Vegas Sands stock is Moderate Buy based on the current 1 hold rating and 11 buy ratings for LVS. The average twelve-month price prediction for Las Vegas Sands is $62.64 with a high price target of $76.00 and a low price target of $42.00.

Summary.....

Las Vegas Sands’ fourth-quarter performance benefited from the solid recovery in its Singapore business, strong customer demand for the gaming and retail perspective (in Macau) and sales-building initiatives. This and the emphasis on new project investments and revenue diversification efforts aided the company’s performance in the to-be-reported quarter.

TAKE PROFIT WHEN AVAILABLE!

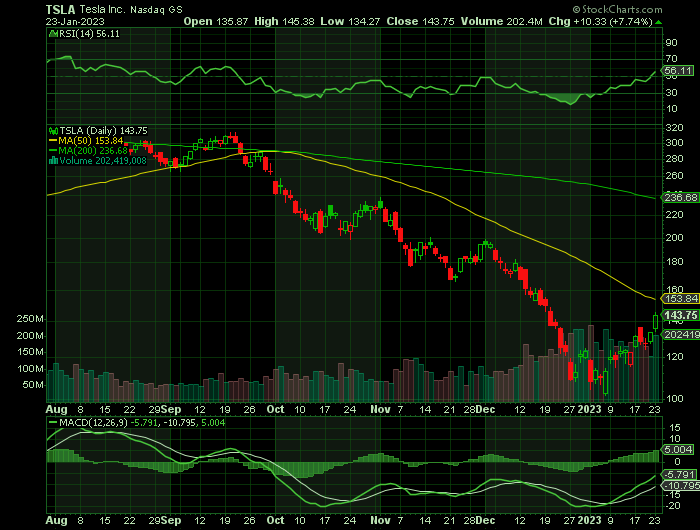

Weekly Options Trade – Tesla Inc (NASDAQ: TSLA) CALLS

Tuesday, January 24, 2023

** OPTION TRADE: Buy TSLA FEB 03 2023 150 CALLS - price at last close was $5.99 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Tesla Inc (NASDAQ: TSLA) reports earnings on Wednesday, after the market closes. The consensus earnings estimate is for $1.17 per share on revenue of $26.16 billion but the Whisper number is for $1.04 per share.

Consensus estimates are for year-over-year earnings growth of 33.46% with revenue increasing by 47.64%.

The electric car maker has had a tough year, between production delays in China, backlash over Chief Executive Elon Musk’s acquisition of Twitter Inc. and his unloading of tens of billions of dollars of his own Tesla shares. Investors have soured on the stock, which had its worst year in 2022.

None of that has deterred analysts who follow the company. In fact, 64% of analysts covering Tesla have “buy” or “overweight” ratings for its stock, according to FactSet. That is the highest share since the end of 2014, according to the data provider.

The analysts have a median target price of $194 for Tesla. Tesla shares closed at $143.75 Monday, 26% below that level.

Canaccord Genuity analyst George Gianarikas says to bet the farm on battered Tesla stock ahead of the company's hotly anticipated earnings report.

"Buy [Tesla stock] — it's pretty simple," Gianarikas said. "The stock had a pretty bad 2022 in terms of performance. That was based on multiple things, and some would attribute it to Elon Musk's rantings on Twitter. We think it had a lot to do with the demand situation impacting Tesla, first in China and later kind of leaking into other parts of the world, including the United States. People know that. A lot of that seems to be priced into the stock."

The bullish call on Tesla — which has become a rarity in recent months on the Street — runs counter to a host of red flags on the automaker's fundamentals.

Tesla reported a delivery growth figure of 39% for 2022, which badly missed analyst estimates and fell below the company's own guidance of 50%.

And earlier this month, Tesla cut the price of the Model 3 base version by $3,000 to $43,990 and the Model 3 Performance version by $9,000 to $53,990 in the U.S. As for the Model Y Long Range, the price dropped by $13,000 to $52,990 while the Performance model was cut to $56,990, about $13,000 cheaper than the prior price.

The U.S. discounts come hot on the heels of recent price reductions in China, Japan, and South Korea as Tesla looks to reignite demand against growing competitive threats.

Gianarikas said he believes the price cuts will stoke demand, even if it weighs on profit margins. The analyst is also bullish on the margin lift to Tesla from selling more software upgrades to customers.

Tesla remains the most dominant player in the electric-car industry.

Sales of electric cars in the U.S. jumped last year, even as total U.S. auto sales fell 8%, according to market-research firm Motor Intelligence. Although legacy car companies such as Ford Motor Co., General Motors Co. and Hyundai Motor Co. have rolled out more of their own electric models in recent years, they have continued to trail behind Tesla. Mr. Musk’s company accounted for 65% of electric cars sold in the U.S. last year, according to Motor Intelligence.

“Despite lowering estimates and reported production cuts, we continue to believe [Tesla] is the best positioned EV maker in both the near and long term,” Ben Kallo, senior research analyst at Baird, said in a December note on the company.

Other analysts believe the stock has fallen too much, given its potential for further growth.

Tesla is “way oversold,” Wedbush Securities analysts Daniel Ives and John Katsingris wrote in a January note.

Tesla’s recent price cuts may help boost demand for its vehicles in key markets such as China, Mr. Ives said in a separate note. The analyst, who conducted a survey of 500 electric car buyers in China, said he found that nearly 70% of respondents said they were more likely to purchase a Tesla Model Y because of lower prices.

The price cuts “have been a home-run success out of the gates,” he said.

Summary.....

As with many other growth stocks, Tesla soared during the pandemic, only to then tumble last year after accelerating inflation forced the Federal Reserve to swiftly raise interest rates. In the past few weeks, though, investors have grown more hopeful that the Fed will pivot from raising rates to cutting them by the second half of the year. That has fueled a comeback among many growth stocks—Tesla included. Shares, while still down substantially from their 2021 high, are up 17% this year, compared with the S&P 500’s 4.7% gain.

“We are as bullish about Tesla as we have ever been,” ARK Investment Management founder Cathie Wood said Thursday on a webinar. Tesla is the third biggest holding in Ms. Wood’s flagship ARK Innovation Fund, which is invested in companies that she believes are at the forefront of “disruptive innovation” in their industries.

She added that she believes Tesla shares could rise fivefold over the next five years.

TAKE PROFIT WHEN AVAILABLE!

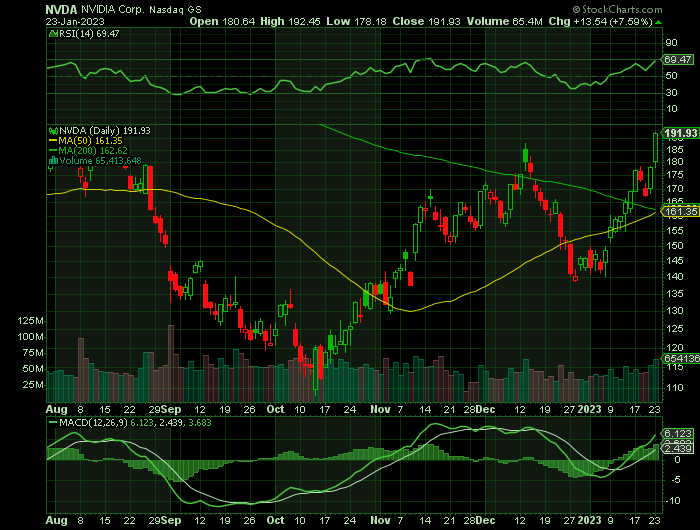

Weekly Options Trade – NVIDIA Corporation (NASDAQ:NVDA) CALLS

Tuesday, January 24, 2023

** OPTION TRADE: Buy NVDA FEB 10 2023 200 CALLS - price at last close was $5.35 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

NVIDIA Corporation (NASDAQ:NVDA) is one of the leading companies in the fast-growing fields of PC graphics, gaming and artificial intelligence.

In the weeks since the ChatGPT artificial intelligence tool took the world by storm, Nvidia Corp. has emerged as Wall Street’s preferred pick for traders seeking to profit from its potential.

Nvidia dominates the market for graphics chips designed for complex computing tasks needed to power AI applications. The more people use ChatGPT, the more computing power its owner OpenAI requires to generate responses to the millions of queries received from lazy students with essay assignments or struggling songwriters.

Last week, Citigroup Inc. estimated that rapid growth in ChatGPT usage could result in sales for Nvidia of $3 billion to $11 billion over 12 months. Analyst Atif Malik, while acknowledging the difficulty in modeling growth for such a nascent service, based his values on projections for number of words generated by ChatGPT and revenue per word for Nvidia.

“We believe Nvidia has in ChatGPT a potentially meaningful compute demand driver,” Malik wrote in a research note last week.

Bank of America Corp. said Nvidia is at the forefront of the companies that stand to benefit from growth in so-called generative AI. Wells Fargo & Co. said upcoming chips from Nvidia are well positioned to take advantage of greater computing needs required by AI models like ChatGPT.

Nvidia shares were up more than 7% on Monday afternoon. And, if the market continues on a positive track, more is expected.

The chipmaker’s stock has rallied 29% since the start of the year, placing it among the best performers in the S&P 500 Index.

Truist Securities analyst William Stein on Monday upgraded his view of semiconductor stocks to positive from neutral. He sees the most upside potential for buy-rated semiconductor stocks Nvidia.

Stein likes Nvidia for its presence in AI computing.

As well, Barclays gave the larger increase, sending its price target $80 per share higher to a new level of $250. Meanwhile, Truist gave Nvidia stock a $40-per-share target boost to $238.

Summary.....

Nvidia has worked hard to build up proprietary prowess with specialty products. That's a big part of why its share prices have soared over the years, despite the ups and downs of the broader industry.

Therefore, it's not surprising to see Wall Street analysts applauding the efforts that Nvidia has made. With the stock down sharply from their highs, investors are getting a relative bargain.

Back to Weekly Options USA Home Page