TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, jUly 12, 2021

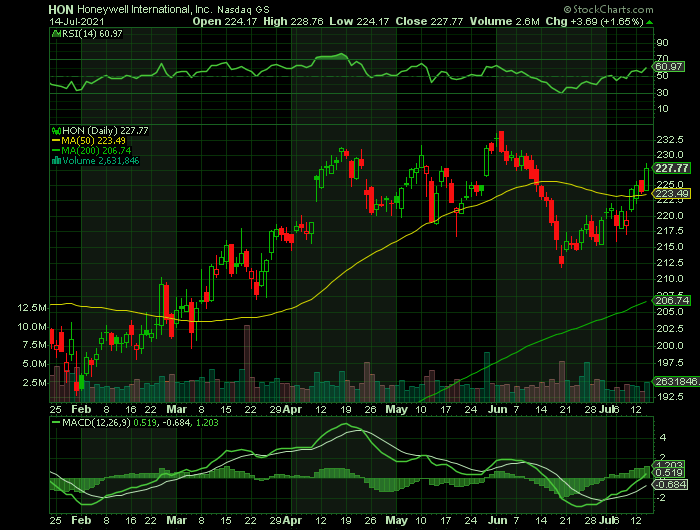

Weekly Options Trades – Honeywell International Inc. (NYSE:HON) Calls

Thursday, July 15, 2021

** OPTION TRADE: Buy HON JUL 30 2021 230.000 CALLS at approximately $3.00.

(Some members have asked for the following.....

Place a pre-determined sell at $5.00.

Include a protective stop loss of $1.20.

Prelude.....

Software investments are essential and positive for two reasons:

- They are a natural and necessary development, as more of the productivity in industrial companies' solutions is likely to come from the software side due to the growth in the Internet of Things (IoT) and digitization, and

- The shift toward more software revenue usually means higher margin, higher recurring revenue, and should translate to investors valuing these businesses somewhere between a traditional industrial company and a software company.

And,Honeywell International Inc. (NYSE:HON) is investing internally to develop software capability.

CEO Darius Adamczyk wants Honeywell to be known as a software-industrial company. It's an aim that highlights the investment Honeywell has been making in digital capability, not least in its software and digital solutions capability, known as Honeywell Forge. A company that makes everything from power units on airplanes to building controls, process automation, chemicals, safety equipment, and warehouse automation is never going to be viewed as a software company.

Shares of the diversified technology and manufacturing company are up around 4.1% year-to-date, closing at $227.77 yesterday. A strong Q2 earnings report might be the catalyst to steer the stock back to its 52-week high of $234.02.

THE Major CatalystS for This Trade.....

1. Buying Before Earnings – Then Sell Before Earnings…..

Honeywell's next earnings report is expected to be released on July 23, 2021, before the market opens.

Wall Street analysts expect Honeywell to report Q2 earnings per share of $1.96. Meanwhile, the company has guided for EPS of between $1.86 and $1.96. Analysts expect revenues of $8.61 billion against the company’s guidance of between $8.4 and $8.7 billion.

The reported EPS for the same quarter last year was $1.26.

Honeywell consistently beats earnings estimates and might be well positioned to keep the streak alive in its next quarterly report.

This company has an established record of topping earnings estimates, especially when looking at the previous two reports. The company boasts an average surprise for the past two quarters of 5.08%.

For the last reported quarter, Honeywell came out with earnings of $1.92 per share versus the Consensus Estimate of $1.80 per share, representing a surprise of 6.67%. For the previous quarter, the company was expected to post earnings of $2 per share and it actually produced earnings of $2.07 per share, delivering a surprise of 3.50%.

The Warehouse and Workflow Solutions segments grew by double-digit in Q1, while the Personal Protective Equipment (PPE) business, Advanced Materials, and Connected Software segments also performed well.

Cost actions taken in 2020 allowed Honeywell to post margin expansion on Safety And Productivity Solutions in Q1.

2. Recent Estimates…..

With this earnings history in mind, recent estimates have been moving higher for Honeywell International Inc. In fact, the Earnings ESP (Expected Surprise Prediction) for the company is positive, which is a great sign of an earnings beat.

The idea here is that analysts revising their estimates right before an earnings release have the latest information, which could potentially be more accurate than what they and others contributing to the consensus had predicted earlier.

Honeywell has an Earnings ESP of +0.52% at the moment, suggesting that analysts have grown bullish on its near-term earnings potential, which shows that another beat is possibly around the corner.

3. Honeywell Forge's solutions …..

Honeywell Forge's solutions cut across the whole swath of the company's industrial businesses and add value to all of them. For example, by analyzing aviation data, Honeywell Forge can increase airline profitability. In addition, buildings can be made more efficient (not least to meet emissions aims), and industrial data helps generate actionable insights to improve asset performance.

4. Positivity…..

While delivering the Q1 results CEO, Darius Adamczyk reiterated that Honeywell's offerings in growing markets, like life sciences, are gaining traction while the hardest hit industries are on a recovery trajectory. The executive also affirmed a Research and Development investment directed towards products that improve environmental and social outcomes for customers. It will be interesting to see the progress made on this front in Q2.

5. Trane Technologies Partnership.....

Late last month, Honeywell confirmed plans to partner with Trane Technologies. The two are joining forces to accelerate the transition to a next-generation environmental-friendly refrigerant. Part of the plan involves testing Honeywell’s Solstice N41 (R-466A), a non-flammable alternative to R-410A.

Vice president and General Manager of Honeywell Fluorine Products, Ken West, stated, "Solstice N41 is a great option for both commercial and residential end users. This next step with Trane solidifies our confidence in moving toward industry adoption of R-466A."

The continuous testing, research, and development of Solstice (R-466A) support Trane Technologies' and Honeywell’s push to improve the carbon footprint. As the two seek to replace R-410A, they should balance the environmental impact, safety, efficiency, and affordability.

6. Battery Energy Storage System …..

Honeywell has launched a battery energy storage system to help users forecast and optimize energy costs. Honeywell's Battery Energy Storage System (BESS) Platform is the new system that will allow organizations to forecast and optimize energy used while leveraging supervisory control and analytics.

The BESS Platform is ideal for a wide range of commercial and industrial companies as well as independent power producers and utilities. It also leverages the best practices, including energy arbitrage and demand management.

7. Peruvian Navy.....

In May, the Peruvian Navy selected HON as its strategic partner for enhancing search and rescue capabilities. The Navy will use Honeywell's next-generation satellite tracking technology to monitor and perform rescue operations and locate important assets.

“Our global tracking solutions help governments and emergency response teams save hundreds of lives around the globe each year, and our MEOSAR system can help the Peruvian Navy save lives by quickly identifying aircraft, ships and people in distress regardless of how remote their location is,” stated Kenneth Deville, GM of Honeywell’s Global Tracking business.

Honeywell is to provide the Peruvian army with its Middle Earth Orbit Search and Rescue ground station system. The system includes satellite antennas, rescue control systems, and computer equipment.

8. Analysts’ Opinions.....

In June, Wolfe Research analyst Nigel Coe reiterated a Buy rating on Honeywell but raised the price target to $239 from $235, implying 8% upside potential to current levels.

Overall, the stock has a Moderate Buy consensus rating based on 8 Buys and 5 Holds. The average Honeywell price target of $238.18 implies 7.62% upside potential from current levels.

Honeywell had its price objective reduced by investment analysts at Deutsche Bank Aktiengesellschaft from $246.00 to $245.00 in a report issued on Wednesday. The brokerage presently has a "buy" rating on the conglomerate's stock. Deutsche Bank Aktiengesellschaft's price target suggests a potential upside of 9.34% from the stock's previous close.

HON has been the subject of a number of other research reports…..

- Zacks Investment Research upgraded shares of Honeywell International from a "hold" rating to a "buy" rating and set a $233.00 price objective for the company in a report on Tuesday, April 27th.

- JPMorgan Chase & Co. boosted their price objective on shares of Honeywell International from $200.00 to $250.00 and gave the company an "overweight" rating in a report on Friday, April 9th.

- Credit Suisse Group boosted their price objective on shares of Honeywell International from $224.00 to $235.00 and gave the company an "outperform" rating in a report on Monday, April 26th.

- Morgan Stanley boosted their price objective on shares of Honeywell International from $230.00 to $246.00 and gave the company an "equal weight" rating in a report on Monday, April 26th.

- Finally, Barclays boosted their price objective on shares of Honeywell International from $230.00 to $245.00 and gave the company an "overweight" rating in a report on Monday, April 26th.

13 Wall Street analysts have issued ratings and price targets for Honeywell International in the last 12 months. Their average twelve-month price target is $220.15. The high price target for HON is $250.00 and the low price target for HON is $160.00. There are currently 5 hold ratings and 8 buy ratings for the stock, resulting in a consensus rating of "Buy."

Summary.....

Honeywell International Inc. has a 12 month low of $142.29 and a 12 month high of $234.02. The company has a 50 day moving average price of $223.61. The company has a quick ratio of 1.17, a current ratio of 1.43 and a debt-to-equity ratio of 0.88. The firm has a market capitalization of $156.11 billion, a P/E ratio of 34.26, a price-to-earnings-growth ratio of 2.65 and a beta of 1.15.

Don’t forget, if there is sufficient profit before earnings then it is suggested that you exit the trade before earnings. Even with a good report many companies are being punished after the fact!

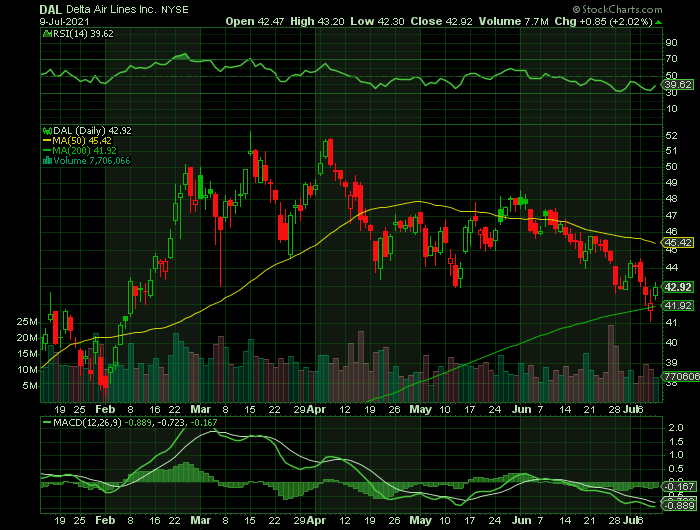

Weekly Options Trades – Delta Air Lines, Inc. (NYSE:DAL) Calls

Monday, July 12, 2021

** OPTION TRADE: Buy DAL JUL 23 2021 43.000 CALLS at approximately $1.30.

(Some members have asked for the following.....

Place a pre-determined sell at $2.60.

Include a protective stop loss of $0.55.

Prelude.....

Airline stocks rebounded for most of this year as travel resumed, coronavirus vaccines found their way into patients' arms and stimulus efforts cushioned the pandemic's impact to the economy.

In the U.S. at least, travel demand is recovering from lows reached last April, after nations around the world restricted flights. U.S. airlines have received government assistance amounting to billions to help keep employees paid. When Delta Air Lines, Inc. (NYSE:DAL) leads the industry into second-quarter earnings season on Wednesday, analysts largely expect the carrier's results to reflect more enthusiasm for travel.

Most airline stocks are also still below pre-pandemic levels. Airline executives have predicted a bumpy recovery this year. But analysts expect most airlines to return to profitability next year.

The pandemic created a wild ride for Delta Airlines shareholders since early 2020, but shares are up heading into this Wednesday's earnings update. The airline is expected to announce big steps back toward sales growth and profitability as travel picks up around the world. Executives raised their Q2 outlook in early June and hinted that Delta might reach operating profitability heading into the second half of the year.

THE Major CatalystS for This Trade.....

1. Earnings.....

Delta Air Lines is confirmed to report earnings at approximately 8:45 AM ET on Wednesday, July 14, 2021. The consensus estimate is for a loss of $1.40 per share on revenue of $6.32 billion; but the Whisper number is a little better at ($1.28) per share.

Consensus estimates are for year-over-year earnings growth of 68.40% with revenue increasing by 330.52%.

Overall earnings estimates have been revised higher since the company's last earnings release.

In the last reported quarter, the company incurred a loss (excluding $1.70 from non-recurring items) of $3.55 per share, wider than the Consensus Estimate of $3.08 and also the first-quarter 2020 loss of 51 cents.

2. Travel Demands.....

Delta Air Lines last month said it expected to lose slightly less than initially expected for the second quarter. And it said it expected to record a pretax profit during the second half of this year, after losing money last year. American Airlines has also reported "continued strength in net bookings and load factors."

At a conference on May 25, Delta also said it expects travel trends for the month of June to be better than May, with a full return of domestic leisure travel demand by June. And it has said demand for premium seats, which bring in more profit, has outpaced that in the main cabin.

3. June Quarter Performance.....

Driven by the recent uptick in air-travel demand (particularly for leisure), total passenger revenues at Delta are likely to have been high on a sequential basis in the quarter to be reported. The Consensus Estimate for the to-be-reported quarter’s passenger revenues indicates a 94% surge from the number reported in the March quarter. Also, the Consensus Estimate for traffic (measured in revenue passenger miles) suggests an 88.5% improvement from the first quarter’s reported figure.

Owing to higher traffic, load factor (% of seats filled with passengers) is expected to have improved sequentially in the June quarter. The Consensus Estimate for the to-be-reported quarter’s load factor is currently set at 70%, suggesting growth from 45% reported in the March quarter.

Also, the Consensus Estimate for second-quarter passenger revenues per available seat miles (PRASM: a key measure of unit revenues) is currently pegged at 10.97 cents, indicating a 60% rise from the figure reported in the first quarter of 2021.

4. Upgrading of Fleet.....

A decade ago, Delta Airlines became known as a savvy acquirer of used aircraft. However, as its fleet aged and its cash flow surged toward the middle of the past decade, Delta began ordering brand-new jets in increasing numbers. By late 2019, management was talking about a new fleet strategy focused on fleet simplification and a shift to new-technology aircraft.

However, the COVID-19 pandemic caused Delta to rethink its fleet strategy once again. The airline has regained interest in used jets and has reportedly finalized at least two deals for used aircraft recently.

5. Effects of Covid.....

The pandemic changed management's perspective in three key ways.....

First, the full-service airline accelerated the retirement of hundreds of jets last year in order to simplify its fleet and reduce costs.

Second, the pandemic caused Delta to burn billions of dollars of cash, making balance sheet restoration a key priority for the next few years.

Third, used aircraft values have tumbled due to the sharp drop in air travel demand -- particularly outside the U.S. and China.

Once again, used aircraft represent an elegant solution, allowing Delta to replace the jets it plans to retire in a cost-effective manner. It has agreed to lease seven Airbus A350s from AerCap, according to The Air Current (subscription required). These jets were previously operated by LATAM, which decided earlier this year to permanently eliminate the A350 from its fleet, even though its oldest A350s were delivered in 2016.

6. Analysts’ Opinions.....

Recent activity for Delta has been commonly positive. June, so far, has featured not only the Wolfe Research double upgrade, but a week prior, featured MKM Partners initiated coverage on the company as a “buy” with a $59 price target. Morgan Stanley also boosted Delta's price target from $70 to $73, the new high; the previous high of $79 was held by Wolfe Research, who despite a double upgrade also cut the price target from $79 to $55. That same day, Jefferies Financial Group upgraded Delta from “hold” to “buy”, and boosted the price target from $50 to $60 per share.

18 Wall Street analysts have issued ratings and price targets for Delta Air Lines in the last 12 months. Their average twelve-month price target is $50.21, predicting that the stock has a possible upside of 16.99%. The high price target for DAL is $73.00 and the low price target for DAL is $30.00. There are currently 6 hold ratings and 12 buy ratings for the stock, resulting in a consensus rating of "Buy."

Summary.....

For Delta, the Most Accurate Estimate is higher than the Consensus Estimate, suggesting that analysts have recently become bullish on the company's earnings prospects. This has resulted in an Earnings ESP of +5.65%.

Delta appears a compelling earnings-beat candidate. The information available predicts a bottom-line outperformance for Delta this time around.

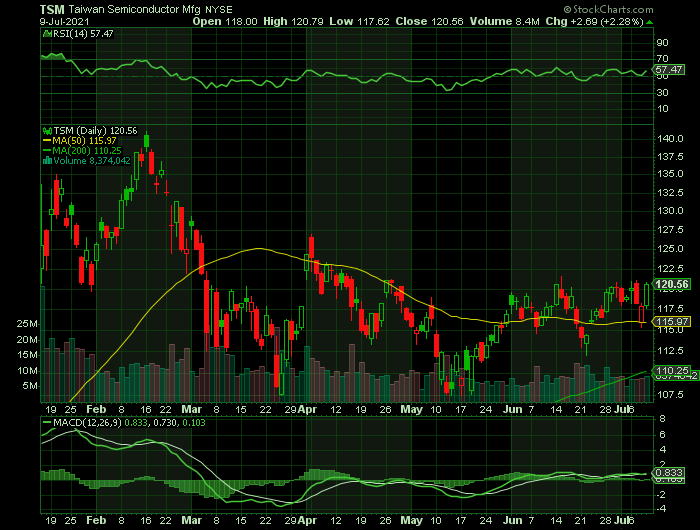

Weekly Options Trades – Taiwan Semiconductor Mfg. Co. Ltd. (ADR)(NYSE: TSM) Calls

Monday, July 12, 2021

** OPTION TRADE: Buy TSM JUL 23 2021 121.000 CALLS at approximately $2.55.

(Some members have asked for the following.....

Place a pre-determined sell at $5.10.

Include a protective stop loss of $1.00.

Prelude.....

The biggest stock market gains are usually from growth stocks, which plow all of their earnings back into big market opportunities.

One fascinating sector today is the semiconductor manufacturing sector, companies that can be thought of as the "picks and shovels" to the "gold rush" that is the competition for leading-edge chips.

Semiconductors are now at the heart of many electronic devices that we use regularly, be it personal computers (“PCs”), laptops, smartphones, and the like. The automotive industry is also a major user of semiconductors as chips are an important component of vehicles.

Although semiconductors, and therefore their manufacturers, are thought of as cyclical companies, over the long term, their clear growth trend is up and to the right.

Despite the strong past performance, chip-reliant technologies such as artificial intelligence, 5G, and the Internet of Things aren't slowing down anytime soon. Yet semiconductor manufacturing is becoming more difficult and capital intensive, and the semi equipment sector has consolidated and matured.

That has led to fat profit margins for leading semi equipment companies and foundries – and Taiwan Semiconductor Mfg. Co. Ltd. (ADR)(NYSE: TSM), the biggest semiconductor manufacturing company in the world, is certainly at the forefront.

Taiwan Semi isn't an equipment manufacturer, but it is the world's leading pure-play foundry, where other companies turn to get their leading chips made. Thanks to its foundry-only business model, Taiwan Semi has recruited many of the top tech companies in the world to use TSM as their main foundry. Garnering expertise across many types of chips, from Apple's M1 chip to Qualcomm's cellular modems to NVIDIA GPUs, Taiwan Semi has cemented itself as not only the largest but also the most capable foundry in the world.

Taiwan first surpassed Intel in the race to a 7nm chip several years ago, and has only cemented and extended that lead. After its 5nm chips first made it into the first 5G iPhone last year, Apple is already sampling Taiwan Semi's 3nm process, which should be ready some time in 2022, according to the Nikkei Asia.

About TSM…..

Taiwan Semiconductor Manufacturing's has obtained lead in advanced semiconductor manufacturing over the past few years, and that lead only seems to be getting bigger. Last month, rival Intel, one of the last chipmakers that manufactures its own chips, admitted that it had run into a design flaw for its 7 nm manufacturing process, and would be falling some 12 months behind schedule. Intel had already ceded the leading-edge node lead to TSM in 2018, and that lead only seems to be getting bigger.

Advanced chip manufacturing is hard, but TSM's years of experience making a wide variety of semiconductors has given it a knowledge and process lead that other manufacturers are struggling to match. In fact, rival GlobalFoundries threw in the towel on competing with Taiwan Semi on the leading edge back in 2018. Intel itself even hinted that it may outsource some manufacturing going forward, likely to TSM. The U.S. government also recently subsidized TSM to build a new fabrication plant in Arizona on national security grounds.

It seems TSM has built itself a formidable moat in chip manufacturing.

THE Major CatalystS for This Trade.....

1. Earnings…..

Taiwan Semiconductor Manufacturing is confirmed to report earnings at approximately 6:00 AM ET on Thursday, July 15, 2021. The consensus earnings estimate is $0.89 per share on revenue of $12.96 billion; but the Whisper number is higher at $0.96 per share.

Consensus estimates are for year-over-year earnings growth of 14.10% with revenue increasing by 24.80%.

2. Better Than Expected June Sales.....

TSMC, on Friday, announced better-than-expected June sales. The news bodes well for the chipmaker's second-quarter earnings report next week. TSM stock rose on Friday.

TSMC said its sales last month rose 22.8% year over year in local currency to the equivalent of $5.35 billion. And its sales jumped 32.1% from May. TSMC reports financial results in New Taiwan dollars.

Year-to-date through June, TSMC's sales are up 18.2% from the same period last year.

"The strong finish to the quarter fits with our view that: 1) foundry capacity remains tight, and 2) TSMC is likely realizing the initial benefits from shipments of silicon for Apple's next generation of iPhones," Wedbush Securities analyst Matt Bryson said in a note to clients. He rates TSM stock as outperform.

“TSMC’s better pricing power on the back of the capacity tightness should largely offset the margin pressure it is seeing from the massive capex spending. Meanwhile, TSMC’s technology/productivity breakthrough in EUV should enlarge its technology gap with peers and insure a better cost structure for leading edge technology nodes,” Citi analysts Roland Shu and Grant Chi wrote in a recent note.

3. Dominance…..

Even Intel is now sampling TSM's 3nm process, even though Intel is competing with TSM in process technology and has ambitions to be a foundry for third parties itself. Intel just announced yet another delay to its 10nm Sapphire Rapids server chip, which will now be ready in early 2022 rather than 2021. Intel's 10nm process is roughly equivalent to Taiwan Semi's 7nm, but since TSM is already manufacturing 5nm and will soon have 3nm in production, Intel is falling further behind. So even Intel will probably be using TSM's services as it looks to claw back lost market share against Advanced Micro Devices, a TSM client, while it aims to catch up with its own capabilities.

While others like Intel are spending big in an attempt to catch-up, TSM recently announced its own $100 billion three-year spending plan to cement its lead and meet soaring demand for leading-edge chips. For perspective, TSM spent $17.2 billion on capital expenditures last year, so it's essentially doubling that figure over the next three years. With that much spending, investors can be pretty confident growth will follow. Meanwhile, TSM's 1.5% dividend should follow on that long-term growth path along with revenue and profits.

4. COVID-19 vaccine deal.....

Taiwan's Foxconn and TSMC said on Monday they had reached deals to buy 10 million doses of Germany's BioNTech SE's COVID-19 vaccine, putting the total cost of the highly politicised deal at around $350 million.

Taiwan's government has tried for months to buy the vaccine directly from BioNTech and has blamed China, which claims the self-ruled island as its own territory, for nixing an agreement the two sides were due to sign earlier this year. China denies the accusations.

Last month, facing public pressure about the slow pace of Taiwan's inoculation programme, the government agreed to allow Foxconn's founder Terry Gou, as well as Taiwan Semiconductor Manufacturing Co (TSMC), to negotiate on its behalf for the vaccines.

BioNTech's Chinese sales agent Shanghai Fosun Pharmaceutical Group Co Ltd said on Sunday that an agreement had been signed, but did not give details of a delivery timeframe.

Gou wrote on his Facebook page that he was "gratified" the deal had been completed, which will see Foxconn and TSMC each buy 5 million doses, to be donated to the government for distribution.

5. Benefiting From Apple.....

"The strong results in the month of June give us additional confidence in our projection for a significant sequential uptick in sales in Q3 and through the second half of 2021 as TSMC should continue to benefit from Apple's ramp of iPhone 13 production as well as typical seasonal strength," Bryson said. Apple is on track to announce its iPhone 13 handsets in September.

Meanwhile, Apple stock hit an all-time high of 145.65 in intraday trading on Friday. It ended the regular session Friday up 1.3% to 145.11.

TSMC should continue to benefit from strong pricing and margins because of tight foundry capacity, Wedbush Securities analyst Matt Bryson said.

6. Vehicle Demand…..

In recent times there has been a shortage of semiconductors. When the coronavirus broke out last year, people were compelled to stay at home and work remotely. This led to a surge in demand for devices like laptops and PCs. Demand for gaming also skyrocketed as people turned to at-home forms of entertainment and bought gaming consoles as well as gaming hardware for their PCs. This, in turn, shifted the supply of semiconductors to consumer electronics as automotive factories were shut when COVID-19 intensified. But when the restrictions began to gradually ease, demand for vehicles made a solid comeback as people preferred to buy their vehicles and not travel via public transport to avoid coming in contact with the virus.

As semiconductor supply had already shifted, automotive manufacturers started facing a shortage of chips. Even though the shortage mostly affected the automotive segment, other industries like consumer electronics began to face the crisis too as demand for such items remained high.

Glenn O’Donnell, a vice president research director at Forrester stated that factors like growth in cloud computing and cryptocurrency mining will also bolster the demand for chips, cited the article.

But this ongoing supply-related concern should bode well for chip manufacturers and also for companies that manufacture equipment for chip making. Semiconductor sales have remained robust in 2021 and per a report by the Semiconductor Industry Association (“SIA”), global semiconductor industry sales rose 26.2% in May, on a year-over-year basis, and reached $43.6 billion. The report further stated that semiconductor sales increased 4.1% in May compared to April.

The International Data Corporation (“IDC”) also predicted that the semiconductor market is set to continue its solid growth this year. Per a report published by the IDC on May 6, the worldwide semiconductor market is estimated to grow 12.5% this year and reach $522 billion, following a rise of 10.8% in 2020.

7. Analysts’ Opinions.....

Taiwan Semiconductor Manufacturing was upgraded by equities research analysts at Susquehanna from a “negative” rating to a “neutral” rating in a report issued on Wednesday. The brokerage presently has a $105.00 price target on the semiconductor company’s stock, up from their previous price target of $85.00. Susquehanna’s price objective points to a potential downside of 11.33% from the stock’s current price.

TSM has also been the subject of a number of research reports.....

- Argus began coverage on shares of Taiwan Semiconductor Manufacturing in a research note on Tuesday, June 22nd. They set a “buy” rating and a $150.00 price target on the stock.

- Atlantic Securities began coverage on shares of Taiwan Semiconductor Manufacturing in a research report on Monday, April 19th. They issued a “neutral” rating on the stock.

10 Wall Street analysts have issued ratings and price targets for Taiwan Semiconductor Manufacturing in the last 12 months. The range between the high target price and low target price is between $177 and $105 with the average target price sitting at $140.62. There are currently 4 hold ratings and 6 buy ratings for the stock, resulting in a consensus rating of "Buy."

Summary.....

TSMC is experiencing rising earnings estimates and the consequent rating upgrades fundamentally mean an improvement in the company's underlying business. And investors' appreciation of this improving business trend should push the stock higher.

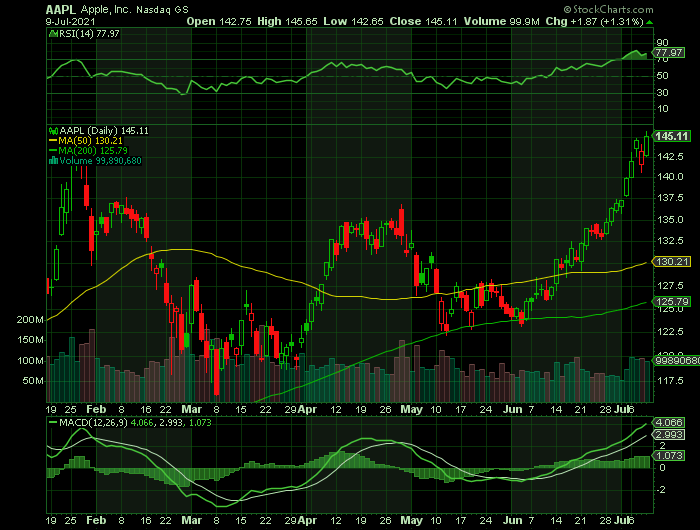

Weekly Options Trades – Apple Inc. (NASDAQ:AAPL) Calls

Monday, July 12, 2021

** OPTION TRADE: Buy AAPL JUL 23 2021 146.000 CALLS at approximately $2.30.

(Some members have asked for the following.....

Place a pre-determined sell at $4.60.

Include a protective stop loss of $0.95.

Prelude.....

Shares of tech giant Apple Inc. (NASDAQ:AAPL) have risen sharply in recent weeks. The stock has climbed about 15% in the last 30 days alone, to its record intraday high of $144, recovering from a slump that has persisted since late January.

Bullishness in the market for the tech stock comes ahead of Apple's fiscal third-quarter earnings report, which is set to be released on July 27.

Shares of the iPhone maker are up 7.5% in last six sessions. The advance marks the longest stretch of positive sessions for Apple since April, according to Bloomberg data.

Apple stock continues to trend very strongly toward making fresh all-time highs.

Apple gained its popularity and size by being a consummate innovator and marketer. The company enjoys a solid moat thanks largely to the stickiness of its iPhone-centric ecosystem. But despite its size, Apple still can grow much larger.

Augmented reality devices, foldable iPhones, and even a self-driving car are high on the list of potential new products on the way from Apple. The company also has opportunities in major markets where it doesn't already dominate, notably including India.

Even though Apple operates in the cyclical tech sector, the company's exceptionally loyal following has turned its products into basic-need goods. Anytime Apple unveils a new product, lines typically wrap around its stores, demonstrating the customer loyalty and innovation that are at the heart of Apple's operating model.

Legendary investor Warren Buffett has praised Apple as "probably the best business I know in the world," and he has a good point. The company's iPhone ecosystem is a cash cow, and many of its customers are die-hard fans who wouldn't consider switching to a rival.

THE Major CatalystS for This Trade.....

1. Buying Before Earnings…..

Bullishness in the market for the tech stock comes ahead of Apple's fiscal third-quarter earnings report, which is set to be released on July 27.

Analysts on average expect Apple to set a new third quarter revenue record of $72.9 billion, up around 22% from $59.7 billion in the year-ago quarter.

Based on 10 analysts' forecasts, the consensus EPS forecast for the quarter is $0.99. The reported EPS for the same quarter last year was $0.64.

2. Impressive Growth…..

Apple set a high bar when it reported its fiscal second-quarter results in April. Revenue during the period soared 54% year over year, crushing analysts' estimates. Of course, the period was expected to be somewhat of an anomaly due to an easy comparison in the year-ago quarter when Apple was facing supply shortages and weak demand in China amid COVID-19 lockdowns. Still, growth was higher than expected -- far higher. On average, analysts expected revenue of $77.4 billion yet the tech company's actual top line came in at an incredible $89.6 billion. Earnings per share were $1.40, beating a consensus forecast for $0.99.

It was a blockbuster quarter, to say the least.

Of course, these strong results mean expectations are high for Apple's fiscal Q3. On average, analysts expect Apple's fiscal third-quarter revenue to increase 22% year over year. While this is a much lower growth rate than what Apple saw in fiscal Q2, investors should note that the tech giant is up against a tougher year-ago comparison.

3. Capital…..

Apple may have an astounding $2.4 trillion dollar market capitalization. But it also notably has more than $204 billion in cash and marketable securities ($83 billion net of its debt) and it is generating over $90 billion of free cash flow on a trailing-12-month basis. Further, Apple's gross profit margin has been expanding recently thanks to its fast-growing services business, which commands a gross profit margin that is about twice that of its products business.

Based on the company's recent growth and its fundamentals, Apple shares seem to justify their high price-to-earnings ratio of 32. This doesn't mean the stock may not trade lower at some point in the future. But the long-term prospects for the stock from this level do seem compelling.

4. Resistance…..

Now that the last big resistance at $137 before all-time highs has been taken out, it paves the way for an easier ascent for AAPL stock. The volume profile has dropped off significantly above this $137 level. The trend has gained strength above $135 and then again above $137. This is exactly what should happen given the volume profile drops off each time above these resistance levels.

There is very little volume and price resistance to stop AAPL from breaking record highs above $145.09.

5. Growth In India.....

India is the second-most-populous country in the world, counting nearly 1.34 billion people as citizens, trailing China's population of almost 1.4 billion by a small margin. Not surprisingly, global companies are competing hard for a portion of India's substantial private consumption expenditure pie, which was reportedly worth more than $460 billion in March this year, according to database provider CEIC.

Apple is one of the many companies that have been trying to crack the Indian market for a long time now, albeit with mixed results. The iPhone is still a bit player in the booming Indian smartphone space despite being in the country for many years. Apple reportedly held just 4% of India's smartphone market in the fourth quarter of 2020.

However, there are signs that Apple's fortunes in India are changing thanks to a series of smart steps, as well as the huge opportunities afforded by the upwardly mobile population that's getting exposure to new technologies. India's massive population presents a huge revenue opportunity for Apple across various device categories, and the good part is that the company is already on track to take advantage of it.

Technology market analysis firm Canalys points out that the launch of the online Apple store in India in September last year has triggered its impressive sales growth. That's not surprising, as Apple is offering trade-ins, discounts, and no-cost equated monthly installments (EMIs) through its online store, which seems to be bringing more consumers into its fold. Additionally, discounts offered by e-commerce platforms on popular Apple products are also driving sales.

More importantly, Apple is taking steps to ensure that it sustains its terrific momentum in India.

Encouraged by the sales growth spurred by its online store, Apple is now working toward opening physical stores in India. CEO Tim Cook had said in January this year that the company has plans to launch physical stores in India, and it will continue to expand that network over the long run. Sources cited by the Indian daily newspaper Business Standard suggest that Apple may be planning to open physical stores in the three metro cities of Mumbai, Bengaluru, and Delhi.

6. Strong Growth…..

Apple will continue to deliver strong growth. The rollout of high-speed 5G wireless networks is fueling a surge in demand for the latest iPhone versions. That, in turn, has helped boost Apple's sales for other products and services, including apps and EarPods.

Innovation will be the key to Apple's fortunes going forward. Look for the company to launch a foldable iPhone within the next couple of years. Apple is also building its augmented reality (AR) capabilities, with CEO Tim Cook stating publicly that AR is "critically important" for the company's future.

7. Analysts’ Opinions.....

Apple's stock has caught an under-the-radar bid over the past four weeks, and the momentum may be sticking around says JPMorgan (JPM) telecom and networking analyst Samik Chatterjee.

"The upside pressure on volumes for the iPhone 12 series, historical outperformance in the July-September time period heading into launch event, and further catalysts in relation to outperformance for iPhone 13 volumes relative to lowered investor expectations implies a very attractive set up for the shares in the second half of the year and thus expect Apple shares to outperform the broader market materially in 2H21," Chatterjee wrote in a new research note last Tuesday.

The analyst reiterated his Outperform rating and raised the price target to $170 from $165. He also lifted his estimates modestly higher on iPhone and iPad volumes.

Chatterjee is particularly bullish near-term on Apple (AAPL) as it gears up for its typical barrage of new product launches this fall.

Says Chatterjee, "The historical track record for Apple shares heading into the September iPhone launch event has been to outperform the broader market consistently each year. While the magnitude of the outperformance in July-September is generally driven by investor expectations heading into the next iPhone cycle, we believe the setup is attractive and Apple shares are positioned for a significant outperformance over the next 2-3 months given the 1H underperformance as well as the near-term upside on volume expectations for iPhone 12 series from recent share gains, particularly in China."

As well, Wedbush tech analyst Dan Ives says, "The tech bull cycle will continue in our opinion its upward move in 2H2021/2022 given the scarcity of growth names/winners in this market looking ahead on the heels of the 4th Industrial Revolution playing out among enterprises/consumers. Our favorite large cap tech name to play the 5G transformational cycle is Apple, with the 1-2 punch of its massive services business and iPhone product cycle translating into a $3 trillion market cap for Cupertino in 2022 in our opinion."

Ives rates Apple's stock at an Outperform with a $185 price target.

Moving Forward.....

For the next couple of years, the iPhone should remain Apple's core cash flow driver. As wireless companies upgrade their infrastructure to handle 5G speeds, consumers and businesses are liable to spend years upgrading their devices. Let's not forget that it's been a decade since we last witnessed a notable improvement in wireless download speeds.

Apple CEO Tim Cook is also overseeing a transition that should result in less lumpy revenue recognition and higher margins over time. While Apple will continue to be a leader in products, Cook is spearheading a shift that emphasizes Apple's services and platforms. Services are a sustainable double-digit growth opportunity.

Having generated nearly $100 billion in operating cash flow over the trailing 12-month period, Apple continues to prove to investors why it's such a winner.

Summary.....

Apple climb upwards is boosting its market cap lead significantly bringing the Cupertino-based tech company to within striking distance of where it traded in January.

The move up comes after a quiet time for Apple stock, which had fallen 20% from its highs during the late winter and early spring.

Now, though, investors seem to be focusing on the coming debut of the iPhone 13. Rumors about potential features are making the usual rounds, but what's clear is that Apple fans seem just as excited about future releases as they have been about recent ones.

That level of loyalty is Apple's greatest asset, and it'll be the key to drive further gains for the stock. If the holiday season goes well, then Apple could easily make further progress on the path to $3 trillion and beyond.

Back to Weekly Options USA Home Page