TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, jUly 05, 2021

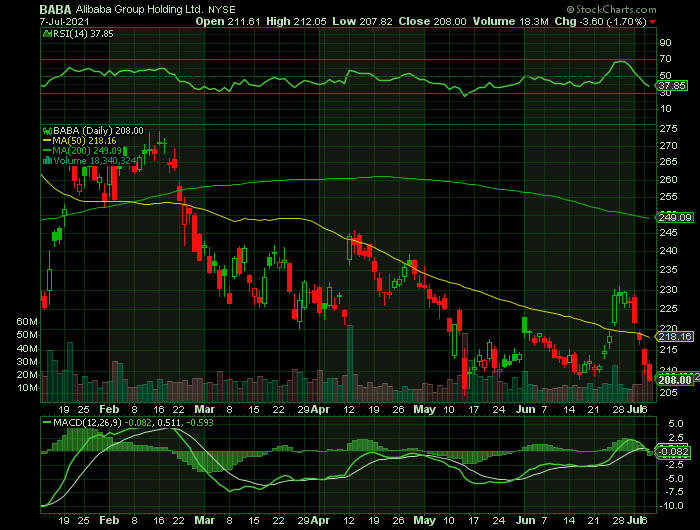

Weekly Options Trades – Alibaba Group Holding Ltd (NYSE:BABA) Puts

Thursday, July 08, 2021

** OPTION TRADE: Buy BABA JUL 09 2021 202.500 PUTS at approximately $0.60.

(Some members have asked for the following.....

Place a pre-determined sell at $1.20. (Or double the amount you paid for the trade)

Also include a protective stop loss of $N/A.

OR.....for longer term.....

** OPTION TRADE: Buy BABA JUL 23 2021 200.000 PUTS at approximately $2.20.

(Some members have asked for the following.....

Place a pre-determined sell at $4.40. (Or double the amount you paid for the trade)

Also

include a protective stop loss of $0.90.

IMPORTANT INFORMATION.....

This is a very short-term options trade as the stock market is incredibly volatile at the moment. During the trading day the indexes have swung from positive to negative several times during the day.

At the time of setting up this recommendation (5:30am), the futures are firmly in the red and are increasing.

If you have more than one membership with us much of the information for each of the recommendations is similar – obviously the actual recommended trade is different.

Prelude.....

China’s technology giants have seen a combined $823 billion wiped from their market value since a February peak, with Beijing’s expanding crackdown on the sector fueling investor concern that the selloff is far from over.

Authorities on Tuesday issued a sweeping warning to the nation’s biggest companies, vowing to tighten oversight of data security and overseas listings just days after Didi Global Inc.’s contentious decision to go public in the U.S. That has put further selling pressure on China’s biggest technology names including Tencent Holdings Ltd., Alibaba Group Holding Ltd., JD.Com Inc., Baidu Inc. and Meituan.

“The selling will continue in the third quarter,” said Paul Pong, managing director at Pegasus Fund Managers Ltd. He says he sold two thirds of his technology stock holdings, including in Tencent and Alibaba, in May. “The measures from authorities will keep coming.”

The losses have come from 10 firms including three U.S. listed names.

So, our concentration is on Alibaba Group Holding Ltd (NYSE:BABA) one of the most affected by this situation.

China’s sweeping warning Tuesday followed the opening of a security review by the nation’s internet regulator last week into Didi and a demand for app stores to remove it. The move stunned investors and industry executives and has hammered the Hong Kong shares.

THE Major CatalystS for This Trade.....

The latest security-based probes have opened a new front in President Xi Jinping’s broader campaign against China’s internet giants that began in November with the collapse of Ant Group Co.’s mega IPO and subsequent antitrust investigations into Alibaba and Meituan. Over the weekend, China moved against two other companies that also recently listed in New York -- Full Truck Alliance Co. and Kanzhun Ltd.

Investors are likely to take “a sell first, talk later approach” to limit policy risks in their portfolio, said Justin Tang, the head of Asian research at United First Partners in Singapore. Stock prices are likely to be driven by near-term sentiment swings as opposed to company fundamentals, Jian Shi Cortesi, a Zurich-based fund manager at GAM Investment Management, wrote in an email.

The Chinese moves are the latest in a growing estrangement between the U.S. and Chinese financial markets, against the background of a geopolitical rivalry that hasn't lessened since the departure of ex-President Donald Trump.

China will step up supervision of Chinese firms listed offshore; days after Beijing launched a cybersecurity investigation into ride-hailing giant Didi Global Inc on the heels of its U.S. stock market listing.

Under the new measures, China will improve regulation of cross-border data flows and security, its cabinet said on Tuesday.

The market is also spooked by a reversal in Crude Oil prices, on the dawning realization that any spike caused by the failure of last week's OPEC meeting could easily be followed either by a breakdown of output discipline by the world's biggest exporters, or by further rises in inflation that could prompt global central banks to withdraw monetary stimulus. U.S. crude futures fell 0.4% to trade again below $$75 a barrel.

Another factor weighing on sentiment was the sign that the bounce in U.S. economic activity may be flattening out, after a series of short-term economic data that have benefited from extremely weak year-earlier comparables. The Institute for Supply Management's non-manufacturing PMI fell to 60.4 from 66.2 the previous month.

Alan Lancz, president of Alan B. Lancz & Associates Inc., an investment advisory firm based in Toledo, Ohio, said with Treasury yields down, "investors may be worried the economy might not be a good as the stock market was showing."

Also, investors may be taking profits after a strong end of the quarter and string of recent records. "It was such a good quarter end," he said. Now, "cyclicals are really getting hit."

Moving Forward.....

To be sure, valuations may start to look attractive. Tencent, Alibaba and Baidu Inc. -- among the earliest Chinese tech companies to enter public markets and the biggest, trade at an average of 22 times forecasted earnings over the next 12 months. That compares with the 10-year average of 26 times, according to data compiled by Bloomberg.

“In case the market sentiment goes into extreme pessimism and we see the Hang Seng Tech Index down 20% from here, it could be a rare opportunity to buy some fast-growing Chinese internet companies at extremely attractive prices,” GAM’s Jian Shi said.

The Hang Seng Tech Index is down 31% from its February high. Investors in mainland China, who accounted for about a third of turnover in Tencent shares this year, turned net sellers of the stock in June.

“While the long-term future of Chinese tech remains, it will be caveat emptor for investors in the near term,” said United First’s Tang.

Summary…..

Other U.S.-listed Chinese e-commerce firms, including Alibaba Group , Baidu Inc and JD.com , fell between 3.5%and 4.6% with the Chinese crackdown also weighing on global markets.

"Investors need to be looking at not just valuations of the company based on global opportunities, but keeping in the back of their mind that policies could go into effect and how will that affect companies here in the (United States)," said Matthew Keator, managing partner in the Keator Group in Lenox, Massachusetts.

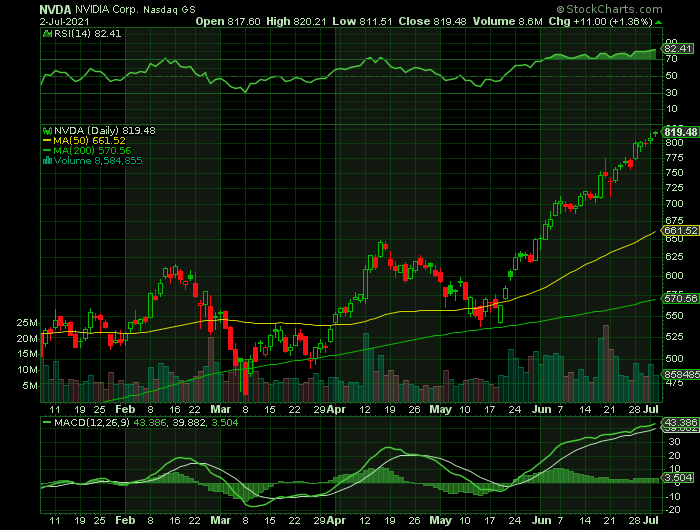

Weekly Options Trades – NVIDIA Corporation (NASDAQ:NVDA) Calls

Tuesday, July 06, 2021

** OPTION TRADE: Buy NVDA JUL 09 2021 825.000 CALLS at approximately $10.00.

(Some members have asked for the following.....

Place a pre-determined sell at $20.00. (Adjust as necessary)

Include a protective stop loss of $4.00.

Prelude....

Wall Street completed an impressive first half of 2021 after a stellar run in 2020 despite the pandemic.

Nationwide COVID-19 vaccinations, a sharp decline in new coronavirus cases, a faster-than-expected reopening of the economy, an unprecedented fiscal stimulus, Fed's ongoing easy-money policy and the Fed Chairman's reiteration that the inflation is transitory despite raising the inflation forecast for 2021, significantly bolstered market participants' confidence in risky assets like equities.

U.S. stock markets are set to continue their strong performance on the back of solid consumer and business confidence, solid improvement in GDP growth, and corporate profits.

At this stage, it would seem to be a safer strategy to look for stocks that are winners and have the potential to gain further; and one such stock is the maker of graphics and high-performance computing chips NVIDIA Corporation (NASDAQ:NVDA).

Nvidia

has freshly been

on a bull run, and is continually seeing price strength which has a high chance

of carrying the momentum forward.

If a stock is continuously witnessing an uptrend, there must be a solid reason

or else it would have probably crashed. So, Nvidia appears capable of beating

the benchmark that they have set for themselves.

NVIDIA is a market-leading provider of graphics processing units (GPUs) and AI solutions. Its brand name has become synonymous with best-in-class graphics in video games and high-performance computing in data centers. In fact, NVIDIA has over 90% market share in the supercomputing accelerator market.

Last year this semiconductor company strengthened its position with the acquisition of Mellanox, a provider of high-performance networking solutions. NVIDIA CEO Jensen Huang noted that this move creates "significant product synergies," allowing the company to take a more holistic approach to data center hardware design.

Nvidia shares are up 49.88% in the past three months and 53.28% year-to-date. The chipmaker began rallying in October 2019, and was only briefly affected by the pandemic downturn in March 2020. After falling that month, the stock resumed its rally in April of last year. Monthly upside trading volume was higher seven times since February 2020.

Nvidia has announced a four-for-one stock split in May. Beginning on July 20, shares are expected to begin trading on a split-adjusted basis, which means the price per share should fall to somewhere around $200.

Nvidia shares are up more than 30% since the split was announced. But while hype surrounding the split may be driving some of this price increase, the reality is investors shouldn't care at all that about the split.

While stock splits change the per-share price, they have no actual impact on the underlying value of the company or its share value. Because they alter none of the company's fundamentals, splits should have no effect on the long-term prospects of the business at all.

With a four to one stock split, investors in the company simply end up owning four shares for every one they owned pre-split. But the actual value of their investment hasn't increased despite having more shares.

In May, we executed a trade on Nvidia for a 600 strike price, based on earnings, and had a return profit of 1,038%. It would be nice for this to occur again! However, be realistic about your profit target.

THE Major CatalystS for This Trade.....

1. Influence of Nvidia.....

Together, NVIDIA and Mellanox power eight of the top 10 supercomputers in the world. Even more impressive, Italy's CINECA has selected NVIDIA GPUs (and Mellanox networking) to power the world's fastest AI supercomputer, the Leonardo. Once built, the system will deliver 10 exaflops of performance, making it nearly 19 times faster than Japan's Fugaku, which currently tops the list of the world's fastest supercomputers.

According to Cathie Wood's ARK Invest analysis, accelerators like NVIDIA GPUs will displace central processing units (CPUs) as the dominant processors in data centers by 2030, growing at 21% annually over that period. That opens the door to a $41 billion market opportunity for the chipmaker.

Additionally, factoring in other use cases like enterprise and edge AI, management believes its total addressable market in the data center sector will actually hit $100 billion by 2024.

2. Earnings Factor.....

There was very little bad that could possibly be said about Nvidia’s Q1 results. Revenue was up massively from a year earlier, and 13% on the quarter. Net income more than doubled over the past year, and 31% on the quarter. The overall business and financial picture were stellar.

And on a business-by-business basis things were equally positive. Gaming revenues were more than double where they were a year earlier. And each of Nvidia’s data center, professional visualization and automotive businesses also realized revenue growth as well.

Just about the only arguable dull spot was that cash flows from operations declined 9% from the previous quarter. Even that could be explained away in that the company made a $317 million investment in capital expenditures.

On those results NVDA stock has been tearing upwards from $546 in mid-May to hitting $800 this week. The price chart indicates that shares might run sideways for a bit, but most believe it’ll continue upward.

3. Overvalued Effect.....

That Nvidia is technically overvalued is likely news to no one. Nvidia carries a very high P/E ratio. The company’s other valuation metrics are equally skewed. Nvidia’s price-book and price-sales ratios are both among the lowest 5% in the semiconductor industry.

But these concerns are nothing new and the fact remains that Nvidia has been on a long upward trend since the end of 2018. Those who have bet against it over the last two-and-a-half years have lost.

Investors will continue to be willing to pay richly for a dollar of its earnings and many multiples of its book value as long as it remains hot. Many believe Nvidia is going to stay up.

Clearly Wall Street believes that will be exactly what happens. In the last few days analysts from Wells Fargo, Tigress Financial, and Raymond James raised their price targets to between $875 and $920.

4. Robinhood Backing.....

The Wisdom of Crowds gained widespread attention when it was published 17 years ago. In the book, author James Surowiecki laid out the case that "the many are smarter than the few."

To be sure, there are plenty of times when the crowd isn't all that wise. However, Surowiecki's point is often spot-on.

And, Nvidia The Wisdom of Crowds gained widespread attention when it was published 17 years ago. In the book, author James Surowiecki laid out the case that "the many are smarter than the few."

To be sure, there are plenty of times when the crowd isn't all that wise. However, Surowiecki's point is often spot-on.

Shares of the graphics chip maker have skyrocketed nearly 5,000% during its growth period.

Are NVIDIA's growth days over? Not at all! Its market cap currently stands at a little over $500 million. Don’t be be surprised if NVIDIA becomes the next $1 trillion company.

NVIDIA optinism stems from the company's leadership in three hot growth areas.....

The least of these (based on the current financial impact for NVIDIA) is cryptocurrency mining.

The most important (again, based on its current financial impact) is gaming. NVIDIA's graphics processing units (GPUs) are highly prized by gamers.

However, NVIDIA's expertise in artificial intelligence (AI) could be the biggest catalyst for the stock over the long term. NVIDIA's GPUs are already widely used in data centers, especially in powering AI applications.

5. Arm Acquisition's Approval Chances Increasing.....

NVIDIA is making progress to get its proposed acquisition of Arm Holdings approved by regulators. It needs agreement from the U.K., China, the European Union, and the U.S., and when it announced the deal in September, it initially said getting all the necessary agencies to sign on could take about 18 months.

Three top customers of Arm -- Broadcom, MediaTek, and Marvell Technology -- recently threw their support behind the deal, which significantly raises the chances that NVIDIA will receive approval from the U.K.

Despite obstacles, NVIDIA CFO Colette Kress said at an investor conference in early June that "we are still expecting in the early part of 2022 to complete the acquisition of Arm."

6. The Past Month Growth.....

Shares of NVIDIA gained 23.1% in value last month, according to data provided by S&P Global Market Intelligence. During June, Broadcom, Marvell Technology, and MediaTek expressed support for NVIDIA's $40 billion acquisition of Arm Holdings from Softbank Group. The proposed acquisition is currently making its way through a rigorous regulatory review process, but the vote of support from three of Arm's customers puts the deal one big step closer to being finalized.

This news comes on top of incredible momentum NVIDIA has right now. It delivered a terrific earnings report in May, with revenue reaching a record $5.66 billion, up 84% year over year, and there's no sign of growth slowing down.

If the Arm deal is completed, which NVIDIA believes will happen by early 2022, it will accelerate NVIDIA's deployment of AI computing across all of the markets where Arm's chip architecture is already dominant, in addition to paving a path for NVIDIA's expansion into new markets, such as bringing AI computing to the edge on 5G networks.

Growth Opportunities Abound Even Without The Arm Acquisition.....

Even without Arm, the company is still well positioned for long-term growth. With the debut of NVIDIA's first data center CPU (Grace), the company now has a trio of products across CPUs, DPUs, and GPUs to pursue an estimated $100 billion opportunity in the data center market.

1. Arm-based Tegra.....

NVIDIA's Arm-based Tegra CPUs power infotainment and navigation systems for high-end automakers like Audi and Lamborghini. They also power its Drive onboard computers for autonomous vehicles.

NVIDIA generated 3% of its revenue from automotive chips last quarter. That's just a tiny sliver of its business, and the unit faced severe headwinds last year as the pandemic disrupted the production of new vehicles. The global semiconductor shortage could further delay that recovery.

But after those headwinds wane, NVIDIA's automotive business should recover and gradually account for a larger slice of its revenue. Until then, NVIDIA should continue to generate high double-digit percentage revenue and earnings growth as it sells more gaming and data center GPUs.

2. Cryptocurrency......

Cryptocurrencies are hot once again, which means that demand for graphics processing units (GPUs) for crypto mining rigs is through the roof. Nvidia has been through this cycle before and learned a painful lesson. Crypto miners can be big business, but they compete against NVDA’s core customer base for graphics cards. That results in bad PR when stock runs out. Plus, the crypto market can dry up without warning. In 2018, this effect hammered NVDA stock when miners suddenly stopped buying.

This time, though, the company is doing things differently and managing the crypto market much more carefully. Acknowledging mining as an actual line of business, NVDA created a GPU specifically for that market. Additionally, it took measures to prevent miners from snapping up all its new consumer GPUs. New graphics cards will automatically throttle performance if used for crypto mining.

Nvidia’s new RTX 3000 series GPUs are still in short supply, but consumers aren’t competing against crypto miners to buy them now. Meanwhile, the new crypto cards are selling better than expected. In its Q1 earnings update, the company noted that it has already sold $150 million worth, compared to the projected $50 million.

3. Grace.....

This product is a custom designed, Arm-based processor aimed at data centers. NVDA says that its first data center CPU is optimized to deliver 10 times “the performance of today’s fastest servers on the most complex AI and high performance computing workloads.”

Of course, Nvidia has always been about GPUs, so its first data center CPU is a shot across the bow of PC processor leaders. If Grace lives up to claims, it has the potential to significantly grow Nvidia’s data-center market. Back in Q4, that market brought in $1.9 billion.

4. Gaming.....

Nvidia announced new devices across its portfolio and launched a new bit of gaming software. To begin with, the company unveiled a new wave of gaming laptops, flaunting its latest GPUs. This was followed by the reveal of new collaborative laptops with the likes of Dell (NYSE: DELL) and other consumer hardware names. On top of all that, Nvidia GPU owners now have access to GeForce NOW, powering optimal cloud gaming experiences.

NVIDIA's graphics processing units (GPUs) are used for a range of high-performance computing tasks, such as powering live-streamed video, artificial intelligence (AI) assistants, weather forecasting, medical imaging, and even fraud detection in financial services. At the company's 2021 investor day, NVIDIA unveiled its BlueField-3 data processing unit (DPU), which it built specifically for AI and accelerated computing. BlueField-3 delivers performance that is equivalent to up to 300 CPU cores.

5. Funds Input.....

The number of mutual funds owning shares rose in each of the past seven quarters, to 4,367 most recently.

The largest holder is the Vanguard Total Stock Market Index Fund (VTSMX), which owns 2.68% of Nvidia shares. Meanwhile, at the Fidelity Advisor Semiconductors Fund (FELAX), Nvidia shares comprise a whopping 19.89% of fund assets.

6. Move Into 5G.....

Nvidia is making moves into the 5G wireless space, which should give its data center business a huge shot in the arm. NVIDIA has already trained its sights on the 5G market, and its latest announcements indicate that its development efforts are gaining currency with key customers.

NVIDIA's 5G play is aimed at using the blazing-fast speeds brought by the new wireless standard in the field of artificial intelligence (AI). The chipmaker has been making steady progress on this front, announcing a slew of partnerships in April with a bunch of companies for the development of an AI-on-5G platform. This AI-on-5G platform powered by NVIDIA's Aerial application framework aims to accelerate the deployment of edge AI services with the help of fast 5G speeds.

NVIDIA has now taken a couple of steps to encourage the adoption of its Aerial platform, which the company says is "an application framework for building high performance, software-defined, cloud-native 5G applications to address increasing consumer demand."

All of this indicates that NVIDIA is preparing to take advantage of the intersection of 5G wireless technology and AI, a combination that could spawn a huge revenue opportunity. According to Frost & Sullivan, the market for AI, memory, and power amplifier semiconductors within the 5G space could be worth $15 billion by 2025, clocking a compound annual growth rate (CAGR) of 74% during the forecast period. That's a huge jump from just $537 million in revenue last year, so NVIDIA is sitting on a massive catalyst.

7. Analysts’ Opinions.....

BMO Capital Markets analyst Ambrish Srivastava boosted his price target on shares of Nvidia Corp. to $1,000 from $750, with the new target being the highest among analysts tracked by FactSet who cover Nvidia's stock. Srivastava is upbeat about the growing relevance of software to the Nvidia business model. “We now see the company's data-center business growing to a $32 billion business a few years out vs. our prior expectation of $25 billion,” Srivastava said.

“We also think that as software starts to become a bigger portion of the business, gross margin will continue to trend [up. We] now see gross margins of 75% for the business vs. our prior modeled 72%.”

Further, “We arrive at our target price of $1,000 with a higher 40 times price-to-earnings multiple vs. our prior 35 times,” he said.

One analyst expects NVIDIA's data center business alone to generate $30 billion in annual revenue by 2025. If NVIDIA can achieve that, the stock should have more room to run, since data center products carry higher profit margins than other products.

The analysts covering NVIDIA for Bank of America and Raymond James have both set a $900 price target on the stock, citing the company's momentum in the data center segment.

Selling graphics cards to gamers is still NVIDIA's largest revenue source, but analysts are more bullish about its prospects in the data center space. Bank of America Securities analyst Vivek Arya expects the data center segment to overtake gaming, bringing in an estimated $30 billion in revenue annually by 2025. Over the last four quarters, the data center segment generated $7.6 billion, so there are huge growth expectations here, which helps explain why the stock price is rocketing higher.

NVIDIA's guidance for its fiscal second quarter calls for another record period of gaming and data center revenue. Analysts expect NVIDIA to report revenue growth of 49% for the current fiscal year.

32 Wall Street analysts have issued ratings and price targets for NVIDIA in the last 12 months. Their average twelve-month price target is $688.85, predicting that the stock has a possible downside of 15.94%, allowing for analysts to re-assess their price targets. The high price target for NVDA is $1,000.00 and the low price target for NVDA is $400.00. There are currently 3 hold ratings, 28 buy ratings and 1 strong buy rating for the stock, resulting in a consensus rating of "Buy."

Summary.....

The stock price has surged 16.6% in the past four weeks. The company has an expected earnings growth rate of 59% for the current year (ending January 2022). The Consensus Estimate for current-year earnings has improved 0.4% over the last 7 days.

NVIDIA is already a leading supplier of hardware in the data center market and has penetrated the networking side with the 2020 acquisition of Mellanox. But investors are very optimistic about the company's prospects to expand into software solutions, which is part of NVIDIA's mission to democratize artificial intelligence for companies all over the world. During an earnings call with analysts in May, CEO Jensen Huang said that the company is set up for "years of growth in data center."

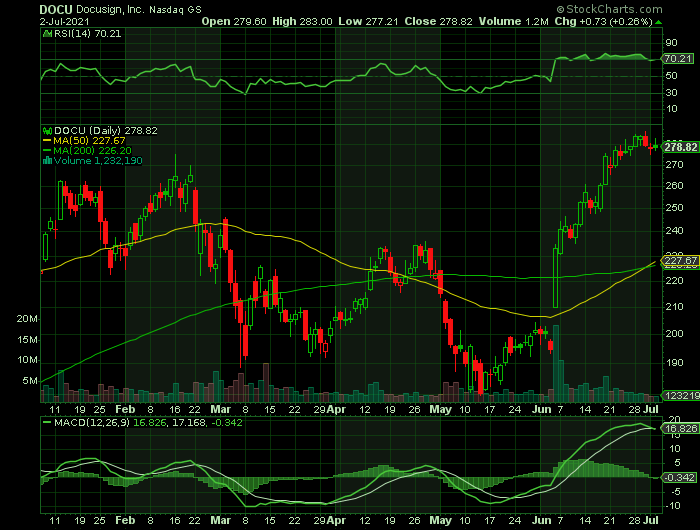

Weekly Options Trades – Docusign Inc (NASDAQ: DOCU) Calls

Tuesday, July 06, 2021

** OPTION TRADE: Buy DOCU JUL 23 2021 285.000 CALLS at approximately $5.90.

(Some members have asked for the following.....

Place a pre-determined sell at $11.80.

Include a protective stop loss of $2.40.

Prelude.....

It is inevitable that you will need to sign documents throughout your life. And Docusign Inc (NASDAQ: DOCU) is transforming this cornerstone of business by unblocking the signing bottleneck. They have opened the entire agreement process to automation and, in doing so; have become a clear leader in an area with room for massive growth.

And, the coronavirus was a big boost to Docusign's e-signature platform as businesses scrambled to continue operating in a remote environment. As the pandemic slowly becomes something in our rearview mirror, inflation has crept up above 3% for the first time in over a decade.

Understanding The Pricing of Docusign Products…..

This is really important to understand as we look at the future of DocuSign and how companies adopt this product and end up potentially paying more every year. There are really two key components. As product functionality, whether you're a single-user, a business pro, or buying the enterprise platform, there's a couple of different platforms, and this is really [about] features. What kind of features do you want, and how many users are generally going to log into the platform. That sets a base subscription fee.

Then they tag on components. There's no magic formula that they publish, but this is certainly what goes through the contract process and the pricing process for enterprises is they look at the capacity of what's called envelopes. Think of envelopes as a document that needs to get a couple of signatures, that's running around the internet to make those happen.

THE Major CatalystS for This Trade.....

1. Docusign Contracts and Revenue.....

One of the other key factors about DocuSign, is 88 percent of its revenue comes from its enterprise and commercial customers. These are large corporate customers businesses that have multiple employees, probably in multiple locations. Customers close to doubled over the past couple of years.

The dollar-weighted contract average length is about 18 months. Most contracts are under 12 months or at 12 months, and then about a third of them are over 12 months. One of the things that could play out is as envelopes are used up, that's something that DocuSign knows, because this is cloud software, so that gives the salesperson an opportunity to come back a couple of months later, 3, 6, 9 months before the contract is up; which provides them an opportunity to come back and talk to them about upping their contract volume, or even upping it from a functionality standpoint.

There are many companies that are in their first contract, and their first time they've estimated the envelopes. The other thing that happens, is look at this net dollar retention, which is just going up over time and this is really impacted by larger companies signing on the DocuSign, and realizing the benefits across their organization for more use cases and more departments, and potentially even integrating it into existing infrastructure and process workflows.

2. Customer Growth.....

Enterprise and commercial revenue makes up 88% of the business.

Total customers are 988,000, almost 1 million customers. Interestingly enough, only 14% of its customers are enterprise in commercial, but they make up 88% of the revenue.

DocuSign manages contracts from beginning to end, and executing them in a corporate environment. This second act for DocuSign is really focused on its corporate customer and digitizing and making contracts like a living piece of software versus just a piece of paper. That's all about corporate customers.

Almost every single department across the enterprise has agreement as part of their doing business.

3. Inflationary Considerations.....

Inflation has crept up above 3% for the first time in over a decade.

The rolling four-quarter revenue growth year-over-year is accelerating. Inflationary periods now kick in and the salesperson comes back and says, hey, you need to renegotiate your contract and it has gone up by five percent or went up by seven percent. There is no way the company is going to say, well, we're not using the product as much as we thought we can get by on paper signatures. Nobody is going to say that; therefore, DocuSign is well set up, in any environment going forward even in an inflationary period.

4. Untapped Market.....

DocuSign has been on a roll with its flagship e-signature software as businesses scrambled to adapt to remote working environments. But this e-signature specialist has much more available to customers to enhance the overall agreement process. This is a huge untapped market opportunity for the company.

Docusign received a leader ranking from Gartner for its contract management project. This is the second year in a row that DocuSign has been ranked as a leader. This year, it placed highest among 15 vendors related on the "ability to execute axis" and it ranked highly on the "completeness of vision" axis.

Why does this matter? E-signature is really just the ticket to entry for this tech subscription company. Once customers are in doing this e-signature thing, they're looking to see what other benefits this software can bring. The market for this cloud opportunity beyond e-signature is just as big as the e-signature market. The software that it has enables companies to do more with their contracts. Think about how contracts are handled today. Almost any department can sign a contract, whether it's for their property maintenance or for legal services or development services, or even freelancers. These end up getting shared all over the company in shared drives, Word docs, PDF files, maybe even paper storage.

The e-signature market is $26 billion. This is essentially annual revenue that is there for an opportunity. Notary and identification services, $4 billion. This broader Cloud agreement, $17 billion, and then, just the contracts platform overall is $3 billion. These three on the bottom, they've not released any progress against these, partly because this e-signature business has been growing so fast for them. This company has got a ton of opportunity ahead of itself.

5. Return to Normalcy.....

The U.S. government is looking at this Independence Day weekend to largely mark the country’s return to normalcy after over a year of disruption by the Covid-19 pandemic. About 46% of the U.S. population is now fully vaccinated, per the U.S. CDC and mask mandates have also largely been lifted for vaccinated people, signaling the government’s confidence in the recovery.

Companies are likely to adopt a hybrid working model post the pandemic giving employees some flexibility to work remotely. Moreover, with the broader trend of greater digitization, those software companies which are focused on connectivity, collaboration, and cybersecurity, should stand to benefit. And, DocuSign, a company focused on e-signature solutions, has been the strongest performer, with its stock rising by 25% year-to-date.

The trend of working from home appears to be here to stay even post the pandemic, as companies look to cut costs, access a larger base of talent, and give employees more flexibility. This should ensure that demand holds up in the long-term.

6. Analysts’ Opinions.....

Wedbush raised their price objective on DocuSign from $260.00 to $290.00 and gave the stock an “outperform” rating in a research note on Friday, June 18th.

DOCU has also been the subject of a number of research reports.....

- TheStreet upgraded DocuSign from a "d" rating to a "c-" rating in a research report on Thursday, June 3rd.

- Morgan Stanley increased their price target on DocuSign from $290.00 to $295.00 and gave the company an “overweight” rating in a research note on Friday, June 4th.

- Bank of America reaffirmed a "buy" rating and issued a $250.00 target price on shares of DocuSign in a report on Wednesday, April 14th.

- Oppenheimer lowered their target price on DocuSign from $300.00 to $260.00 and set an "outperform" rating for the company in a report on Friday, June 4th.

- Finally, Royal Bank of Canada started coverage on DocuSign in a research note on Friday, June 11th. They set an “outperform” rating for the company.

20 Wall Street analysts have issued ratings and price targets for DocuSign in the last 12 months. Their average twelve-month price target is $272.29, predicting that the stock has a possible downside of 2.34%, or that analysts will be looking to re-assess their calls. The high price target for DOCU is $325.00 and the low price target for DOCU is $215.00. There are currently 3 hold ratings and 17 buy ratings for the stock, resulting in a consensus rating of "Buy."

Summary.....

With e-signature growth being the primary focus coming into the coronavirus, that has overshadowed growth for the CLM business. In a recent quarter, CEO Daniel Springer said, "Our view coming out of fiscal year '21, particularly out of Q4." This was a couple of months ago. "We're seeing that to build the pipeline of growth again. We're quite optimistic we're going to see that reacceleration we saw a little over a year ago." What they're seeing from their largest customers is, "Hang on. Let me just get e-signature in place. We've got a crisis as people broke out remotely and we didn't expect that."

As people come back into the office DocuSign has had another year to improve their software.

Weekly Options Trades – Li Auto Inc. (NASDAQ: LI) Calls

Tuesday, July 06, 2021

** OPTION TRADE: Buy LI JUL 09 2021 33.000 CALLS at approximately $0.88.

(Some members have asked for the following.....

Place a pre-determined sell at $1.80.

Include a protective stop loss of $0.35.

Prelude.....

China has 1.4 billion people, who are rapidly urbanizing and growing in wealth, and the country is becoming a voracious consumer of sorts of material goods – including cars. As government mandates in China require that, by 2030, 40% of all automotive sales be in electric vehicles.

With significant support from the government and a speedy economic revival, Chinese EV company Li Auto Inc. (NASDAQ: LI) should benefit significantly in the coming months. As a result, Wall Street analysts are optimistic about the prospects of this stock.

The electric vehicle industry has registered significant growth over the past year, making it one of the most profitable industries amid the COVID-19 pandemic. With lower maintenance costs and higher efficiency, as well as supportive government policies, the momentum of the EV industry is likely to continue in the long run. Global EV sales are expected to rise by 70% in 2021, according to an IHS Markit report.

Also, China’s EV market, which is the largest in the world, is expected to rebound quickly in tandem with the country’s economic growth.

With rising per capita income increasing the demand for EVs, Wall Street analysts expect Li Auto to deliver solid returns in the future.

Li Auto, founded in 2015, currently boasts one of China’s best-selling EV models, the Li ONE. In 2020, despite the corona virus crisis, Li delivered over 32,000 units, with 14.464 of those deliveries made in Q4. The company reported US$635.5 million in revenues for the quarter, and a gross profit of US$111 million, up 45% year-over-year. The company’s quarterly net loss fell by more than half from Q3 to Q4, to just US$12.1 million, while quarterly free cash flow increased 113% sequentially to US$245.1 million.

Li One is more of a hybrid since it comes with a fuel tank to charge the battery and extend driving range.

And the latest catalyst of good news for Li Auto is the report that the company has quadrupled June sales and more than doubled Q2 deliveries, easily beating its own company target.

Li Auto Inc. also known as Li Xiang, is a Chinese electric vehicle manufacturer and one of three top Chinese electric car start-ups listed in the US. The three companies are Li Auto, Xpeng Motors and Nio. Amongst the three, Li Auto ranks in second place as it recently overtook Xpeng for making more deliveries in the month of June

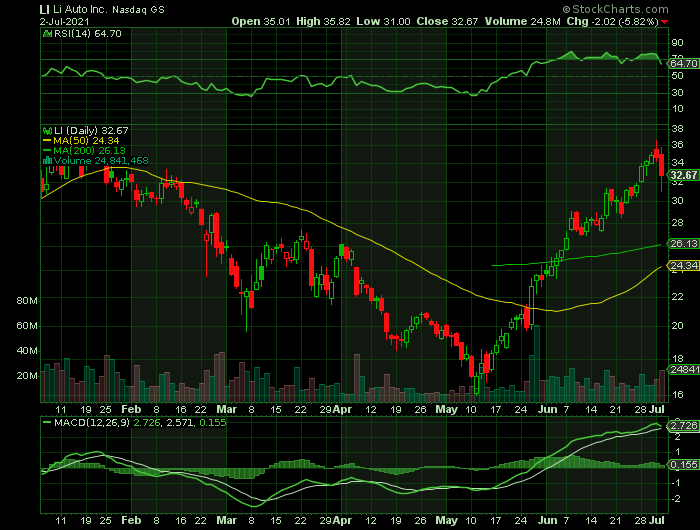

Shares of Li Auto jumped by a staggering 32.48% in 30 days from $24.66 to $32.67 at close of the market on Friday, following the last session’s downward trend.

About Li Auto…..

Li Auto Inc, through its subsidiaries, designs, develops, manufactures, and sells smart electric sport utility vehicles (SUVs) in China. It offers Li ONE, a six-seat electric SUV that is equipped with a range of extension system and cutting-edge smart vehicle solutions.

The company was formerly known as Leading Ideal Inc and changed its name to Li Auto Inc in July 2020.

The Li One SUV was designed to serve a specific niche in China: It includes a small gasoline engine onboard that can be used to recharge its batteries, allowing for longer travel between charging stations.

The Company had 97 retail stores covering 64 cities, and 167 servicing centers and Li Auto-authorized body and paint shops operating in 127 cities as of June 30, 2021.

The Company leverages technology to create value for its users. It concentrates its in-house development efforts on its proprietary range extension system, next-generation electric vehicle technology, and smart vehicle solutions. Beyond Li ONE, the Company aims to expand its product line by developing new vehicles, including BEVs and EREVs, to target a broader consumer base.

THE Major CatalystS for This Trade.....

1. Booming Q2 Sales.....

Li Auto, the Chinese electric-vehicle maker, reported second-quarter deliveries more than doubled and topped its estimates.

Li Auto reported June deliveries of 7,713 Li One SUVs, up 78.4% vs. May and 321% vs. a year earlier. Second-quarter deliveries hit 17,575, up 166% vs. a year earlier and far above the company's target for 14,500-15,500. Li Auto's lone production vehicle, the Li One, has a tiny gas engine as a range extender.

“On the day that marks Li Auto’s sixth anniversary, I'm pleased to share with you that thanks to strong user endorsement for the 2021 Li ONE, we set records in deliveries and new orders in June, the first full month of sales for the 2021 Li ONE after its launch,” said Yanan Shen, co-founder and president of Li Auto.

2. Global Semiconductor Shortage A Problem?

Some analysts will point to the global semiconductor shortage as an industry-wide headwind.

However, Yanan Shen, co-founder and president of Li Auto, evidently isn’t fazed by this concern.

Shen acknowledges that the “ongoing industry-wide semiconductor shortage continues to generate uncertainties.”

Nevertheless, Shen remains “optimistic” that Li Auto’s second-quarter 2021 deliveries “will exceed the top end of our guidance range, and keep rising going forward.”

In defense of this highly optimistic position, Shen cites “the strong uptake of the 2021 Li ONE since its launch,” which is indisputable given the aforementioned data points.

Shen also cites his company’s “continuous expansion of our direct sales and servicing network,” along with the “very positive feedback and strong recognition from our users” in regard to the Li ONE.

3. Sales and Revenue.....

Li Auto’s sales growth is 126.2% for the present quarter and 110.3% for the next. The company’s growth estimates for the present quarter and the next is 97.6% and 100%, respectively.

Year-on-year quarterly revenue growth grew by 319.8%, now sitting on 12.18B for the

4. Money-Managers Opinions.....

Some of the world’s biggest money managers say the strong rally in China’s renewable energy stocks has more legs, citing the sector’s rosy earnings prospects and policy support.

BlackRock Inc., Aberdeen Standard Investments Ltd. and UBS Global Wealth Management are among those backing investments in Chinese electric vehicle-related companies and solar firms. Their endorsement comes as the world’s largest battery maker Contemporary Amperex Technology Co. and major solar producer LONGi Green Energy Technology Co. hit record highs last week after surging more than 40% each in the last quarter.

Global funds are upbeat because of China’s continued dominance in global EV battery and solar panel production, and the nation’s supportive industry policies serving its ambitious goal of reaching carbon neutrality in 2060. International expansion by key players is among other reasons for their optimism.

Chinese companies are increasingly threatening the EV market share of Tesla Inc., which has captivated much of the investment world’s imagination until recently.

“It’s a structural, long-term growth story that investors are prepared to pay up for today,” said James Thom, an investment director at Aberdeen Standard. “The anticipated uplift in renewable energy capacity over the next five years under the latest ‘five-year plan’ is sufficient to justify current valuations,” he added, referring to Beijing’s blueprint for economic and social development through 2025.

5. Analysts’ Opinions.....

EV makers are entering a “golden age,” with global sales expected to surge 76% this year amid supportive policies in Europe and the U.S., as well as increased “high-quality” supply from China, Essence Securities Co. analysts wrote in a note last Monday.

For Hartmut Issel, head of Asia Pacific equities at UBS Global Wealth Management, there’s also scope for solar glass manufacturers to outperform as a potential rise in demand can help improve margins. That’s after increased supply reduced prices earlier in the year, dragging down names such as Xinyi Solar Holdings Ltd.

Many provincial governments are setting “an even tighter target” than 2060 to reduce carbon emissions, BlackRock portfolio manager Lucy Liu said at a briefing last month.

Other recent developments include an “old-for-new” car subsidy scheme launched by Guangdong authorities, one that Citigroup Inc. says could boost sales for EV makers.

LI has also been the subject of a number of research reports.....

- Citigroup Inc. 3% Minimum Coupon Principal Protected Based Upon Russell dropped their price objective on shares of Li Auto from $45.60 to $43.60 and set a "buy" rating on the stock in a research report on Tuesday, June 1st.

- On June 7, Goldman Sachs analyst Fei Fang reiterated a Buy rating on the stock but raised the price target to $62 from $60. The new price target implies 78.7% upside potential from current levels. Fang currently expects Li Auto’s sales to grow from 33,000 vehicles in 2020 to 580,000 in 2025. Furthermore, the analyst is impressed with the optimistic backlog for the new face-lifted version and expanding gross margins of the company.

- Zacks Investment Research raised shares of Li Auto from a "sell" rating to a "hold" rating in a research report on Thursday, June 10th.

- Finally, Needham & Company LLC assumed coverage on shares of Li Auto in a research report on Thursday, March 11th. They issued a "buy" rating and a $37.00 price objective on the stock.

The 17 analysts offering 12-month price forecasts for Li Auto Inc have a median target of 39.06, with a high estimate of 61.39 and a low estimate of 22.71. The median estimate represents a +20.47% increase from the last price of 32.42.

Summary.....

Friday saw Li Auto’s share price drop but the reality of the company’s progress hasn’t registered with many traders and analysts as yet – expect this to change soon.

Li Auto’s value is way higher than its 50-day moving average of $26.20 and way higher than its 200-day moving average of $26.58.

Back to Weekly Options USA Home Page