TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, June 13, 2022

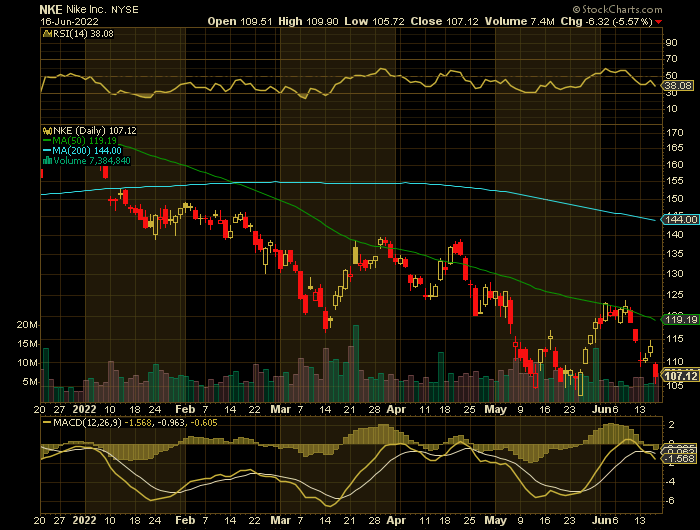

Weekly Options Trades – Nike Inc (NYSE:NKE) Puts

Friday, June 17, 2022

** OPTION TRADE: Buy NKE JUL 01 2022 108.000 PUTS - price at last close was $5.60 - adjust accordingly.

A longer expiry has been chosen to help offset the volatility being experienced in the stock market – exit where profit can be found!

As well, if the market is positive you will have time to pick the best entry price during the day!!

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 100% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Nike Inc (NYSE:NKE) stock price is currently negatively impacted by supply chain woes, inflation, and the Russian invasion of Ukraine; and NKE stock is poised to continue declining in the short term.

NKE will report

earnings on June 27, 2022 after the market closes. The report will be for the

fiscal Quarter ending May 2022; and analysts' forecast that the consensus EPS

for the quarter will be $0.81. The reported EPS for the same quarter last year

was $0.93.

Also, the latest

consensus estimate is calling for revenue of $12.31 billion, down 0.3% from the

prior-year quarter.

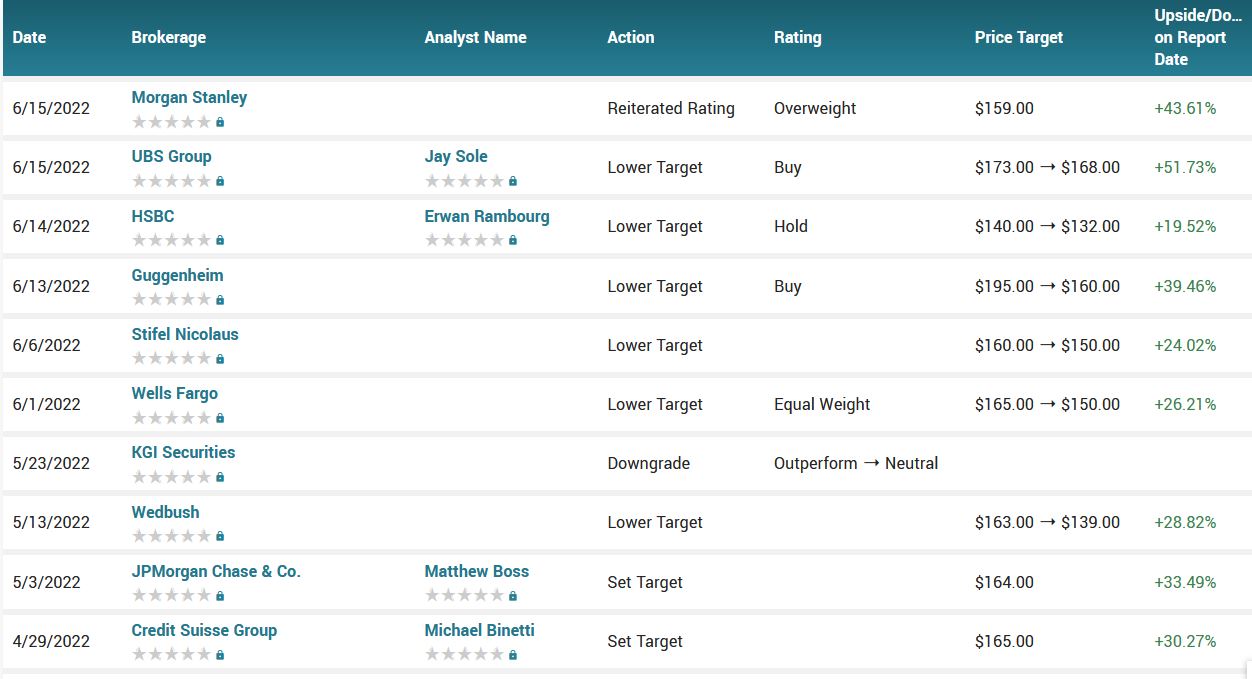

Analysts.....

According to the issued ratings of 29 analysts in the last year, the consensus rating for NIKE stock is Buy based on the current 1 sell rating, 5 hold ratings and 23 buy ratings for NKE. The average twelve-month price prediction for NIKE is $166.46 with a high price target of $195.00 and a low price target of $132.00.

Summary.....

NKE stock traded down $5.55 during midday trading on Thursday, hitting $107.89. The stock had a trading volume of 109,925 shares, compared to its average volume of 6,974,556. The firm has a market cap of $169.79 billion, a PE ratio of 29.93, a price-to-earnings-growth ratio of 1.84 and a beta of 0.96. The company has a debt-to-equity ratio of 0.64, a current ratio of 3.06 and a quick ratio of 2.18. NIKE, Inc. has a 12-month low of $103.46 and a 12-month high of $179.10. The company’s 50-day moving average price is $119.71 and its 200 day moving average price is $137.64.

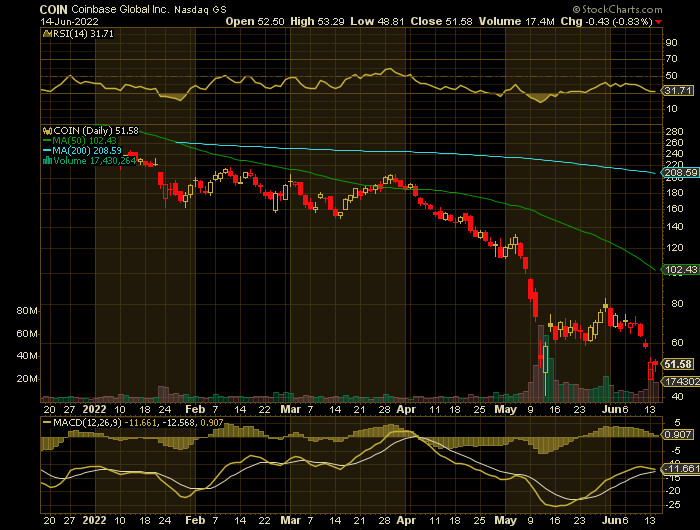

Weekly Options Trade – Coinbase Global Inc (NASDAQ: COIN) Puts

Wednesday, June 15, 2022

** OPTION TRADE: Buy COIN JUL 01 2022 50.000 PUTS - price at last close was $5.93 - adjust accordingly.

A longer expiry has been chosen to help offset the volatility being experienced in the stock market – exit where profit can be found!

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 100% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

That loud sucking sound we hear is the stock market digesting the work of a hawkish Fed that's trying to fight unexpectedly sticky inflation.

"We expect a tumultuous year, and our plan was not to sell into extreme whooshes — I would say we are in an extreme whoosh," Canaccord Genuity Chief Market Strategist Tony Dwyer said on. "I would say if you are looking to cut back exposure because money availability and the outlook isn't so great, I would love to do it on a ramp — some kind of oversold bounce — [rather] than into an extreme whoosh."

All three major equity indices reversed positive starts on Tuesday to trade in the red. Yahoo Finance's trending tickers show big swings for various stocks for various reasons.

The generally bearish action on Tuesday dovetailed with more notable weakness to kick off the week.

U.S. stocks sank into a bear market on Monday, with the S&P ending the session more than 20% below its recent record high in January. The apparent catalyst for the sell-off was a surprisingly hot Consumer Price Index (CPI) on Friday that stoked fresh rate hike fears.

The Nasdaq Composite fell 4.7% in the session, ending at its lowest level since September 2020. The S&P 500 dropped 3.9%.

In the area of cryptocurrency Coinbase Global Inc (NASDAQ: COIN) is cutting its workforce by 18%, according to an 8-K filed by the company on Tuesday, as the crypto market continues to get hammered on expectations of more aggressive Federal Reserve interest rate hikes.

The reduction will shrink the company’s workforce by 1,100 employees to 5,000 in total by June 30, according to the filing.

The announcement adds to a litany of bad news for the crypto industry, with the total value of crypto assets dropping by 25% over the past month from $1.24 trillion to $929 billion as of Tuesday morning, according to Coinmarketcap.

"We appear to be entering a recession after a 10+ year economic boom. A recession could lead to another crypto winter, and could last for an extended period. In past crypto winters, trading revenue (our largest revenue source) has declined significantly," Coinbase Founder and CEO Brian Armstrong said in a blog post that announced the layoffs.

“We grew too quickly," Armstrong added.

Last month, Coinbase said it would slow hiring and rescind some job offers, a far cry from the company’s original goal at the beginning of this year to triple its headcount.

The layoffs announced on Tuesday will “incur approximately $40 million to $45 million” in restructuring expenses, according to the filing, but the company did not change the outlook it provided in May when reporting its most recent quarterly earnings.

"Coinbase has survived through four major crypto winters, and we’ve created long term success by carefully managing our spending through every down period," Armstrong wrote. "Down markets are challenging to navigate and require a different mindset."

About half of bitcoin holders using Coinbase as an exchange likely are facing losses, after the largest cryptocurrency fell to $20,834 late Monday, the lowest level since December 2020, according to analysts at Mizuho.

Bitcoin is trading at around $20,400, down 7.77% over the past 24 hours and almost 70% lower from its all-time high in November, according to CoinDesk data. (This was at 6:27 – and fluctuation continues).

A Mizuho survey pegged the average cost basis for bitcoin holders on Coinbase at $21,000, based on a poll of 145 customers on the exchange. With the cryptocurrency falling below that figure, they estimate roughly half of holders surveyed would be facing losses.

Bitcoin has plunged below its current realized price of $23,430, according to data at Glassnode. The metric represents the average price of every bitcoin in supply, valued at the last time it was last spent on the blockchain.

Bitcoin rarely has dipped below its realized price “outside the deepest and latest stages of bear markets,” the Glassnode analysts wrote in a Tuesday note. The last instances when it dropped below such levels were in March 2020, and the end of the 2018-2019 bear market.

Meanwhile, Coinbase is estimated to have seen $220 billion of total trading volume of crypto for the second quarter, well below its $309 billion volume in the first quarter, analysts at Mizuho wrote in a Tuesday note.

They estimated average daily trading volume on Coinbase at $1.7 billion from June 1 to June 11. If recent weakness lingers through the end of the year, the company’s total volume in 2022 would be about $836 billion, potentially translating to $3 billion of revenue, or 30% below current consensus, the Mizuho analysts wrote.

Weekly Options Trade –Netflix Inc (NASDAQ: NFLX) Puts

Monday, June 13, 2022

** OPTION TRADE: Buy NFLX JUN 24 2022 175.000 PUTS - price at last close was $4.90 - adjust accordingly.

A longer expiry has been chosen to help offset the volatility being experienced in the stock market – exit where profit can be found!

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 100% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

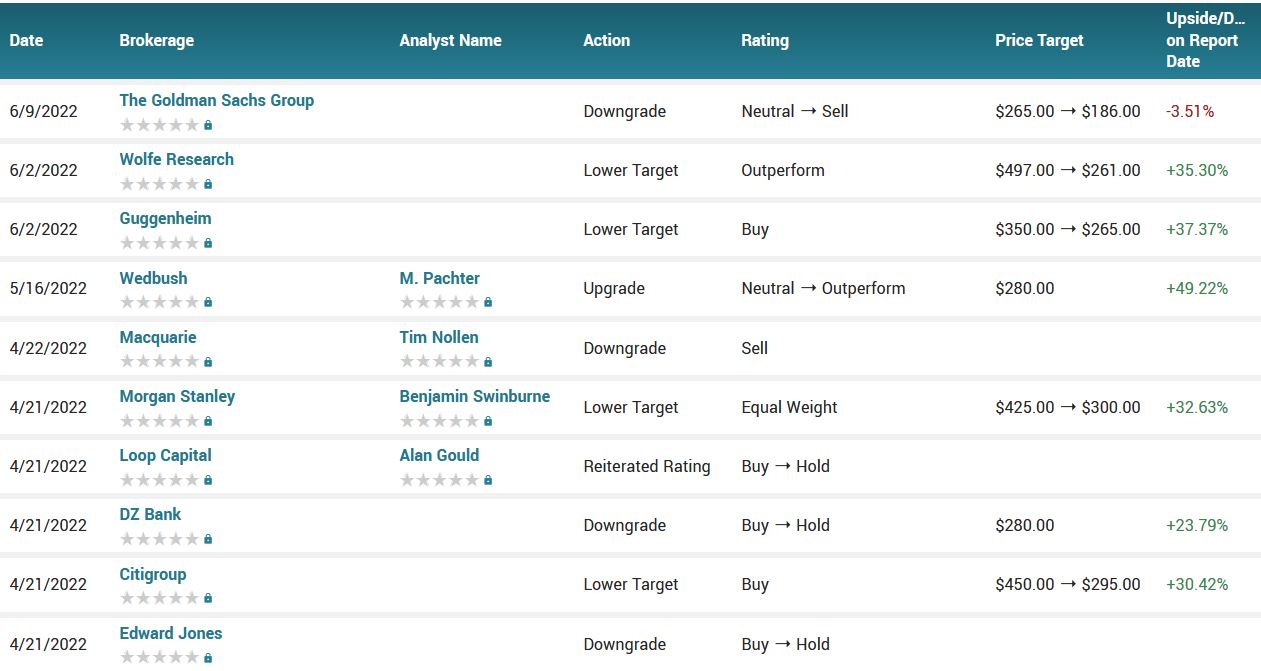

Netflix Inc (NASDAQ: NFLX) shares fell 5% on Friday after Goldman Sachs analyst Eric Sheridan downgraded the streaming pioneer over risks of slower consumer spending and tough competition from Amazon and Walt Disney Co.

In April, Netflix lost subscribers for the first time in more than a decade, signaling trouble ahead for the industry as rising prices of food and gas left people with little to spend on entertainment.

Suspending its services in Russia after the Ukraine invasion also took a toll on Netflix.

Goldman downgraded the stock to "sell" from "neutral" and slashed its price target to $186 from $265, the lowest PT among analysts covering the stock, according to data from Refinitiv.

"We have concerns around the impact of a consumer recession as well as heightened levels of competition on demand trends (both in the form of gross adds and churn), margin expansion, and levels of content spend and view Netflix as a show-me story with a light catalyst path in the next 6-12 months," Sheridan warned in the new note to clients.

The brokerage also lowered its ratings on e-commerce platform eBay Inc and online gaming firm Roblox Corp to "sell" from "neutral". Roblox and eBay shares fell nearly 4% in afternoon trading.

Netflix is now a "show-me story", Goldman said, as it cut revenue estimates for 2022-2023.

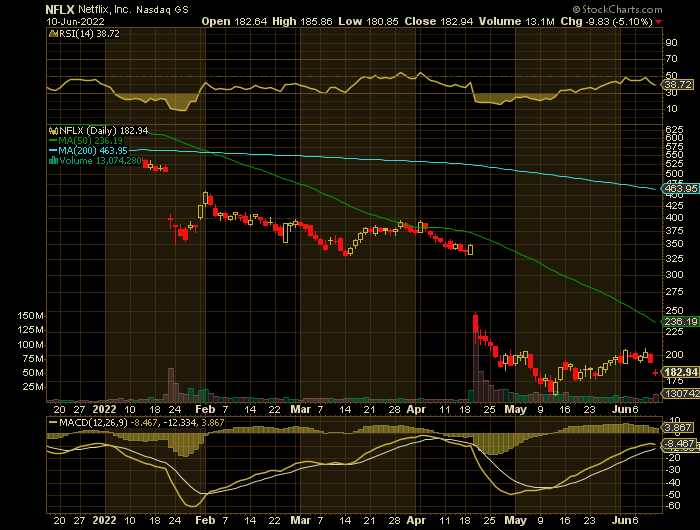

That sent Netflix shares down 4.6% at $184.06 in midday trading on Friday, adding on to this year's 68% slump.

About Netflix.....

Netflix, Inc. provides entertainment services. It offers TV series, documentaries, feature films, and mobile games across various genres and languages.

The company provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, television set-top boxes, and mobile devices. It also provides DVDs-by-mail membership services in the United States. The company has approximately 222 million paid members in 190 countries.

Netflix, Inc. was incorporated in 1997 and is headquartered in Los Gatos, California.

The Other Major Catalysts for the NFLX Weekly Options Trade…..

Previous Trade…..

On Tuesday, May 10, 2022, we executed a Weekly Put Option on Netflix providing members with a potential return of 227%.

Many of the catalysts mentioned at that time are still applicable today.

To view that recommendation CLICK HERE.

Earnings.....

Netflix was on the outs long before April rolled in. The stock took a massive haircut in January after its subscriber growth guidance for the first quarter came in below Wall Street's expectations.

The first-quarter report hit the news wires on April 19, and it wasn't pretty. The soft prediction for subscriber additions turned into a negative number for the first time since the Qwikster era in 2011. Even worse, management sees the negative trends continuing in the second quarter, so the next quarter's subscriber drop looks even larger.

It didn't matter that Netflix also reported revenue right in line with analyst projections while crushing analysts' bottom-line targets. Earnings of $3.53 per share left the Street consensus far behind at $2.90 per share.

The company is raising subscription prices and tweaking its business operations to cut costs and boost profits. But investors are ignoring all of that to focus on those all-important subscriber figures. Netfix shares fell more than 37% the next day alone.

Inflation Effect.....

Shares

of Netflix gained downside momentum together with other tech stocks after the

U.S. reported that Inflation Rate increased by 8.6% year-over-year in May.

Analysts expected that Inflation Rate would grow by 8.3%.

The

high Inflation Rate is a bearish catalyst for Netflix stock for several

reasons. First, the Fed will be forced to raise the rate aggressively in order

to curb inflation. This is bearish for tech stocks in general.

Second,

Netflix may face additional problems as consumers analyze their budgets amid

high inflation and cut “unnecessary” subscriptions.

Moving Ahead.....

Analyst estimates for Netflix have been moving lower after the release of a disappointing quarterly report in April. Currently, the company is expected to report earnings of $10.91 per share in 2022 and $11.97 per share in 2023, so the stock is trading at 15 forward P/E.

While such valuation levels may look cheap for Netflix, traders should keep in mind that the company’s growth is slowing down. In addition, the situation in the economy is worse than previously expected, which could hurt Netflix’ financial performance.

Analysts…..

"The cost of living crisis will have a major impact on all streaming services. Let's not forget the market is now awash with too many streaming media services chasing too few services," said Paolo Pescatore, an analyst at PP Foresight.

"Expect some to pivot more towards a yearly discounted bundle to entice users and increase loyalty."

Netflix is already considering a cheaper subscription that includes advertising, following the success of similar offerings from rivals HBO Max and Disney+.

According to the issued ratings of 38 analysts in the last year, the consensus rating for Netflix stock is Hold based on the current 4 sell ratings, 24 hold ratings and 10 buy ratings for NFLX. The average twelve-month price prediction for Netflix is $365.24 with a high price target of $730.00 and a low price target of $186.00.

Summary.....

Netflix has a quick ratio of 1.05, a current ratio of 1.05 and a debt-to-equity ratio of 0.83. The firm has a market cap of $81.27 billion, a P/E ratio of 16.60, a PEG ratio of 1.00 and a beta of 1.28. Netflix has a 52 week low of $162.71 and a 52 week high of $700.99. The business’s fifty day simple moving average is $231.96 and its 200 day simple moving average is $389.59.

Back to Weekly Options USA Home Page