TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, APRIL 26, 2021

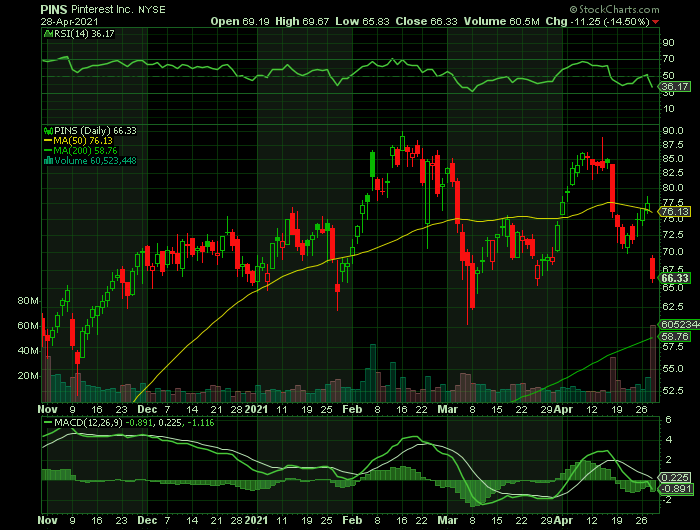

Weekly Options Trade – Pinterest Inc (NYSE: PINS) Calls

Thursday, April 29, 2021

** OPTION TRADE: Buy PINS MAY 14 2021 67.500 CALLS at approximately $2.75.

(Some members have asked for the following.....

Place a pre-determined sell at $5.50.

Include a protective stop loss of $1.10.

Prelude.....

Pinterest Inc (NYSE: PINS), a unique medium, reported earnings on Tuesday April 27, after the market closed. Before the report consensus earnings estimate were for $0.08 per share on revenue of $472.67 million; the Whisper number was higher at $0.13 per share.

The company's guidance was for revenue of approximately $469.00 million. Consensus estimates were for year-over-year revenue growth of 73.81%.

Overall earnings estimates had been revised higher since the company's last earnings release.

Pinterest's revenue rose 48% to $1.69 billion in 2020, even as the pandemic temporarily throttled its ad growth in the first half of the year.

Its U.S. revenue rose 39% to $1.43 billion, while its international revenue surged 129% to $268 million. Its growth in monthly active users (MAUs) and average revenue per user (ARPU) also remained robust.

Pinterest's share price had shot up over 273% in the past year. The visual search-based social media company lost almost 14.7% in the last week after Cleveland Research noted a probable decline in spending on Pinterest by some omnichannel retailers in the first quarter.

Omnichannel retailers aim at providing a seamless experience to customers across all online and offline sales channels.

The Actual Earnings Report.....

Pinterest's revenue rose 78% year over year to $485 million, besting Wall Street's forecast of $474 million. With people spending more time online during the pandemic, businesses flocked to the image-sharing site to advertise their wares. Pinterest's expansion outside the U.S. also contributed to the gains.

"This quarter, we continued strong growth internationally, including our recent launch of advertising in Brazil, and made significant progress with shopping, making it easier for people to discover and buy products they find on Pinterest," CEO Ben Silbermann said in a press release.

Pinterest's adjusted earnings per share of $0.11 also came in above the consensus estimate of $0.07.

Pinterest's monthly active users (MAUs) climbed 30% to 478 million. Analysts, however, had expected 480.5 million users.

Major Catalysts for This Trade.....

1. Over-Reaction To Pinterest Earnings.....

Pinterest stock dropped 14.5%, closing at 66.33 yesterday

But, Pinterest’s first-quarter numbers were great.

Users rose 30%. ARPU rose 35%. Revenues rose 78%. Gross margins expanded 880 basis points. The expense rate compressed 31 percentage points. Adjusted EBITDA margins expanded a jaw-dropping 37 percentage points.

But management said that since mid-March, the platform’s user growth rate has slowed significantly.

Management expects this consumer behavior normalization to act as a headwind for user growth over the next few months, and is actually guiding for the platform to add just a few million new users in Q2, versus 19 million new users in Q1.

PINS stock dropped big on that news, because user growth is the centerpiece of a social media company’s growth narrative.

However, this is not a concern at all, because slowing user growth is ephemeral and that, while it lasts, it will be offset by accelerating ARPU growth.

Pinterest is a social commerce platform with a wide array of durable value props that, yes, were exceptionally valuable during the pandemic, but will remain very valuable after the pandemic leaves, too.

People are still going to remodel their homes. They are still going to look for new outfits to wear, find inspiration for where to go on vacation, seek new workout routines, and share cooking recipes. Pinterest is the place to do all of those things.

Plus, Pinterest is adding multiple new features — like Story Pins, on-platform shopping, interactive videos, and Shopify integrations — which are collectively drawing in more and more Gen Z users. This is a cohort that Pinterest has failed to meaningfully crack yet but which, if Pinterest does crack, will provide a long runway for user growth over the next few years.

By summer, Pinterest will be back to adding 10+ million new users every quarter.

While this slowdown does last, it will be offset by healthy ARPU growth.

Analysts Still Positive.....

Morgan Stanley, KeyBanc, Wedbush, JPMorgan, Deutsche Bank, and Wells Fargo all reiterated “Buy” ratings on PINS stock after the earnings report.

KeyBanc Capital Markets analyst Justin Patterson lowered his price target on Pinterest stock to 89, from 92. But he maintained a rating of overweight.

"We view monthly active user guidance, which Pinterest historically does not provide, as appropriately conservative, and believe several use cases (e.g. travel, wedding) and marketing initiatives could help drive upside," Patterson wrote in a note to clients. "We recommend buying PINS on weakness."

Overall, consensus on the Street is that PINS is a Moderate Buy based on 13 Buys and 9 Holds. The average analyst price target of $92.69 implies upside potential of about 19.4% to current levels.

3. Robust Second-Quarter Guidance.....

Management expects Q2 revenue will grow about 105% year over year. This outlook is brighter than Wall Street had been expecting. Going into the release, analysts had been modeling for Q2 revenue to increase 94% year over year.

Management also said it expected "Q2 global MAUs to grow in the mid-teens and U.S. MAUs to be around flat on a year-over-year percentage basis."

That Pinterest guided for U.S. MAU year-over-year growth to stall in Q2 is probably the biggest factor behind the stock's decline on Wednesday.

Summary.....

This near-term plunge will not last. Over the next few months, PINS stock will power toward $100.

Bear-in-mind: First, advertising rates should continue to climb in the U.S. (and in many international markets) as the economy continues to rebound from the pandemic. Second, in Q2, the company will be facing an ultra-tough year-over-year U.S. user comparable. The second quarter of last year was the first full quarter following stay-at-home orders being issued in mid-to-late March by most U.S. states.

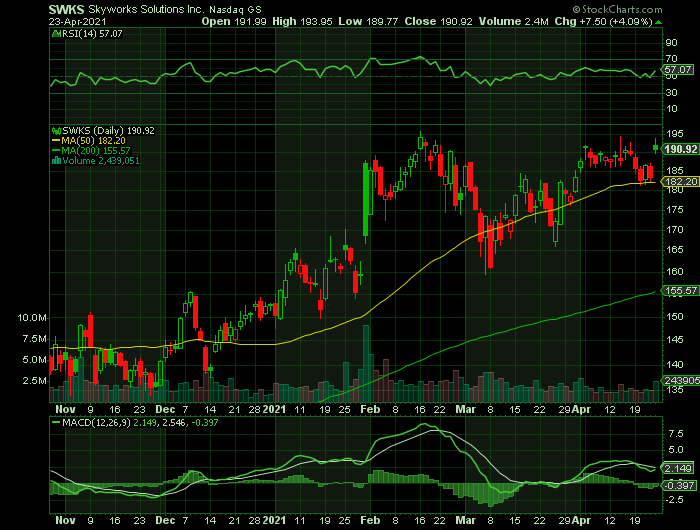

Weekly Options Trade Follow-Up– Skyworks Solutions Inc (NASDAQ: SWKS) Calls

Tuesday, April 27, 2021

** OPTION TRADE: Buy SWKS MAY 07 2021 205.000 CALLS at approximately $4.00.

(Some members have asked for the following.....

Place a pre-determined sell at $8.00.

Include a protective stop loss of $1.60.

Prelude.....

As you would know, Skyworks Solutions Inc (NASDAQ: SWKS) took off running yesterday, the lowest entry for the option recommended was $7.24, and that had a limited window of entry. The trade hit a high of $10.50.

Here is another opportunity to enter a SWKS options trade at a lower cost (at this stage).

What Happened.....?

Skyworks Solutions saw its stock rise almost 5% Monday afternoon. The company continued to make progress following favorable news recently.

The good news for Skyworks started last week, when the company announced it would pay $2.75 billion to acquire assets from Silicon Laboratories (NASDAQ:SLAB) – as mentioned in the previous recommendation on SWKS. The cash deal will help Skyworks get greater exposure to some areas with high growth potential, particularly the autonomous-vehicle end of the automotive sector. Skyworks expects the acquisition will immediately boost earnings.

Subsequently, a host of analysts weighed in favorably on the move, with B. Riley giving a minimal boost to its price target on Friday. UBS joined in with a price target bump on Monday, although it kept its rating on the stock at neutral.

Analyst Timothy Arcuri raised his price target on Skyworks shares from $181 to $190. The valuation adjustment comes just a few days after UBS expressed positive opinions about the tech company's pending $2.75 billion acquisition of Silicon Labs' infrastructure and automotive business, which was announced last week.

Conclusion.....

Skyworks' efforts to diversify its business are important, as it remains dangerously exposed to its agreements with Apple. That's been problematic for Skyworks stock in the past, and if deals like the Silicon Labs acquisition can help protect the company from the ups and downs of Apple's fortunes, call options trades will benefit.

Weekly Options Trade – Skyworks Solutions Inc (NASDAQ: SWKS) Calls

Monday, April 26, 2021

** OPTION TRADE: Buy SWKS MAY 07 2021 195.000 CALLS at approximately $4.65.

(Some members have asked for the following.....

Place a pre-determined sell at $9.30.

Include a protective stop loss of $1.90.

Prelude.....

Semiconductor firm Skyworks Solutions Inc (NASDAQ: SWKS), a smartphone chip supplier, has turned up the heat in recent quarters as booming sales of 5G smartphones and the success of Apple's iPhone 12 series has led to sharp growth in the company's revenue and earnings.

The chipmaker started fiscal 2021 on a high thanks to these tailwinds. Not surprisingly, Skyworks stock has done well so far in 2021 despite facing a bout of volatility. However, shares of the semiconductor specialist have pulled back this month for no visible reason.

This could be a chance for this options trade on Skyworks stock, which is at an attractive valuation, and it should take off after the release of its second-quarter results on Thursday, April 29.

After a few years of slumber that started in 2018 (the start of the last chip and tech hardware downturn, hastened by the U.S.-China trade war and culminating in the economic lockdown last spring), Skyworks Solutions has been on a tear. Shares of the connectivity chipmaker are up nearly 60% since the start of 2020. However, even after the big jump higher, the stock trades for 36 times trailing-12-month free cash flow.

Skyworks is poised to benefit from a massive 5G smartphone upgrade cycle. Its largest customer, Apple, makes up about half of sales, so it has a lot to gain as iPhone fans purchase a new device with a 5G connectivity chip. It's won some other design contests for other tier one smartphone makers that could send sales soaring higher for the rest of this year, and its non-smartphone portfolio (about one-quarter of revenue) is also growing by double-digit percentages as businesses and consumers start to upgrade to Wi-Fi 6 hardware.

As to specific growth figures, Skyworks' first-quarter 2021 revenue grew 69% year over year to $1.51 billion and management forecast second-quarter sales to jump 50% from a year ago to about $1.15 billion.

Major Catalysts for This Trade.....

1. Earnings on Thursday, April 29.....

Skyworks Solutions has already set a high bar for the second quarter of fiscal 2021. The company expects to deliver $2.34 per share in adjusted earnings on revenue between $1.125 billion and $1.175 billion. Skyworks' revenue would increase 50% year over year at the midpoint of the guidance range, while adjusted earnings are on track to spike an impressive 75%.

Skyworks Solutions could surpass its expectations and deliver stronger Q2 numbers. Apple -- Skyworks' largest customer, which produced 56% of its sales last fiscal year -- is one reason why that may be the case. Skyworks is supplying multiple radio-frequency chips for use in the iPhone 12 lineup, and that's going to create a massive tailwind for the company given the popularity of Apple's new phones.

For the last reported quarter, it was expected that Skyworks would post earnings of $2.08 per share when it actually produced earnings of $3.36, delivering a surprise of +61.54%.

Over the last four quarters, the company has beaten consensus EPS estimates three times.

2. iPhone Sales.....

The iPhone 12 models have been setting the sales chart on fire ever since they were launched late last year, encouraging Apple to raise production. Supply chain checks indicate that Apple could have made around 60 million iPhones in the first quarter of 2021, driven by a sales "supercycle." Strategy Analytics estimates that Apple sold 57 million iPhones last quarter, an increase of 44% over the prior-year period.

A jump in iPhone sales volumes, and the fact that Skyworks should be getting more revenue from each unit of Apple's new devices thanks to the higher cost of components of 5G smartphones, should pave the way for revenue and earnings beats.

3. Non-mobile Business Spiking.....

Skyworks' revenue from the non-mobile business (formally known as the broad markets segment) spiked 35% year over year in the first quarter. Though this segment accounts for 22% of the company's total revenue, it is showing signs of moving the needle in a bigger way in the long run. That's because the broad markets business stands to gain from a fast-growing technology trend in the form of the Internet of Things.

4. Targeting Wireless Connectivity Applications.....

Skyworks is targeting wireless connectivity applications such as Wi-Fi 6 devices, automotive, healthcare, and audio solutions, among others. The company has found success in these areas as the rapid growth of the broad markets business shows us. It has also built a wide customer base including the likes of Cisco Systems, Netgear, Alphabet's Fitbit, Volkswagen, and Toyota, to name a few.

5. Solid Guidance.....

Wall Street expects Skyworks to deliver third-quarter revenue of $1.07 billion and adjusted earnings of $2.10 per share. That would translate into 45% year-over-year sales growth and a 68% rise in adjusted earnings. This is already impressive, but Skyworks can deliver better guidance considering the developments that are reportedly taking place at its largest customer.

Apple supplier Taiwan Semiconductor Manufacturing is reportedly planning to start the production of the chip that will go into this year's iPhone lineup next month. For comparison, the iPhone 12's A14 chip hit the production lines in June last year. Additionally, Apple is expected to produce 25% more units of this year's iPhone models as compared to 80 million units of the iPhone 12 produced in 2020.

If true, such a development could pave the way for strong guidance from Skyworks for the rest of the year. Analysts expect the chipmaker to end the fiscal year with 46% revenue growth and a 67% jump in earnings, and the sustained success of its largest customer in the 5G smartphone market could make that possible.

6. Acquisition of Silicon Labs.....

Liam Griffin, president and CEO of Skyworks Solutions announced Friday the acquisition of the infrastructure and automotive business of Silicon Labs (SLAB) for $2.75 billion.

“We are pleased to welcome the Infrastructure & Automotive team to Skyworks when this transaction is completed. This acquisition will broadly expand our capabilities across high-growth end markets including automotive, communications and industrial, creating new and highly compelling opportunities for Skyworks.”

Griffin called the announcement a "perfect deal" that gives Skyworks great technologies that they wanted in a transaction that's immediately accretive to their earnings. He said it gives Skyworks access to markets they wanted to be in, including autos and the data center.

“By leveraging our global sales channels, operational scale and deep customer relationships, Skyworks is well positioned to drive above-market growth, while diversifying revenues, expanding margins and delivering strong returns in earnings and cash generation,” Griffin added.

Unlike most acquisitions that include a lot of cost cutting synergies, Griffin noted that with this deal, they'll be investing and bringing all of the Skyworks' resources to grow these segments. He said he can't wait to bring 385 really smart people into the Skyworks family.

The acquisition is expected to be immediately accretive to SWKS and is anticipated to close in the third quarter of this year. SWKS believes that Silicon Labs’ technology portfolios and related assets will be “highly complementary” to its connectivity portfolio.

With this acquisition, SWKS also expects to expand rapidly into different business segments including electric and hybrid vehicles, 5G wireless infrastructure, power supply, industrial and motor control, and optical data communication. This acquisition will enable SWKS to provide products to a market worth $20 billion annually.

Raymond James and BMO note that the deal will immediately add to Skyworks' earnings.

Raymond James said the deal "isn't inexpensive" while BMO said Skyworks is paying "a reasonable multiple." Both rate Skyworks outperform.

Morgan Stanley, with a more conservative equal-weight rating on the stock, said the deal should be a positive for both companies.

7. Analyst Positivity.....

Skyworks Solutions had its price objective boosted by research analysts at B. Riley from $225.00 to $230.00 in a research report issued on Friday. The brokerage currently has a “buy” rating on the semiconductor manufacturer’s stock. B. Riley’s price objective would indicate a potential upside of 25.40% from the company’s current price.

Also, Skyworks Solutions had its price objective lifted by Mizuho from $195.00 to $207.00 in a report released last Thursday morning. They currently have a buy rating on the semiconductor manufacturer’s stock.

Several other research analysts also recently weighed in on the company.....

- Susquehanna boosted their target price on Skyworks Solutions from $160.00 to $190.00 and gave the stock a “neutral” rating in a research note on Friday, January 29th. They noted that the move was a valuation call.

- Needham & Company LLC boosted their target price on Skyworks Solutions from $200.00 to $245.00 and gave the stock a “buy” rating in a research note on Friday, January 29th.

Overall, consensus among Wall Street analysts is a Moderate Buy based on 12 Buys and 7 Holds. The average analyst price target of $208.25 implies upside potential of about 13.5% to current levels.

Summary.....

Skyworks Solutions is in prime position to sell lots of next-gen connectivity equipment for the foreseeable future.

Back to Weekly Options USA Home Page