TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, APRIL 05, 2021

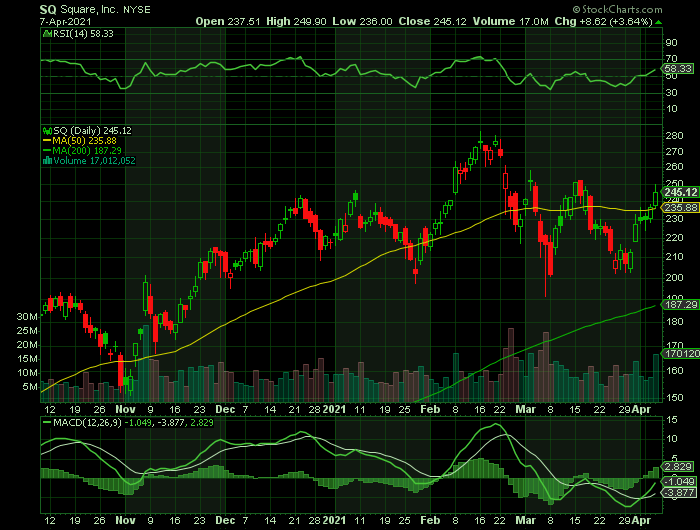

Weekly Options Trade – Square Inc (NYSE:SQ) Calls

Thursday, April 08, 2021

** OPTION TRADE: Buy SQ APR 23 2021 255.000 CALLS at approximately $6.00.

(Some members have asked for the following.....

Place a pre-determined sell at $12.00.

Include a protective stop loss of $2.40.

Prelude.....

Square Inc (NYSE:SQ) 's pullback is primarily a result of the market rotation. Although the company's seller ecosystem was negatively impacted by the COVID-19 pandemic, there were signs of improvement in the fourth quarter. And the increased availability of vaccines bodes well for a stronger performance throughout the rest of 2021.

Meanwhile, Square's Cash App digital wallet continues to be a monster growth story for the company. Cash App gross profit skyrocketed 162% year over year in Q4. Square should be able to deliver even more growth by driving increased adoption of related products and services such as the Cash Card debit card.

The company achieved a significant milestone in March as its Square Financial Services unit began banking operations. With a federally chartered bank under its umbrella, Square will be able to offer more financial services for its business customers. Over time, the fintech leader is likely to expand its banking services.

In many ways, Square is just getting started in its quest to turn the financial services industry upside down. Its shares have plenty of room to run.

The Major Catalysts for This Trade.....

1. The Chart.....

Square’s stock lost over 32% of its value between Feb. 16 and March 5 following a consolidation period on the Nasdaq 100.

Since hitting a temporary bottom of $191.68, Square’s stock also eased into a consolidation pattern and on Tuesday broke bullish.

On Wednesday morning, option traders saw signs of bullish follow-through on the chart and bought a large amount of call sweeps.

Although Square’s stock has been trading in a bearish descending triangle since reaching an all-time high of $283.12, a bullish inverted head-and-shoulder pattern within the descending triangle overrode the bearish pattern.

On Tuesday, Square’s stock broke up through the descending line that had been holding it down, and on Wednesday morning a significant amount of bullish volume came into the stock, which gave traders the indication that a larger move to the upside was imminent.

By midday Wednesday, the volume on Square’s stock matched the volume from the entire trading session Tuesday.

2. Sweepers.....

When a sweep order occurs, it indicates the trader wanted to get into a position quickly and is anticipating an imminent large move in stock price.

A sweeper pays market price for the call option instead of placing a bid, which sweeps the order book of multiple exchanges to fill the order immediately.

These types of call option orders are usually made by institutions, and retail investors can find watching for sweepers useful because it indicates “smart money” has entered into a position.

At 10:01 a.m., a trader executed a call sweep of 2,048 Square options with a $250 strike price expiring on April 9. The trade represented a $622,592 bullish bet for which the trader paid $3.04 per option contract.

At 10:04 a.m., a trader executed a call sweep of 541 Square options with a $220 strike price expiring on April 16. The trade represented a $1.44-million bullish bet for which the trader paid $26.60 per option contract.

At 10:33 a.m., a trader executed a call sweep of 638 Square options with a $260 strike price expiring on May 21. The trade represented a $880,440 bullish bet for which the trader paid $13.80 per option contract.

Together, traders are betting over $2.94 million the share price of Square is going higher.

3. Analysts Positivity.....

Barclays also maintained and Overweight rating on Square Wednesday and raised its price target from $320 to $330.

Barclays argues that Square has been investing significantly in its international operations, is hiring briskly abroad, and is now "finally positioned correctly" to grow in global markets. This implies that there's now meaningful upside for Square to outperform analyst expectations internationally, Barclays says, giving rise to the possibility of an earnings beat when Square reports its first-quarter 2021 results, probably in May.

Also, French investment bank Oddo BHF initiated coverage of Square Wednesday.

Summary.....

Analysts were already feeling pretty optimistic about those first-quarter results, forecasting a turn to profitability and $0.16 per share in pro forma earnings -- and 138% revenue growth to $3.3 billion. So how much might international growth move those numbers?

According to S&P Global Market Intelligence, Square currently gets only about 3.3% of its total revenue from outside the U.S. On the one hand, this means that even a doubling of international revenue would still leave this segment very small relative to U.S. sales, at least initially. On the other hand, it means that there's quite a lot of room to grow internationally. Barclays (and Oddo, too) are probably right to be optimistic.

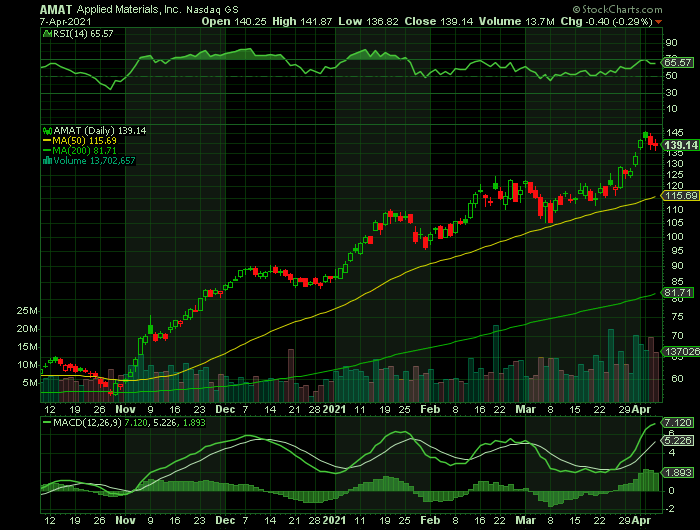

Weekly Options Trade – Applied Materials, Inc. (NASDAQ:AMAT) Calls

Thursday, April 08, 2021

** OPTION TRADE: Buy AMAT APR 23 2021 145.000 CALLS at approximately $2.50.

(Some members have asked for the following.....

Place a pre-determined sell at $5.00.

Include a protective stop loss of $1.00.

Prelude.....

The stock of chip-gear maker Applied Materials, Inc. (NASDAQ:AMAT), headquartered in Santa Clara, manufacturing equipment, services, and software to the semiconductor, display, and related industries worldwide, has soared in the last six months, as investors bet that a world-wide shortage of computer chips spells opportunity for the supplier of semiconductor-fabrication gear. But after the company held its first analysts meeting in four years, on Tuesday, the stock has slid.

In Wednesday morning trading, Applied Materials stock was off 1.6%, to $137, amid a flat stock market.

The Major Catalysts for This Trade.....

1. Chip Shortage.....

The leading semiconductor equipment company by revenue continued to benefit as the global race in advanced chip production heated up, amid severe semiconductor shortages across a broad range of applications.

Widespread reports of a severe semiconductor shortage this year have also pushed sentiment higher for Applied as well.

The good news kept on coming in March, when Intel held an event updating investors on its future production strategy. Intel has struggled with its 7-nanometer chip production in recent years, falling behind Taiwan Semiconductor and leading some to believe Intel may scrap its in-house production entirely. Yet new CEO Pat Gelsinger did the opposite, announcing Intel would instead invest $20 billion in two new fabs (chip factories) of its own in Arizona, while also becoming a foundry for other chip designers.

That means there will be another large buyer for Applied Materials' machines, as companies and countries around the world seek to own significant in-country chip production.

2. Investor Meeting.....

Chip-gear maker Applied Materials, saw its stock drop after the semiconductor equipment maker gave its outlook for the next four years at a virtual investor meeting on Tuesday. But many Wall Street analysts liked what they heard, and several raised their price targets on AMAT stock.

The Santa Clara, Calif.-based company said it expects to grow revenue by over 55% and adjusted earnings per share by more than 100% by fiscal 2024, compared with fiscal 2020.

Under its base case, Applied Materials forecast fiscal 2024 adjusted earnings of $8.50 a share on revenue of $26.7 billion. In fiscal 2020, Applied Materials earned an adjusted $4.17 a share on sales of $17.2 billion.

"The target model appears conservative," Credit Suisse analyst John Pitzer said in a note to clients. He rates AMAT stock as outperform with a 12-month price target of 175.

Buy-side analysts had expected fiscal 2024 earnings of $10 a share and were disappointed by the $8.50 target, Evercore ISI analyst C.J. Muse said in a report. Still, he kept his outperform rating on AMAT stock with a price target of 175.

Needham analyst Quinn Bolton maintained his buy rating on AMAT stock and upped his price target to 153 from 130.

"We believe AMAT's prudent outlook is a blessing in disguise," Bolton said in a note to clients. "Behind the conservative outlook is AMAT's confidence in a much less volatile and a more steadily growing WFE (wafer fabrication equipment) industry, which in our view justifies a continued re-rating of AMAT's stock."

3. Analysts Positivity.....

Cowen analyst Krish Sankar reiterated his outperform rating on AMAT stock and raised his price target to 160 from 140.

Applied Materials "is uniquely positioned to outperform the already strong industry growth over the next few years," Sankar said. He noted the company's strong product and services portfolio and semiconductor industry drivers such as artificial intelligence.

At its investor meeting, Applied Materials unveiled plans to grow the company's revenue, earnings and free cash flow by enabling customers to accelerate improvements in chip power, performance, area, cost and time to market.

The company also committed to returning between 80% and 100% of free cash flow to shareholders.

At least five Wall Street firms raised their price targets on AMAT stock following the investor day event.

4. AIx for New Chip Technologies.....

The company remains well-poised to capitalize on the uptick in the chip design activity across the world on the back of the new platform.

The latest introduction is AIx, which stands for Actionable Insight Accelerator.

Notably, AIx is a platform powered by big data and AI,which helps in the development and deployment of new chip technologies by allowing engineers to check semiconductor processes in real-time.

Further,

these engineers will be able to take several measurements across wafers and

individual chips.

Moreover, the latest move bodes well for the company’s growing ML and AI

efforts. It is applying ML in semiconductor fabs to enhance automated defect

analysis.

The company has developed an automated defect classification technology that

utilizes different imaging techniques to identify and eliminate defects in chip

manufacturing.

With all these, the company is set to gain from strength in semiconductor

equipment demand. Further, increased customer spending in foundry and logic on

the back of the rising need for specialty nodes in IoT, communications,

automotive and sensor solutions remains a positive.

Summary.....

For much of the past two years, amid the trade war, Applied Materials was a cheap value stock. Now, with pandemic-era digitization trends accelerating and countries realizing the need to have critical capacity on their own shores, demand for leading semiconductor manufacturing equipment is soaring. No wonder Applied's stock is up so much this year. Even more strikingly, the company still only trades at 22 times this year's earnings estimates.

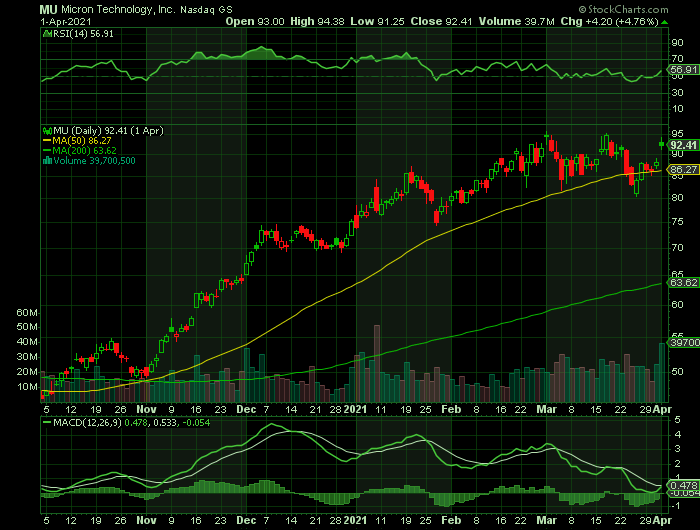

Weekly Options Trade – Micron Technology Inc. (NASDAQ: MU) Calls

Monday, April 05, 2021

** OPTION TRADE: Buy MU APR 09 2021 95.000 CALLS at approximately $1.00.

(Some members have asked for the following.....

Place a pre-determined sell at $2.00.

Include a protective stop loss of $0.40.

Prelude.....

The global chip shortage might be causing havoc for industries heavily reliant on semiconductor chips, but the strong demand continues to favor Micron Technology Inc. (NASDAQ: MU).

The memory giant delivered the goods in its latest quarterly statement and expects the business to keep on outperforming for the rest of the year.

In FQ2, Micron generated revenue of $6.24 billion, a 30% year-over-year uptick and coming in ahead of the Street’s forecast by $30 million. Non-GAAP EPS came in at $0.98, 3 cents above the consensus estimate and at the high-end of Micron’s revised guidance range of $0.93 to $0.98.

With ASPs up slightly quarter-over-quarter, DRAM revenue grew sequentially by 10%, while NAND sales increased by 5% quarter-over-quarter. DRAM generated 71% of the company’s revenue, and Nand flash chip sales amounted to 26%.

Micron expects F3Q (May) revenues to come in between $6.9 and $7.3 billion, higher than Wall Street’s forecast of $6.75 billion. The company’s EPS guidance is in the $1.55-$1.69 range, far higher than the consensus calls for $1.33.

The company also said that as enterprise spending picks up and cloud demand strengthens, data center demand should get an additional boost in the year’s second half.

The Major Catalysts for This Trade.....

READ the article “Micron Technology Inc Tops Earnings Estimates! Provides Upbeat Q3 Outlook!”

1. The Actual Earnings Report for Micron Technology Inc.....

Micron Technology Inc reported revenue of $6.24 billion and adjusted earnings of $0.98 per share, beating analyst estimates on both earnings and revenue. The company’s operating cash flow totaled $3.06 billion compared to $1.97 billion in the previous quarter.

2. Looking Ahead for Micron Technology Inc…..

In the next quarter, Micron Technology Inc expects to report revenue of $7.1 billion and adjusted earnings of $1.62 per share. The company’s guidance looks strong which is not surprising given the current market situation in the semiconductors segment. The world is suffering from a shortage of chips, which is a bullish development for Micron Technology Inc.

3. Enthusiasm From The Analysts…..

RBC Capital analyst Mitch Steves reiterated a “Buy” rating and raised the price target to $120 from $110 on the stock, implying a 36% upside potential.

Steves’ price target raise comes after the chipmaker's quarterly earnings beat last week and a better-than-expected outlook. The analyst notes that Micron’s gross margins are “expanding rapidly considering that the firm guided to 41.5% gross margins at the midpoint.”

The Wall Street Journal reported last week that Micron and Western Digital are considering a deal that would result in the acquisition of Kioxia for about $30 billion.

Deutsche Bank analyst Sidney Ho says things are looking “pretty, pretty, pretty good through CY21.”

“MU's outlook for CY21 in both DRAM and NAND has improved since its last earnings call with strong demand driven by multiple key end markets including cloud, enterprise, mobile and PC,” Ho said. “Post results, we have increased conviction in the business environment for MU in CY21 and believe that the stock should continue to trade at a premium to its historical P/B as it benefits from strong DRAM and NAND markets.”

Accordingly, Ho raised his F3Q EPS estimate to $1.62 from the prior $1.22. For CY21, Ho also increased his EPS forecast - from $6.13 to $7.50.

Ho’s rating is a Buy with a $110 price target.

Also, Needham analyst Rajvindra Gill maintained a Buy rating on Micron Technology Inc shares and increased the price target from $115 to $130.

"We expect MU to benefit from the recovery in the memory cycle, which we believe has exited a super-cycle and is now in a more typical cycle," Gill said.

As well, Rosenblatt Securities analyst Hans Mosesmann reiterated a Buy rating and hiked the price target from $150 to $165.

Severe shortages driven by strong demand in virtually all markets drove Micron's beat and raise narrative last night, Rosenblatt Securities analyst Mosesmann said. The analyst expects the dynamic to continue in calendar 2021, given the upward adjustment of bit demand by the company.

The stabilization of the NAND market, implied by the company, comes as a surprise, the analyst said.

"The direction of CapEx we see as quite bullish and it signals to the industry/competitors moderation and discipline, while signaling to customers that the shortage framework likely extends into 2022," the analyst wrote in the note.

And, Raymond James analyst Chris Caso reiterated a Strong Buy rating and $120 price target.

Micron's second-quarter report checked all the right boxes, with no increase in CapEx, strong pricing, shortages persisting through the year, resumption of buybacks and incremental NAND improvement, Raymond James analyst Caso said.

4. Chip Shortage.....

In recent months, production of everything from smartphones to automobiles has been throttled by a global shortage of semiconductors -- the building blocks of all things electronic. These basic commodities for tech are a cyclical affair. Years of booming sales and high prices can be followed by lean periods when demand falls. Such a downturn started back in 2018 after Micron reported new all-time highs for sales and profits.

These cycles are normal for manufacturing, but the downturn was exacerbated by the U.S.-China trade war. Global supply chains had to be rerouted to account for tariffs and embargoes on sales to certain companies. Then COVID-19 struck, temporarily shuttering chip foundries. And chip companies' customers (like automakers, for example) slowed their purchasing of new hardware and worked down existing inventory during 2020 to manage their cash flow.

Demand for electronic devices, autos, and industrial equipment came roaring back, but all the aforementioned effects added up to a global shortfall in supply. For a company like Micron, there could be worse situations. Operating at or near max capacity means greater efficiency, and it appears the global shortage will keep sales pushing higher for the rest of the year. And new technologies like artificial intelligence systems in data centers, the rollout of 5G mobile networks, and more powerful consumer devices mean this uptrend could have legs for a while.

Conclusion.....

The market situation remains favorable for Micron Technology Inc as the coronavirus pandemic has boosted demand for chips, while the increased demand from the auto industry supported the upside trend.

Micron Technology Inc will benefit from both strong demand and higher prices for its production.

Analyst estimates for Micron Technology Inc earnings have increased significantly in the recent months. Currently, analysts expect that the company will report earnings of $4.85 per share for the financial year 2021. For the financial year 2022, Micron is projected to report earnings of $9.41 per share so the stock is trading at less than 10 forward P/E which is cheap by modern market standards.

Micron Technology Inc shares have a good opportunity to develop additional upside momentum in the upcoming weeks, and Micron stock will have a chance to test all-time high levels at $97.50 which were reached back in 2000.

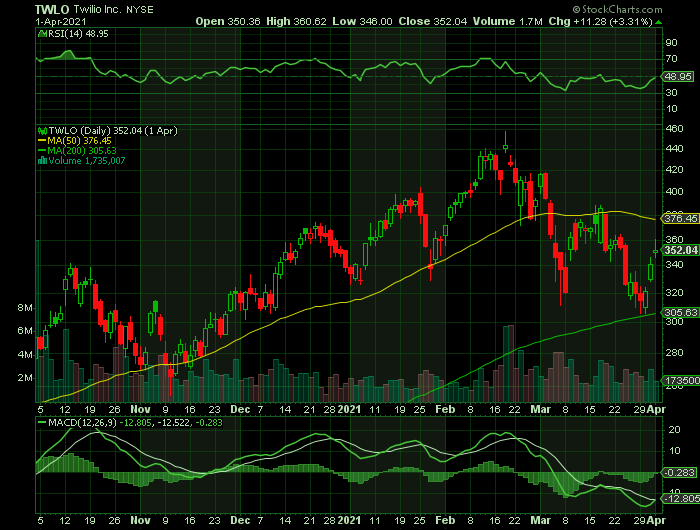

Weekly Options Trade – Twilio Inc (NYSE:TWLO) Calls

Monday, April 05, 2021

** OPTION TRADE: Buy TWLO APR 09 2021 360.000 CALLS at approximately $6.00.

(Some members have asked for the following.....

Place a pre-determined sell at $12.00.

Include a protective stop loss of $2.40.

NOTE: Again, keep a close eye on the stock today – if there is sufficient profit it would be advisable to exit sooner than later!

Prelude.....

Communication platform-as-a-service (CPaaS) company Twilio Inc (NYSE:TWLO) had a dream run in 2020, driven by the pandemic-triggered migration of companies to cloud-based architecture. Despite giving up some of its gains amid the ongoing tech sell-off, the stock is still up over 300% in the last twelve months.

Twilio provides developers usage-based programmable application program interfaces (APIs) to build cloud-based communication protocols like email, voice, messaging, and other app services within customers' applications. The company also offers platform services that include access to networking and storage, as well as application services such as the flexible cloud-based contact center platform Twilio Flex and authorization service Authy. Twilio aims to become a leading consumer engagement platform and is targeting a total addressable market of $87 billion by 2023.

The Major Catalysts for This Trade.....

1. Past Earnings Report.....

Twilio's fiscal 2020 financial performance was quite encouraging. Revenue jumped 55% year over year to $1.76 billion. However, the company's GAAP loss from operations increased from $369.8 million in the prior year to $492.9 million in 2020, mainly due to increased operating expenses and fees to network providers. But the operating expenses grew by 44% year over year -- which is slower than the revenue growth rate. In fact, the company's fiscal 2020 non-GAAP income from operations was $35.7 million, a stark improvement from a loss of $1.8 million in 2019.

Twilio is inching closer to becoming a profitable organization. Hence, it can continue to soar much higher in the coming quarters.

2. Guidance.....

Twilio's guidance for the current quarter indicates that it is on track to sustain a terrific pace of growth. The company expects top-line growth of 45.5% in the current quarter after finishing fiscal 2020 with a revenue increase of 55%. Also, it is worth noting that it had originally expected 30% to 31% revenue growth for 2020, and it ended up blasting past those expectations due to the tailwinds created by the pandemic.

It won't be surprising to see Twilio exceed its own expectations once again in 2021 as more companies make the switch to cloud-based contact centers. According to Twilio's 2021 state of consumer engagement report, 95% of the 2,500 enterprise decision-makers surveyed expect to either maintain or increase their investment in customer engagement, and 87% believe that digital engagement will play an important role in their business.

3. Digital Transformation Acceleration.....

92% of the businesses Twilio surveyed said that the COVID-19 pandemic had led them to accelerate their shift to the cloud. Twilio anticipates this digital transformation will continue. It points out that the forecast that annual investments in digital transformation will double by 2023 to $2.3 trillion and account for over half of information technology spending. As such, it won't be surprising to see more call center seats move to the cloud.

Twilio has estimated that only 17% of the 15 million contact center seats were in the cloud before the pandemic. That proportion is expected to jump to 50% by 2025, setting the stage for the company to sustain its high rate of growth for years to come.

4. Diversification.....

Twilio has been diversifying into higher-margin businesses with the help of acquisitions that should help support long-term margin expansion. The recent purchase of Segment, for instance, will support cross-selling opportunities at Twilio and expand the company's presence into the fast-growing customer data platform market.

5. Analysts Positivity.....

Analysts estimate that Twilio's revenues will grow by more than 30% annually over the next couple of years. That trend could continue over a longer period as contact centers move to the cloud.

Jefferies analyst Samad Samana initiated coverage of Twilio with a Buy rating and $451 price target.

Samana said Twilio has been successfully disrupting the communication space for several years now. He said Twilio should be able to maintain impressive growth numbers even as the business scales up.

Since 2016, Twilio has generated about 60% compound annual revenue growth, and Samana said the company should continue to grow at above a 30% annual rate through at least 2023.

Twilio’s focus on developers differentiates the company from its high-tech peers, Samana said. In addition, the company has been focusing more on landing large customers and working more closely with Deloitte and other partners.

Twilio was modestly profitable in 2020, but Samana said that profitability will increase significantly over time as the company dials back its investments and adds more high-margin revenue streams. Twilio’s long-term gross margin target is above 60%.

“Messaging carries a ~45% GM, but Voice, Email and App Services are all well above 70%,” Samana wrote in the note.

From a valuation perspective, Twilio shares are trading roughly in-line with its high-growth tech stock peers. However, Samana said Twilio deserves to trade at a premium valuation to other growth stocks because of its dominant positioning in a nascent growth market.

Several other analysts have also commented on the company.....

- William Blair restated an "outperform" rating on shares of Twilio in a research note on Thursday, February 18th.

- Northland Securities boosted their target price on Twilio from $390.00 to $500.00 in a research note on Thursday, February 18th.

- Stifel Nicolaus assumed coverage on Twilio in a research note on Wednesday, January 13th. They issued a "buy" rating and a $425.00 target price on the stock.

- KeyCorp boosted their target price on Twilio from $420.00 to $550.00 and gave the company an "overweight" rating in a research note on Thursday, February 25th.

- Finally, Canaccord Genuity boosted their target price on Twilio from $385.00 to $510.00 and gave the company a "buy" rating in a research note on Thursday, February 25th.

Two analysts have rated the stock with a hold rating and twenty-two have issued a buy rating to the company. The company presently has a consensus rating of "Buy" and an average price target of $442.36.

Summary.....

Twilio's stock price declines in recent weeks offer a better opportunity to buy options of a company that appears primed for growth.

Back to Weekly Options USA Home Page