TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, March 27, 2023

TAKE PROFIT WHEN AVAILABLE!

Weekly Options Trade – QUALCOMM, Inc. (NASDAQ:QCOM) CALLS

Thursday, March 30, 2023

** OPTION TRADE: Buy QCOM APR 14 2023 130.000 CALLS - price at last close was $1.70 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Shares of leading semiconductor QUALCOMM, Inc. (NASDAQ:QCOM) rose 3.1% in Wednesday trading and more is expected.

Virtually all chip stocks were lifted by the fiscal second-quarter report Micron Technology delivered Tuesday after the market close. While the results themselves were pretty terrible, the report and the conference call offered reasons to believe that the industry has reached its cyclical bottom.

In addition, Intel gave a presentation Wednesday about its current data center chips and future roadmap that seemed to greatly encourage investors, indicating that the company's pervasive delays in releasing new chips may now be a thing of the past.

About Qualcomm…..

Headquartered in San Diego, CA, Qualcomm Incorporated designs, manufactures and markets digital wireless telecom products and services based on the Code Division Multiple Access (CDMA) technology.

It operates through the following segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and system software based on technologies for the use in voice and data communications, networking, application processing, multimedia, and global positioning system products. The QTL segment grants licenses and provides rights to use portions of the firm's intellectual property portfolio. The QSI segment focuses on opening new or expanding opportunities for its technologies and supporting the design and introduction of new products and services for voice and data communications.

The company was founded by Franklin P. Antonio, Adelia A. Coffman, Andrew Cohen, Klein Gilhousen, Irwin Mark Jacobs, Andrew J. Viterbi, and Harvey P. White in July 1985 and is headquartered in San Diego, CA.

Further Catalysts for the QCOM Weekly Options Trade…..

While Intel was an outperformer Wednesday, both Qualcomm and Taiwan Semiconductor were caught up in buying across the sector as well, likely on the back of Micron's earnings. While Micron's numbers were pretty bad by any measure -- it missed revenue projections and delivered a hefty per-share loss -- it appears as though semiconductor traders see this quarter as the bottom in memory chip demand.

Setting a bullish tone for Qualcomm, Micron CEO Sanjay Mehrotra sounded highly enthusiastic about generative AI and its prospects for boosting the whole semiconductor sector over the next few years. Mehrotra noted the shifting mix in smartphones toward more higher-end flagship models. Consumers favoring larger and more powerful phones should benefit Qualcomm, which gets more money per unit for higher-powered modems. That would pave the way for revenue growth even if sales are flattish on a unit basis.

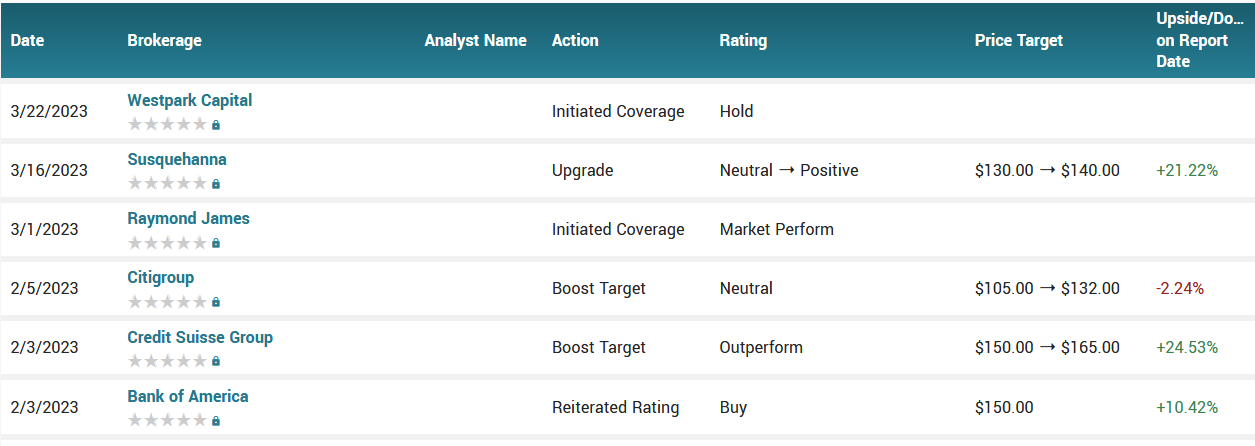

Analysts.....

According to the issued ratings of 23 analysts in the last year, the consensus rating for QUALCOMM stock is Moderate Buy based on the current 1 sell rating, 5 hold ratings and 17 buy ratings for QCOM. The average twelve-month price prediction for QUALCOMM is $156.48 with a high price target of $238.00 and a low price target of $120.00.

Summary.....

QCOM traded up $3.05 on Wednesday, hitting $124.39. The company had a trading volume of 1,982,369 shares, compared to its average volume of 7,699,203. The company has a market cap of $138.69 billion, a PE ratio of 11.69, a PEG ratio of 0.97 and a beta of 1.28. QUALCOMM Incorporated has a 12-month low of $101.93 and a 12-month high of $161.30. The company has a quick ratio of 1.41, a current ratio of 2.09 and a debt-to-equity ratio of 0.82. The business’s fifty day simple moving average is $126.01 and its 200 day simple moving average is $120.68.

TAKE PROFIT WHEN AVAILABLE!

Weekly Options Trade – LYFT Inc (NASDAQ:LYFT) CALLS

Thursday, March 30, 2023

** OPTION TRADE: Buy LYFT APR 28 2023 9.000 CALLS - price at last close was $0.65 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Shares of LYFT Inc (NASDAQ:LYFT) are on the move after the ride-sharing operator announced a change in management. It said that the two co-founders would relinquish their roles in day-to-day operations and David Risher, a former Amazon and Microsoft executive, would become the next CEO.

Lyft has struggled since its 2019 initial public offering (IPO), and the stock is down more than 80% since then. Profits failed to materialize, the pandemic dealt a significant setback to the company, and it lost market share to rival Uber more recently.

Now, co-founders Logan Green (CEO) and John Zimmer (President) will move on to board positions as non-executive chair and vice chair, respectively, putting David Risher in the hot seat, effective April 17. Risher was Amazon's first head of product and ran its U.S. retail division, and has been on Lyft's board since 2021.

Lyft's incoming CEO, David Risher, says he is up to the task of driving a better Lyft business, and it starts with taking the fight back to larger rival Uber (UBER).

"Our top priority is getting a great experience to our customers. To a certain extent, a focus on the basics — we pick you up on time, we are priced in line with the other guys and get you where you want to go," Risher said.

About Lyft.....

Lyft Inc. is a ridesharing company that provides transportation services to consumers through its mobile app. The company was founded in 2012 by Logan Green and John Zimmer and is headquartered in San Francisco, California. Lyft is a peer-to-peer transportation platform that connects drivers with passengers who need a ride. The company operates in over 600 cities across the United States and Canada and has facilitated over 1 billion rides since its inception. Lyft's mission is to improve people's lives through the world's best transportation.

Lyft's management team is led by co-founders Logan Green and John Zimmer. Green serves as the CEO, while Zimmer is the President. Other key management team members include Elaine Paul, the Chief Financial Officer and Ashwin Raj, the Head of Ride Share.

Lyft's financial performance has been impacted by the COVID-19 pandemic, with revenue declining significantly in 2020. In 2019, the company reported revenue of $3.6 billion, an increase of 68% from the previous year. However, in 2020, revenue declined to $2.4 billion, a decrease of 34%. Despite the challenging year, Lyft has a strong balance sheet, with cash and marketable securities available to help carry it through the rebound from COVID-19.

Lyft's valuation metrics have been impacted by the pandemic and the company's financial performance. However, Lyft's price-to-earnings ratio has maintained the pace or slightly exceeded the industry averages. Lyft's stock price has been volatile recently, with significant fluctuations based on investor sentiment and news events.

Further Catalysts for the LYFT Weekly Options Trade…..

Lyft has been scrapping with Uber for years for a bigger sliver of the car-share market, but its new CEO thinks that the challenges to the company go beyond just its longtime competitor.

The company’s founders have just stepped back from their executive roles, and David Risher, who was previously a senior vice president at Amazon and a general manager at Microsoft, has been given the top spot and the task to navigate the company through a period of economic uncertainty and immense competition.

“At some point, I don’t think of this as just an Uber battle,” Risher said on Monday. “It’s a battle against staying at home. How do we get people out? How do we get them playing and working together?”

COVID-19-linked restrictions and cautious behavior severely dented the ride-share business as more people were confined to their houses. Lyft reportedly lost 75% of its ridership in the 12 months between April 2019 and 2020, and Uber said its ride booking dropped by 75% between April and June 2020.

While Risher didn’t reveal his grand plan for prying people out of their homes, he did say that unlike Uber, Lyft would not enter the food delivery space. Uber launched its food delivery arm, UberEats, in 2014 and by March 2023 it had become the second largest meal delivery service in the U.S., according to Bloomberg Second Measure, a data analytics company.

“Our primary vehicle (ha!) will be rideshare. And we’re going to focus on making sure our riders and drivers have an incredible experience every time they interact with us, so they use us again and again to get out into the world,” Richer said in a statement Monday.

Analysts.....

Deutsche Bank had put out a note saying that the move could lead to a buyout. Wedbush said it was more positive on the stock following the CEO change.

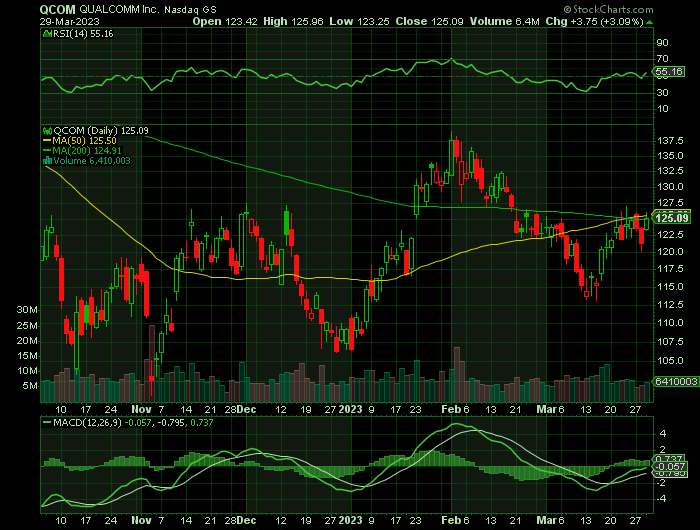

According to the issued ratings of 35 analysts in the last year, the consensus rating for Lyft stock is Hold based on the current 1 sell rating, 28 hold ratings and 6 buy ratings for LYFT. The average twelve-month price prediction for Lyft is $17.57 with a high price target of $60.00 and a low price target of $10.00.

Summary.....

In early February, Lyft reported generating $1.18 billion in fourth-quarter revenue, coming in 21% higher year over year. Its net loss for the quarter was $588 million, marking a nearly 108% widening from the $283 million in the same period in the prior year.

"In the end, I think right now our job … is to remind customers why we're a great alternative to the 800-pound gorilla in the room where we're focused on them, not just on packages and pizza and other things, and how we're going to, you know, really work pretty hard, I think, to earn their ridership back, because I think we've fallen a little off to the side," Risher said. "I think it's time to really come back and really, you know, really make a big statement."

TAKE PROFIT WHEN AVAILABLE!

Weekly Options Trade – Paramount Global Class B (NASDAQ: PARA) CALLS

Wednesday, March 29, 2023

** OPTION TRADE: Buy PARA APR 14 2023 21.000 CALLS - price at last close was $1.15 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

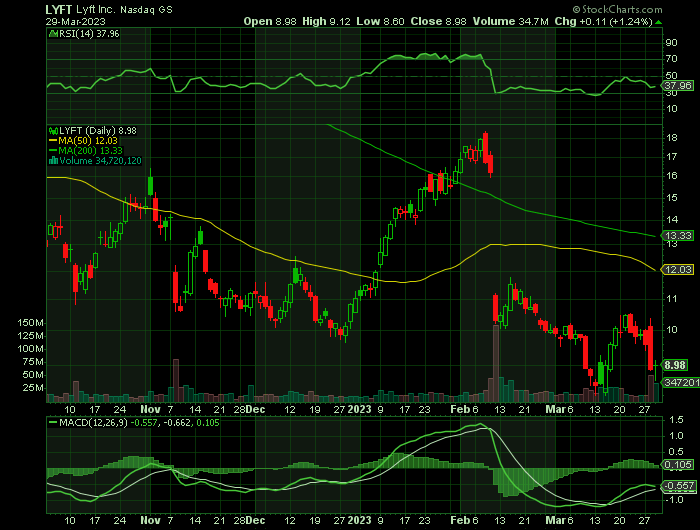

Paramount Global Class B (NASDAQ: PARA) stock closed up more than 3% on Tuesday following an upgrade from Bank of America based on a potential sale of all or part of the company. And the stock is continuing to climb.

As well, Bank of America analyst Jessica Reif Ehrlich upgraded PARA shares to Buy from Neutral, in addition to raising her price target to $32 a share — up from the prior $24.

The analyst cited potential upside if Paramount were to sell all or parts of its business, writing in a new note on Tuesday: "It is our view that PARA has a unique collection of assets that would generate significant buyer interest if ever put up for sale-either in pieces or whole."

Shares of Paramount have gained more than 26% so far this year after falling 44% in 2022.

About Paramount Global.....

Paramount Global operates as a media and entertainment company worldwide. The company operates through TV Media, Direct-to-Consumer, and Filmed Entertainment segments.

The TV Media segment operates domestic and international broadcast networks, including CBS Television Network, Network 10, Channel 5, Telefe, and Chilevisión; and cable networks comprising Showtime, BET, Nickelodeon, MTV, Comedy Central, Paramount Network, Smithsonian Channel, and CBS Sports Network.

It is also involved in the television production operations; and ownership of broadcast television stations.

The Direct-to-Consumer segment provides a portfolio of direct-to-consumer streaming services, including Paramount+, Pluto TV, Showtime Networks' premium subscription streaming service, BET+, and Noggin.

The Filmed Entertainment segment operates produces franchise live-action and animated films, and genre films for audiences. It operates under the Paramount Pictures, Paramount Players, Paramount Animation, Nickelodeon Studio, and Miramax names.

The company was formerly known as ViacomCBS Inc. and changed its name to Paramount Global in February 2022. Paramount Global was incorporated in 1986 and is headquartered in New York, New York. Paramount Global operates as a subsidiary of National Amusements, Inc.

Further Catalysts for the PARA Weekly Options Trade…..

Bank of America Analysts Thoughts.....

Reif Ehrlich highlighted Nickelodeon, Paramount Studios, and CBS Networks as assets that “could also be in high demand given their strategic value.”

"We believe these press reports validate our thesis," she said. "We think other assets such as Nickelodeon, Paramount Studios and CBS Networks could also be in high demand given their strategic value, and it is not difficult for us to contemplate a scenario where the sum of the various assets is worth more than PARA's consolidated [enterprise value]." She was referring to a common measure of the company's total value.

She sees two possible outcomes for the company. The first is that the company will be successful with Paramount+, its direct-to-consumer streaming service, boosting earnings growth in 2024 and after.

A second possibility is that the company has difficulty scaling up its streaming business in a profitable way. This “could lead the company to sell—in our view likely at a significant premium to current market levels,” Reif Ehrlich said.

Although this year appears to mark an “earnings trough,” caused by a variety of factors, the company has levers to push, Reif Ehrlich said. The merger of Paramount+ with Showtime, disclosed in January, is expected to bring in millions in savings over time, she said, arguing that the company has room to cut costs to maintain its profitability.

Acquisition Target.....

Paramount CFO Naveen Chopra weighed in on the sales rumors earlier this month: "There's been speculation around BET. We don't comment on M&A speculation. ...But I will say that, in general, we are always looking at different ways to create value for our shareholders."

"To the extent that there are ways to do that — by buying assets, by selling assets, by restructuring assets — we look at all of those very carefully," he said.

Paramount has long been rumored as a potential acquisition target due to its small size relative to competitors. The media giant boasts a current market cap of just about $14 billion, which pales in comparison to Disney's (DIS) $173 billion and Netflix's (NFLX) $144 billion.

Merger.....

Paramount, which recently announced it will be merging its Paramount+ and Showtime streaming services into one offering dubbed "Paramount+ with Showtime," has eyed greater integration between its cable television and streaming offerings amid escalating cord-cutting trends and direct-to-consumer losses.

Summary.....

Paramount Global gapped up prior to trading on Tuesday. The stock had previously closed at $28.83, but opened at $30.00. Paramount Global shares last traded at $30.22, with a volume of 34,737 shares changing hands.

The stock’s 50-day moving average is $31.09 and its 200 day moving average is $30.15.

TAKE PROFIT WHEN AVAILABLE!

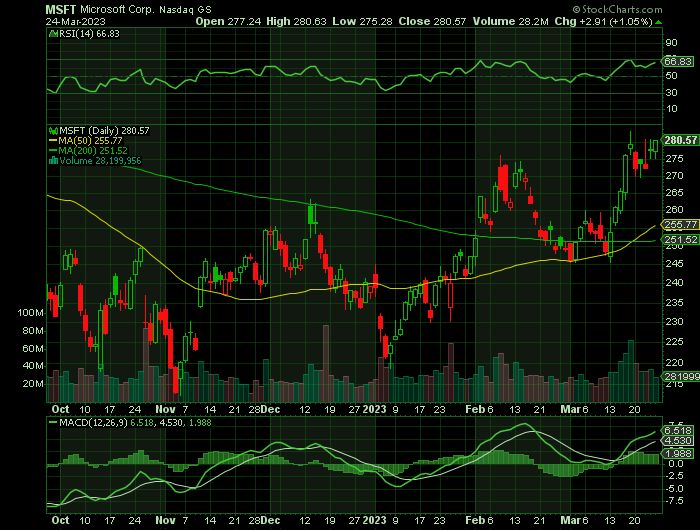

Weekly Options Trade – Microsoft Corporation (NASDAQ:MSFT) CALLS

Monday, March 27, 2023

** OPTION TRADE: Buy MSFT APR 14 2023 285.000 CALLS - price at last close was $5.74 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Last Friday Microsoft Corporation (NASDAQ:MSFT) claimed that the newest model of ChatGPT, an AI algorithm backed by the PC pioneer, was showing “sparks” of intelligence that were “strikingly close to human-level performance”.

Artificial general intelligence, as it is known, has been the holy grail of researchers for decades. The prospect that Microsoft may have gotten there first is yet another body blow for Google.

“Search is as good as how you use it,” says Sachin Dev Duggal, founder of UK start-up Builder.AI. “Most people just type in a bunch of words."

“With a language model [the technology underpinning ChatGPT], you can get a more refined search result. It can infer what those words mean in a wider context.”

Microsoft has already integrated ChatGPT into its search engine, Bing, sparking fears that the new AI-powered search tool could upend the traditional power balance that has seen Google dominate for decades.

“[Microsoft chief executive Satya] Nadella and OpenAI [ChatGPT’s developer] are right now miles ahead of Google and its Bard endeavour for AI,” says Dan Ives, an analyst at Wedbush Securities.

After ChatGPT’s viral success, Microsoft invested billions in OpenAI. Companies including Stripe, Morgan Stanley and Klarna have all announced deals with the start-up.

About Microsoft.....

Microsoft Corporation was founded in 1975 in Albuquerque, New Mexico by Bill Gates and Paul Allen. The two quit their respective Harvard schooling and programming jobs to start a software company focused on the then-popular Altair 8800. Originally named Micro-Soft, Microsoft is a portmanteau of the words microprocessor and software. The company quickly took off and was relocated to Washington State where it is headquartered today.

Microsoft launched a game called Flight Simulator in 1982 that has since become the longest-running video game franchise. The company’s first major breakthrough came in the early 80s when it licensed MS-DOS to IBM for their personal computer and then another came in 1985 the company altered the way computers were used when it launched Windows. Windows used a graphical interface to display information that included drop-down menus, scroll bars, and other features commonly found in operating systems today.

Microsoft went public in 1986 making founder Bill Gates the world’s youngest billionaire. Other innovations that helped make the company’s name include Windows 95 which included many upgrades to the original and, when the Internet took off, Internet Explorer. Bill Gates gave up his role as CEO in 2000 and the company is now run by Satya Nadella. Mr. Nadella took over the role of CEO in 2014 and then the role of chairman in 2021.

Today the company develops, licenses, and supports software, services, devices, and solutions worldwide. The company operates in three segments that include Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. As of 2022, Microsoft’s Azure powered more than 20% of the Cloud putting it in second place globally.

The Productivity and Business Processes segment offers several software solutions including Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, Microsoft Viva, and Skype for Business. Microsoft also operates Skype, Outlook.com, OneDrive, and LinkedIn for business professionals as well as Dynamics 365. Dynamics 365 is a set of cloud-based and on-premises business solutions for organizations and enterprises of all sizes.

Further Catalysts for the MSFT Weekly Options Trade…..

In 2022, the Nasdaq Composite plunged 33%, bringing down the stocks of some of the world's most valuable companies. For instance, despite having the second-largest market cap in the world at $2 trillion, Microsoft fell 29% throughout last year. Like many in the tech world, the company was hit by steep declines in the PC market brought on by reduced consumer spending.

However, Microsoft's history of stellar growth suggests recent headwinds were only temporary, and its developing venture in artificial intelligence (AI) is a strong argument for long-term success. The stock has begun trending up since the start of 2023 but remains down 10% year over year.

OpenAI's ChatGPT.....

The launch of OpenAI's ChatGPT in November 2022 kicked off an AI race that has seen many companies venture into the burgeoning market. So far, Microsoft has had the advantage in the race, investing $1 billion in OpenAI in 2019. ChatGPT's success prompted the company to invest another $10 billion in OpenAI in January.

According to Grand View Research, the AI market was valued at $137 billion in 2022 and is projected to expand at a compound annual rate of 37.3% through 2030. And Microsoft's investment in OpenAI has allowed it to use its technologies in several programs. For example, ChatGPT has been integrated into Microsoft's search engine Bing and is available on its cloud platform Azure.

Each of these products would benefit by incorporating ChatGPT into its customer interface -- as it's clear the chatbot is already a smash hit with the public.

However, the Bing search tool might be the product with the most to gain. Suppose the company can capitalize on ChatGPT's integration with Bing. In that case, Microsoft may finally threaten Alphabet's stranglehold on the online search market.

The stock surged 5% from March 15 to 17 after an announcement that the company would enhance its Office productivity software (like Word and Excel) with OpenAI technology. Microsoft says the AI features, dubbed Copilot, will provide a "first draft to edit and iterate on -- saving hours in writing, sourcing, and editing time."

Azure.....

Microsoft experienced strong market-share gains in the worldwide cloud infrastructure market in 2022, reaching 23%, up from 21% in the preceding four quarters, according to data compiled by Synergy Research Group. In fact, over the past five years, Microsoft has notched the largest share gains in the industry, growing by nearly 11 percentage points since 2017. Given the consistency of the company's market-share increases in recent years, there's every reason to believe that trend will continue.

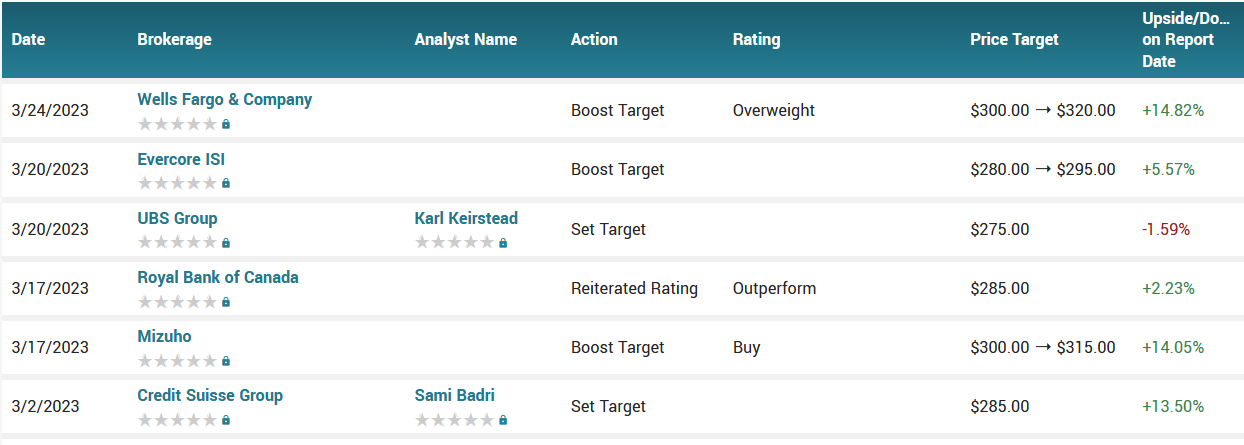

Analysts.....

According to the issued ratings of 32 analysts in the last year, the consensus rating for Microsoft stock is Moderate Buy based on the current 1 sell rating, 4 hold ratings and 27 buy ratings for MSFT. The average twelve-month price prediction for Microsoft is $287.92 with a high price target of $370.00 and a low price target of $212.00.

Summary.....

Today, Microsoft is one of the leading cloud computing companies in the world and the second-largest U.S. company overall.

Microsoft has had a terrific year so far in 2023, riding the tailwinds of a broader rally in technology stocks. Shares of the tech titan are up 15% so far this year, more than triple the gains of the S&P 500. This is in stark contrast to its performance in 2022

The company has a debt-to-equity ratio of 0.24, a quick ratio of 1.89 and a current ratio of 1.93. Microsoft Co. has a one year low of $213.43 and a one year high of $315.95. The company’s fifty day simple moving average is $254.84 and its 200 day simple moving average is $245.71. The stock has a market capitalization of $2.08 trillion, a price-to-earnings ratio of 30.25, and a P/E/G ratio of 2.50 and a beta of 0.92.

Back to Weekly Options USA Home Page