TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, March 20, 2023

TAKE PROFIT WHEN AVAILABLE!

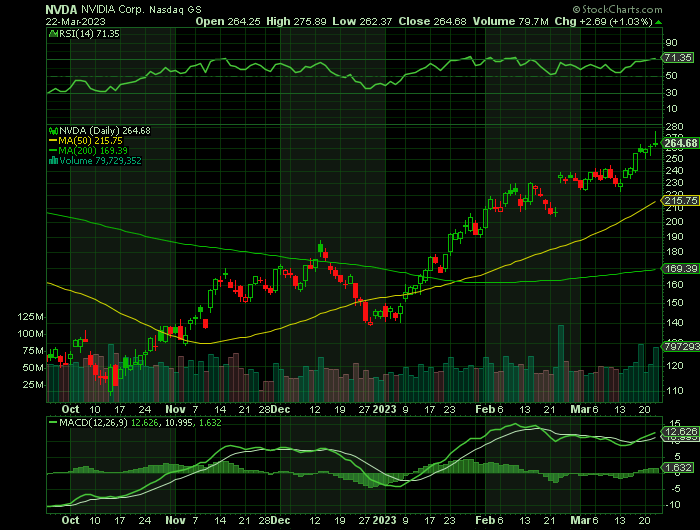

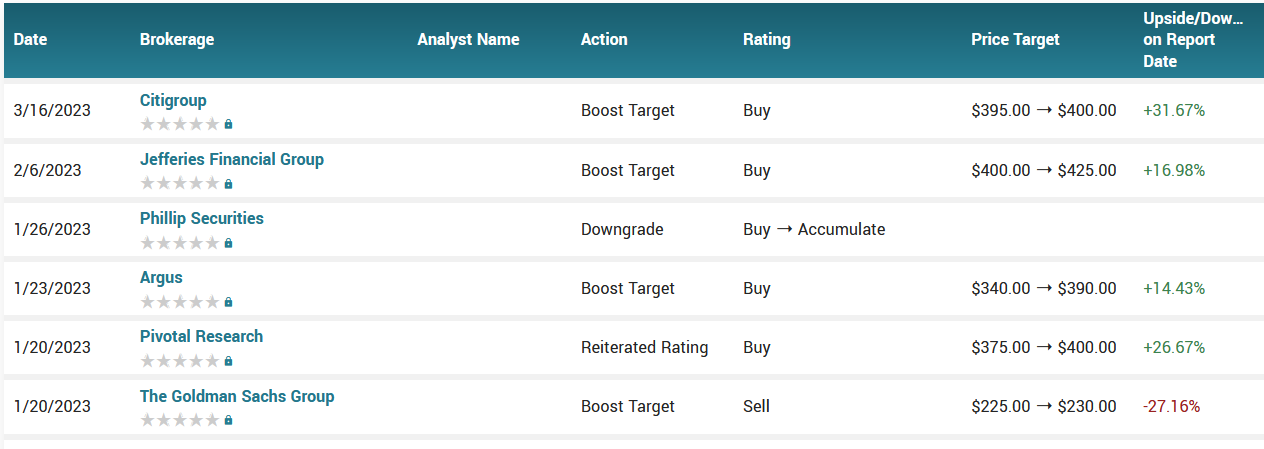

Weekly Options Trade – NVIDIA Corporation (NASDAQ:NVDA) CALLS

Thursday, March 23, 2023

** OPTION TRADE: Buy NVDA APR 06 2023 280.000 CALLS - price at last close was $4.50 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

NVIDIA Corporation (NASDAQ:NVDA) is poised to reap significant near-term benefits from the race to build up generative artificial-intelligence capabilities.

On Tuesday, Nvidia announced a wide-ranging portfolio of products to address the burgeoning AI market. Those products included new graphics processing units, data center hardware, AI software models and AI as a service.

At Nvidia's GTC conference, Chief Executive Jensen Huang said the company's move into AI software and services marked its largest-ever business model expansion.

Wall Street analysts on Wednesday praised Nvidia's approach to artificial intelligence, as it moves from chips and computer hardware deeper into software and services. NVDA stock continued its ascent on the news.

Those announcements were mainly technical in nature but nonetheless impressed Wall Street. Matt Ramsay of TD Cowen characterized the event as showing "the runaway leader in AI broadening aperture further," while Mark Lipacis of Jefferies said the developments further Nvidia’s position as "the de-facto standard for AI and generative AI applications," in a note to clients. Nvidia also held an analyst meeting after Tuesday’s closing bell, where Chief Financial Officer Colette Kress said the company is seeing "more and more demand" from its major cloud customers, even compared with the strong outlook it gave in its last earnings call a month ago.

Lipacis reiterated his buy rating and price target of $300 on NVDA stock after the event.

"Nvidia continues to transform the business model with broad new sources of recurring software/services revenue — a message that should resonate well with investors even after this rally," UBS analyst Timothy Arcuri said in a note to clients.

Arcuri rates NVDA stock as buy with a price target of 270. But Arcuri said he is reviewing his price target.

At least eight Wall Street analysts raised their price targets on NVDA stock after Nvidia's presentation.

At GTC, Nvidia discussed AI initiatives with companies in multiple industries.

In health care, Nvidia is working with firms like medical products giant Medtronic (MDT) and biotech leader Amgen (AMGN). Further, it has automotive projects with China's BYD (BYDDF) and Europe's BMW (BMWYY).

In telecom, AT&T (T) has adopted Nvidia AI technologies to improve its operations. Meanwhile, in semiconductors, it is developing computational lithography advancements with ASML (ASML), TSMC (TSM) and Synopsys (SNPS).

Credit Suisse analyst Chris Caso maintained his outperform rating on NVDA stock after the presentation.

"Nvidia has been our top pick precisely because we think AI is the most transformative trend affecting semiconductors now, and Nvidia is the leader with a strong competitive moat," Caso said in a note.

Nvidia’s share price has more than doubled over the past six months. That makes it the best performing stock in the entire S&P 500 in that time.

The bulk of Nvidia’s gains have come in the past three months, as the public launch of the AI-powered chatbot called ChatGPT in late November sparked a new wave of enthusiasm for so-called generative AI, and how it could revolutionize services like internet search, product design, writing and programming. The new technology requires intense computing power in data centers, where Nvidia has already built up a large-and-growing business for its graphics processors and software designed for AI applications. The company made a slew of announcements Tuesday as part of its annual GTC developers conference that focused mostly on the generative AI opportunities.

The chip maker’s market value has now surpassed that of Tesla and Facebook-parent Meta Platforms and is close to eclipsing Berkshire Hathaway—all much larger companies in terms of annual revenue. Bernstein Research also rates Nvidia as one of the most crowded stocks in the chip sector, and one of only two to remain in the most crowded decile over the past two months, according to Ann Larson, director of quantitative research for the firm.

TAKE PROFIT WHEN AVAILABLE!

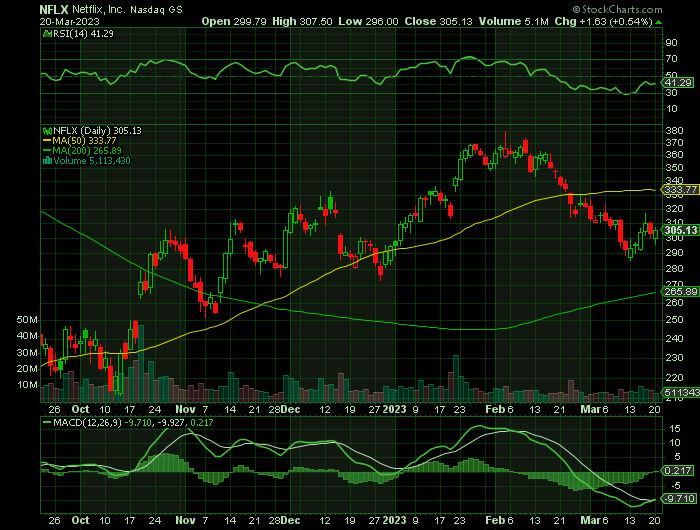

Weekly Options Trade – Netflix Inc (NASDAQ: NFLX) CALLS

Tuesday, March 21, 2023

** OPTION TRADE: Buy NFLX APR 06 2023 320.000 CALLS - price at last close was $5.39 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Not all is it seems for Netflix Inc (NASDAQ: NFLX).

JPMorgan analyst Doug Anmuth is doubling down on his prediction that Netflix is still a good buy—despite user frustration surrounding Netflix's password-sharing crackdown, fears of short-term subscriber churn and a sagging stock price.

Netflix shares, down about 4% since the company's fourth quarter earnings results, have lost more than 17% of gains since hitting a year-to-date high of $369.02 a share on January 26. Wall Street punished the streamer last month after it slashed prices by 50% in about 100 overseas markets.

"We recognize the [near-term] noise and believe in many respects that buying NFLX for 12 months out may be easier than for the next 3-4 months. But overall we remain bullish," Anmuth wrote in a new note on Monday.

Anmuth, who reiterated his outperform rating and 12-month price target of $390 a share, told clients to "buy pullbacks" in the stock. He categorized advertising momentum as one of the main catalysts for his bullish call, coupled with "solid content" and password sharing, which should drive revenue, margin expansion, and free cash flow in 2023.

JPMorgan expects Q1 subscribers to come in at 1.5 million with Q2 net additions hitting 3.25 million.

Further Catalysts for the NFLX Weekly Options Trade…..

Monthly Users.....

On Sunday, it was reported that Netflix's ad-supported service reached roughly 1 million monthly active users in the U.S. after its second month on the market—bucking earlier reports the ad tier was off to a slow start.

The user base grew by more than 500% in the first month from its launch and another 50% in its second month, the report added.

Moving Forward.....

As the company looks to capitalize on more revenue opportunities, games will be another area of focus.

Netflix announced in a blog post on Monday it has 70 games in development with external partners and an additional 16 games in progress at the company's in-house game studios. The streamer has released 55 games so far, with about 40 more slated for later this year.

Broyhill Asset Management.....

Broyhill Asset Management highlighted stocks like Netflix.

Broyhill Asset Management made the following comment about Netflix, Inc. (NASDAQ:NFLX) in its Q4 2022 investor letter:

"Speaking of fresh names, we established a new position in Netflix, Inc. (NASDAQ:NFLX) during the second half. We began accumulating shares after the company reported two consecutive quarters of subscriber losses, which brought the stock down by about 75% from peak to trough. Our investment in Netflix is a good example of what we categorize as a “temporary dislocation” and a great example of the historical investments we’ve made in the tech sector. Unlike other “value” investors, we don’t arbitrarily put tech in the “too hard” pile. We are comfortable and more than happy to underwrite investments in the industry. We just demand a margin of safety when doing it (something often ignored by other investors in the industry). That margin of safety opened up when consensus quickly concluded that Netflix’s growth was over, on the heels of two quarters of subscriber losses, which happened to follow years of surging lock-down-induced demand. The popular narrative was that by pursuing advertising revenue, Netflix was all but admitting that streaming television was completely saturated. We thought otherwise. With ~ 75MM subscribers in the US, even converting a small portion of those 100MM moochers would move the needle3. And given the superiority of the company’s technology and first-party user data, we think the consensus is completely underestimating the long-term potential of a Netflix advertising model."

Price Cuts.....

Competition in the subscription video-on-demand industry has tightened over the last couple of years, with many operators experiencing tepid growth -- or worse, losing customers.

Despite these market challenges, Netflix has opted to try something bold: cutting prices. Last month, the company reduced subscription fees in 30 markets across multiple territories, including Europe, the Middle East, and Africa.

The move may seem counterintuitive -- Netflix is seemingly gambling that it can make up the revenue shortfall by attracting enough new subscribers. However, by some estimates, just 10 million of Netflix's more than 230 million customers will benefit from the revised pricing, so it's ostensibly a risk worth taking.

Revenue Driver....

Netflix has made clear it has several long-term goals, not least of which is to grow the amount of money it makes from advertising.

Before the TV streamer introduced its $6.99 a month Basic with Ads plan in November 2022, the company was purportedly bullish on its prospects; the Wall Street Journal reported Netflix's internal projections pointed toward the company having 40 million customers for its ad-supported tier by the end of its 2023 fiscal third quarter. But sign-up rates were initially lacking, so Netflix had to return some money to its advertisers.

But, Netflix's ad strategy churn doesn't seem to be a major issue for Netflix. As highlighted by Gregory Peters, Netflix's chief operating officer, many investors had raised questions about the risk of Netflix customers transitioning away from higher-cost plans to Basic with Ads. But, Peters says, such churn hasn't been a problem, noting the "unit economy remains very good."

Cheap.....

Perhaps the most compelling reason to snap up Netflix stock right now is that the company's share price is much cheaper than it has been in recent years; in November 2021, Netflix's stock was trading at around $680 apiece. At present, you can purchase shares for around $300 -- a difference of 55%.

Analysts.....

According to the issued ratings of 41 analysts in the last year, the consensus rating for Netflix stock is Hold based on the current 3 sell ratings, 15 hold ratings and 23 buy ratings for NFLX. The average twelve-month price prediction for Netflix is $343.13 with a high price target of $440.00 and a low price target of $215.00.

Summary.....

The streamer is making a solid play for new customers in emerging territories, it's also building out its ad plan without jeopardizing its more expensive offerings. And considering many on Wall Street have faith Netflix's stock has space to climb, the signs are positive.

Netflix has a 50 day moving average price of $334.97 and a 200-day moving average price of $293.18. Netflix has a one year low of $162.71 and a one year high of $396.50. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.17 and a quick ratio of 1.17. The stock has a market cap of $136.66 billion, a P/E ratio of 30.50, a P/E/G ratio of 1.41 and a beta of 1.26.

Back to Weekly Options USA Home Page