TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, mARCH 15, 2021

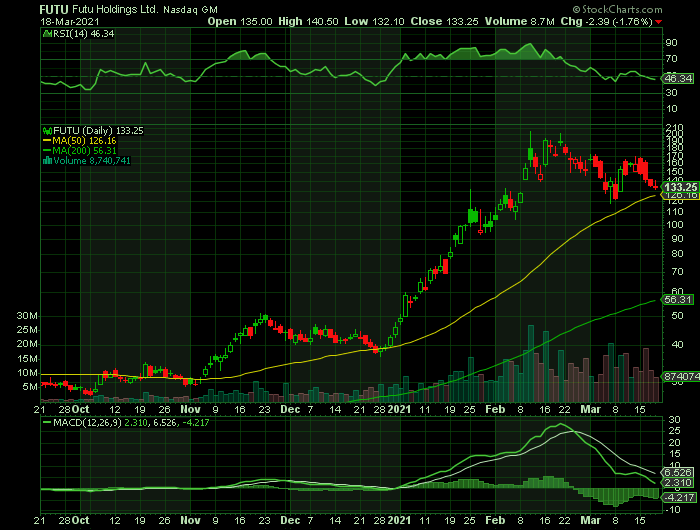

Weekly Options Trade – Futu Holdings Ltd (NASDAQ: FUTU) Calls

Friday, March 19, 2021

** OPTION TRADE: Buy FUTU MAR 26 2021 140.000 CALLS at approximately $5.00.

(Some members have asked for the following.....

Place a pre-determined sell at $10.00.

Include a protective stop loss of $2.00.

Prelude.....

As we know there has been a recent boom in retail investing starting from the crash of March 2020. This is a phenomenon happening across the world beyond the US.

This is very apparent in China with a population of over 1.3 billion people. Retail investors in China have reached 178 million, around 13% of the country's population. Also, China's middle class is rapidly growing and becoming affluent, which indicates a growing interest in investing in equities.

The rise in investing in the stock market has been a global event, beyond North America. Therefore, Futu Holdings Ltd (NASDAQ: FUTU), a solid company, sees great potential stemming from this. In addition, after seeing the significant holdings of Tencent (OTCPK:TCEHY) and the recently announced news that a leading global investment firm has invested significantly into the company, it gives investors more confidence.

About Futu Holdings Limited.....

Futu Holdings Limited is an advanced technology company transforming the investing experience by offering a fully digitized brokerage and wealth management platform. The Company primarily serves the emerging affluent Chinese population, pursuing a massive opportunity to facilitate a once-in-a-generation shift in the wealth management industry and build a digital gateway into broader financial services.

The Company provides investing services through its proprietary digital platform, Futu NiuNiu, a highly integrated application accessible through any mobile device, tablet or desktop. The Company’s primary fee-generating services include trade execution and margin financing which allow its clients to trade securities, such as stocks, warrants, options, futures and exchange-traded funds, or ETFs, across different markets.

Futu enhances the user and client experience with market data and news, research, as well as powerful analytical tools, providing them with a data rich foundation to simplify the investing decision-making process. Futu has also embedded social media tools to create a network centered around its users and provide connectivity to users, investors, companies, analysts, media and key opinion leaders.

The Major Catalysts for This Trade.....

Earnings Report.....

Shares of Hong Kong-based digital broker and wealth management platform Futu Holdings rose more than 10% at one point Tuesday morning after the company reported earnings. But, the shares turned lower to close down 4.1% at 142.22 on the day.

Futu Holdings reported skyrocketing earnings growth that topped expectations.

Futu earnings exploded 880% to 49 cents a share, beating expectations by 8 cents. Revenue swelled 283% to $153 million, also beating.

The brokerage added 98,632 paying clients on a net basis in Q4, representing a 161% growth rate, for a year-end total of 516,721. Futu CEO Leaf Hua Li said "more than half of new clients were from Hong Kong and overseas."

Total client assets surged 227% year over year to $36.7 million in the fourth quarter.

It has a three-year EPS growth rate of 111% and a three-year sales growth rate of 96%.

For 2020, Futu's revenue ballooned 212% year-over-year to $427 million. Total gross profit rocketed 235% to $337.3 million. Total costs were $89.8 million, an increase of 147% from 2019.

The company says it "primarily serves the emerging affluent Chinese population."

"As we further enhanced our capital base, we are able to support a larger margin financing balance, ramp up our marketing efforts in international markets, and further invest into our technology infrastructure," Futu's CFO Arthur Yu Chen said in a statement.

With such a great report, then a sizable pullback, prepare for a movement back upwards.

Analysts Positivity.....

Citigroup reiterated their buy rating on shares of Futu in a research note released on Wednesday.

Other research analysts have also recently issued reports about the stock.....

- Morgan Stanley initiated coverage on shares of Futu in a research report on Tuesday, February 16th. They set an overweight rating and a $253.00 price target for the company.

- Citigroup Inc. 3% Minimum Coupon Principal Protected Based Upon Russell reduced their price objective on shares of Futu from $246.50 to $230.30 and set a buy rating for the company in a research note on Wednesday.

- BOCOM International started coverage on shares of Futu in a research note on Monday, January 18th. They set a buy rating for the company.

- Finally, 86 Research lowered shares of Futu from a buy rating to a hold rating and set a $171.00 price objective for the company in a research note on Monday, February 22nd.

One equities research analyst has rated the stock with a hold rating and four have issued a buy rating to the company’s stock. Futu presently has an average rating of Buy and an average price target of $225.20.

Competitive Advantages.....

Futu has the advantage and technical know-how gained from being one of the first movers to offer completely online-based trading account opening service, charging low fees among the leading players in China. This advantage has allowed them to rapidly improve their technical competence around providing seamless trading, clearing, and risk management, all of which have helped the business to excel.

Futu has a social network collaboration platform called NiuNiu Community. The platform has news, research data, short-videos, recorded lessons, chat rooms, and live broadcast, helping users find investing ideas. The competitive advantage here is that Futu uses the platform to observe user behaviors and identify pain points for users, helping the organization to improve the platform and customer processes which all contribute to greater user satisfaction and increased engagement.

Futu’s customer base and clientele are unique. Futu mostly serves the emerging affluent Chinese population who are around the age of 36. This is the average customer for Futu, affluent because they work in the tech sector in China, which is rapidly growing (about 40% of them). Most importantly, customers love the Futu platform such that they have a <2% churn rate and over 98% annual client retention.

Futu provides FREE market news and stock data. Futu has done an impressive job with attracting users and luring potential investors so that they have more than 7 million active users, similar to the Yahoo Finance brand, well known in America for getting the latest news and information. Futu is similar, but they have the opportunity to convert these users into paying clients who are actively trading.

Future Growth.....

Futu has over 7M users that utilize their news platforms. They have over 1 million registered users (not paying yet) and so far, the company's paying customers increased by 137% to 418,000 in 2020. This means Futu has lots of opportunities to convert users to paying customers.

Futu has been investing in their Wealth Management business. In 2019, they launched a new online wealth management service which provides their clients access to the money market, fixed income, and equity funds products catering to different investment targets and risk preferences of their clients. Over time, this will become a bigger business for Futu and they will be expanding into more of a global financial services platform similar to Morgan Stanley.

Summary.....

The majority of the Chinese population is rapidly moving from a lower income class into the middle class/upper class as a result of a stronger economy. According to Credit Suisse, China is now home to the second largest amount of aggregate household wealth in the world (after the United States). This means more wealth in the hands of Chinese citizens to invest. More people have experienced the benefits from investing in the stock market.

With such a great report, then a sizable pullback, plus the fact that analysts are quite optimistic, prepare for a movement back upwards.

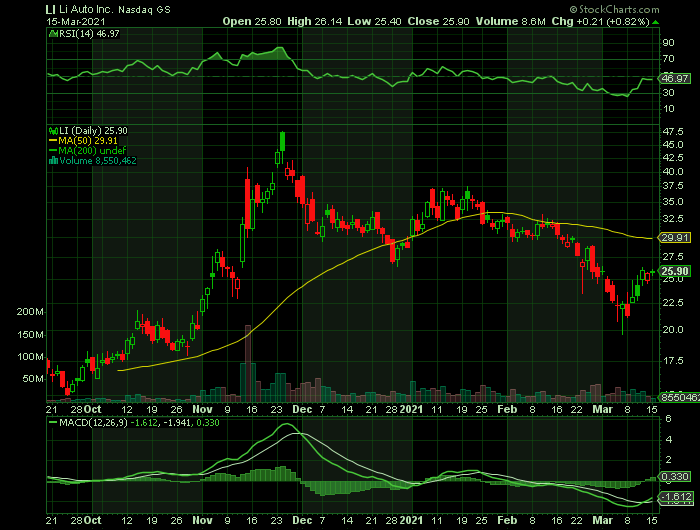

Weekly Options Trade – Li Auto Inc. (NASDAQ: LI) Calls

Tuesday, March 16, 2021

** OPTION TRADE: Buy LI MAR 26 2021 27.000 CALLS at approximately $0.90.

(Some members have asked for the following.....

Place a pre-determined sell at $1.80.

Include a protective stop loss of $0.40.

Prelude.....

Wall Street is favoring some of the newly emerged electric vehicle (EV) stocks, particularly Chinese companies that generated record EV sales last year. With significant support from the government and a speedy economic revival, Chinese EV company Li Auto Inc. (NASDAQ: LI) should benefit significantly in the coming months. As a result, Wall Street analysts are optimistic about the prospects of this stock.

The electric vehicle industry has registered significant growth over the past year, making it one of the most profitable industries amid the COVID-19 pandemic. With lower maintenance costs and higher efficiency, as well as supportive government policies, the momentum of the EV industry is likely to continue in the long run. Global EV sales are expected to rise by 70% in 2021, according to an IHS Markit report.

Also, China’s EV market, which is the largest in the world, is expected to rebound quickly in tandem with the country’s economic growth.

With rising per capita income increasing the demand for EVs, Wall Street analysts expect Li Auto to deliver solid returns in the future.

The stock has gained 60.5% over the past six months and closed yesterday’s trading session at $25.90.

However, growth hit a snag last week, when EV stocks tumbled after a series of negative news events pushed sentiment downwards.

This has provided buying opportunity.

About Li Auto…..

Li Auto Inc, through its subsidiaries, designs, develops, manufactures, and sells smart electric sport utility vehicles (SUVs) in China. It offers Li ONE, a six-seat electric SUV that is equipped with a range of extension system and cutting-edge smart vehicle solutions.

The company was formerly known as Leading Ideal Inc and changed its name to Li Auto Inc in July 2020.

The Li One SUV was designed to serve a specific niche in China: It includes a small gasoline engine onboard that can be used to recharge its batteries, allowing for longer travel between charging stations.

Li Auto opened seven additional retail stores in December and expanded its footprint to three new cities. It now has a presence in 41 cities in China.

The Major Catalysts for This Trade.....

Earnings Report.....

LI’s total revenue for the fourth quarter, ended December 31, 2020 came in at $635.54 million, which represents a 65.2% rise sequentially. The company’s non-GAAP net income increased 621.5% sequentially to $17.69 million and gross its profit increased 45.9% sequentially to $111.05 million. However, its non-GAAP loss from operations was $10.89 million for the fourth quarter and its non-GAAP EPS was t $0.02.

Analysts expect the company’s EPS to remain negative for fiscal 2021. However, a consensus revenue estimate of $688.79 million for the quarter ending June 30, 2021 represents a 128.8% rise year-over-year.

Analysts Positivity.....

China has 1.4 billion people, who are rapidly urbanizing and growing in wealth, and the country is becoming a voracious consumer of sorts of material goods – including cars. As noted above, government mandates in China require that, by 2030, 40% of all automotive sales be in electric vehicles.

Li Auto, founded in 2015, currently boasts one of China’s best-selling EV models, the Li ONE. In 2020, despite the corona virus crisis, Li delivered over 32,000 units, with 14.464 of those deliveries made in Q4. The company reported US$635.5 million in revenues for the quarter, and a gross profit of US$111 million, up 45% year-over-year. The company’s quarterly net loss fell by more than half from Q3 to Q4, to just US$12.1 million, while quarterly free cash flow increased 113% sequentially to US$245.1 million.

The company’s popularity continues to increase, and Li announced on March 2 that it had delivered 2,300 Li ONE models during February. This was a 755% yoy increase, and the company stated that cumulative deliveries of the Li ONE, since its introduction, totaled 41,276 units. The company conducts its sales through 60 retail locations in 47 cities around China, and supports its vehicles with a network of 125 service centers in 90 cities. New models are planned for launch in 2022.

Among the bulls is Needham's analyst Vincent Yu who takes a bullish stance on LI shares.

“We believe the company's unique value proposition, focused strategy, and diligent margin and costs control, make it a quality asset in the growing EV space,” Yu noted.

The analyst added, "We think the lack of charging stations is the main bottleneck for the growth EV markets in China, and Li’s product directly addresses the problem. Li One uses extended-range technology, which allows the vehicle to run on its battery pack that can be charged by a gasoline engine, significantly increases its range (800km) while reducing vehicles' reliance on charging stations. Li's BEV model is set to release in 2023, capturing secular tailwinds from improvements in battery and charging technologies."

To this end, Yu rates LI shares a Buy along with a $37 price target. This figure implies a 42% upside potential for the next 12 months.

Overall, data shows a bullish camp backing this EV player. The ‘Strong Buy’ stock has amassed 6 Buy ratings in the last three months, with just one analyst playing it safe with a Hold. LI is priced at $25.90 and its $40.21 average price target implies a 55% upside from that level in the next year.

Deliveries.....

LI delivered 2,300 Li ONEs in February, which represents a 755% year-over-year increase. Also in February, LI established a new research and development center in Shanghai dedicated to the development of cutting-edge EV technologies. And in January, the company’s Li ONE received a G rating, the highest safety rating per the safety evaluation results published by the China Insurance Automotive Safety Index Management Center.

Summary.....

The company's Li One model uses extended-range technology, which allows the vehicle to run on a battery pack that can be charged by a gasoline engine, significantly increasing its range, the analyst noted.

The company is expected to release a battery EV model in 2023, capitalizing on the secular tailwinds from improvements in battery and charging technologies, he said.

Additionally, the company's focus on vehicle margins and operating efficiencies indicate that it will likely have a faster profitability timeline than peers.

The company's unique value proposition, focused strategy, and diligent margin and costs control, make it a quality asset in the growing EV space.

Back to Weekly Options USA Home Page