TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, FEBRUARY 22, 2021

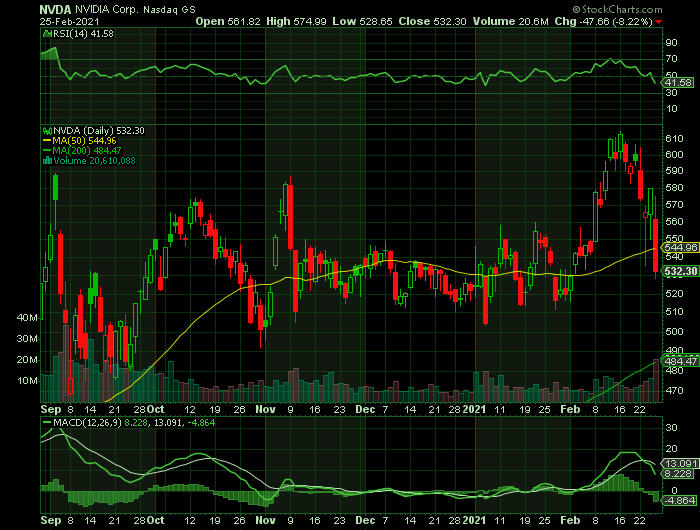

Weekly Options Trade – NVIDIA Corporation (NASDAQ:NVDA) Calls

Friday, February 26, 2021

** OPTION TRADE: Buy NVDA MAR 05 2021 550.000 CALLS at approximately $10.00.

(Some members have asked for the following.....

Place a pre-determined sell at $20.00.

Include a protective stop loss of $4.00.)

Prelude.....

The maker of graphics and high-performance computing chips NVIDIA Corporation (NASDAQ:NVDA) reported earnings on Wednesday, after the market closed.

Nvidia beat earnings expectations as the graphics processing card company reported 4Q FY21 diluted earnings per share (EPS) of $3.10 compared to analysts’ estimates of $2.81. Revenue for the quarter came in at $5 billion, up by 61% year-on-year versus the consensus estimate of $4.82 billion.

However, shares of Nvidia dropped 2.2% in extended trading on Wednesday as the company’s founder and CEO, Jensen Huang, told analysts on an earnings call that he does not expect the selling of processors to cryptocurrency miners to become a large part of the business. “I think that this is going to be a part of our business. It won’t grow extremely large no matter what happens.”

Huang was referring to the Nvidia Cryptocurrency Mining Processor (CMP) that was introduced around a week ago and increases the efficiency of mining the Ethereum cryptocurrency.

Huang said about NVDA’s fourth quarter earnings, “Q4 was another record quarter, capping a breakout year for NVIDIA’s computing platforms. Our pioneering work in accelerated computing has led to gaming becoming the world’s most popular entertainment, to supercomputing being democratized for all researchers, and to AI emerging as the most important force in technology.”

The company’s data center and gaming market platforms saw the biggest jump in year-on-year 4Q revenues growing 97% and 67% respectively due to stronger demand as more people have been working, learning, and playing from home due to the COVID-19 pandemic.

The Major Catalysts for This Trade.....

1. Positive Analysts Input.....

Before the announcement of earnings, Rosenblatt Securities analyst Hans Mosesmann reiterated a Buy and a price target of $650 on the stock.

Mosesmann said, “We see the January quarter being driven by strength in Gaming, Professional Visualization, and a continued recovery in Automotive offset by a sequential decline in Data Center, while the outlook will likely see continued adoption of Ampere and the recently announced Ampere featured laptops, strength in AI and cloud computing verticals, better than expected Gaming, and Automotive growth.”

“We are keen on understanding the visibility the company has in data center in particular, supply chain shortage duration, and controls on cryptocurrency mining using GPUs [graphics processing unit].We see NVDA as the best managed and strategically positioned semiconductor company with secular growth prospects driven by AI and a multi-year data center GPU compute cycle, gaming, a product shift to the data center in the near-term, and Automotive (in the long-term),” Mosesmann added.

The rest of the Street is bullish on the stock with a Strong Buy consensus rating with no less than 14 lifting their price targets, the highest coming from Needham to $800 from $700. J.P. Morgan Securities, which lifted its price target to $660, predicted that the supply/demand issues the company is facing will normalize by the second half of the year.

The average analyst price target of $633.80 implies upside potential of around 9% to current levels.

Sentiment surrounding the equity was already optimistic coming into today. Of the 21 in coverage, 17 considered NVDA a "buy" or better.

2. Taking Steps.....

NVIDIA's graphics processors are very efficient at mining Ethereum (CRYPTO:ETH) tokens and the smart-contract cryptocurrency has seen prices skyrocket 568% over the last year. If Ethereum miners are buying tons of NVIDIA's graphics cards, that leaves fewer units on store shelves for actual gamers. All of this is happening during a marketwide shortage of semiconductor manufacturing capacity, limiting the processor supplies even further. All of this sounds like good news for NVIDIA, but the idea is that it also exposes the company to significant market risks if Ethereum prices crash again, killing the demand for token-mining hardware.

NVIDIA's management has acknowledged this concern and taken steps to limit the Ethereum-mining appeal of its gaming hardware. Furthermore, CEO Jensen Huang argues that the cryptocurrency mining market is a fairly small part of his company's end-user market. Hyper-specialized application-specific integrated circuits (ASICs) play a much larger role in the crypto-mining sector.

"I think that this is going to be a part of our business. It won't grow extremely large no matter what happens and the reason for that is because when it starts to grow large, more ASICs come to the market, which kinds of mutes it," Huang said on the fourth-quarter earnings call. "When the market becomes smaller, it's harder for ASICs to sustain the R&D and so the spot miners, industrial miners come back and then we'll create [cryptocurrency mining processors]. And so we expect it to be a small part of our business as we go forward. "

Going Forward.....

The company expects about $50 million from CMP sales along with plans to break out cryptocurrency-related sales in the future. Revenue is forecasted to be in the range between $5.19 billion to $5.41 billion, while analysts had forecast revenue of $4.49 billion on average.

Gaming-card supply shortages will likely remain going forward with more and more ‘smart' products using AI that will increase demand for data-center chips. Numerous companies across the globe are applying Nvidia AI to create cloud-connected products. The reality is AI services are transforming the world's largest industries.

Summary.....

Everything is rounding up nicely for Nvidia that just reported another record quarter that capped a breakout year for its computing platforms that allowed it to benefit from the "smartphone moment". Technology is offering an opportunity to change the way businesses across industries interact with their customers and Nvidia positioned itself well to play a big part in that exchange.

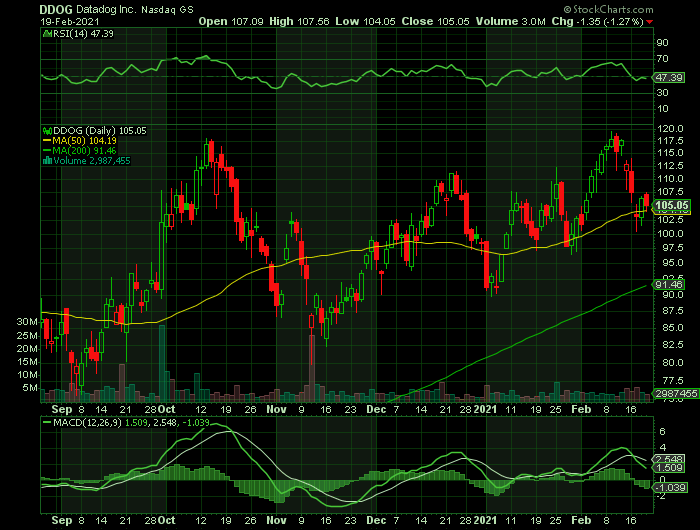

Weekly Options Trade – Datadog Inc (NASDAQ: DDOG) Calls

Monday, February 22, 2021

** OPTION TRADE: Buy DDOG FEB 26 2021 105.000 CALLS at approximately $3.00.

(Some members have asked for the following.....

Place a pre-determined sell at $6.00.

Include a protective stop loss of $1.20.)

Prelude.....

Shares of Datadog (NASDAQ:DDOG) sank on Friday, February 12, after the company reported fourth-quarter results that beat analyst expectations.

Datadog reported fourth-quarter revenue of $177.5 million, up 56% year over year and about $14 million ahead of analyst expectations. Adjusted earnings per share of $0.06 doubled from the prior-year period and were $0.04 higher than the average analyst estimate.

The fourth quarter was a bit more sluggish than the rest of 2020. The company booked 66% revenue growth for the full year, bringing the annual total to $603.5 million. Datadog now has 97 customers with annual recurring revenue of $1 million or more, nearly double the count at the end of 2019.

On top of reporting its results, Datadog announced two acquisitions. The company has agreed to acquire software security platform Sqreen and observability data pipeline provider Timber Technologies.

However, Datadog's guidance may be what's dragging down the stock. The company expects to report first-quarter revenue between $185 million and $187 million, along with adjusted EPS between $0.02 and $0.03. At the midpoint of those ranges, revenue would be up 42% year over year, while earnings per share would be down substantially from the $0.06 reported for the prior-year period.

For 2021, Datadog expects revenue between $825 million and $835 million and adjusted EPS between $0.10 and $0.14. That's good for revenue growth of 38%, while EPS will be down from the $0.22 reported for 2020.

The lower earnings guidance was disappointing, but it wasn't surprising since Datadog recently made several acquisitions -- including the data pipeline firm Timber Technologies and the cloud-based security service provider Sqreen -- to expand its ecosystem. However, buying Datadog's post-earnings dip, and if the market trades positively this week, then expect to see the shares rise again.

The Major Catalysts for This Trade.....

1. Positive Analysts Input.....

Morgan Stanley raised their stock price forecast on Datadog Inc, a monitoring and security platform for cloud applications, to $120 from $112 and said there were several positives out of Q4 earnings that suggest that the New York City-based company is emerging out of the rough patch seen in the summer of 2020.

“Closing 2020 with 56% rev growth supported by customer expansion returning to pre-pandemic levels and record new logo additions suggests momentum heading into 2021. However, initial guidance calling for 37-38% growth, while conservative, likely isn’t enough to fuel shares higher at 34x CY22 sales,” wrote Sanjit Singh, equity analyst at Morgan Stanley.

“The FY21 revenue outlook calls for 38% growth at the high end of guidance compared to 66% growth in 2020 which we think reflects.....

- 1) tougher compares in 1H,

- 2) lingering headwinds from slower customer expansion trends in 2Q20 and

- 3) general conservatism on the still difficult to predict spending environment.

Taking this into account, we view FY21 guidance as conservative and see the current trajectory of growth given recent outperformance consistent with mid-to-high 40% revenue growth for the full year. However, at ~34x CY21e sales, we think shares currently anticipate this level of growth in 2021, leaving us waiting for a more material pullback.”

Morgan Stanley gave a base target price of $120 with a high of $180 under a bull scenario and $40 under the worst-case scenario. The firm currently has an “Equal-weight” rating on the IT company’s stock.

Fourteen analysts who offered stock ratings for Datadog in the last three months forecast the average price in 12 months at $119.09 with a high forecast of $141.00 and a low forecast of $95.00.

The average price target represents a 5.52% increase from the last price of $112.86. From those 14 equity analysts, six rated “Buy”, eight rated “Hold” and none rated “Sell.”

Other equity analysts also recently updated their stock outlook......

- Stifel raised the stock price forecast to $120 from $100.

- Truist Securities upped the price objective to $125 from $120.

- Needham increased the target price to $141 from $109.

- Mizuho raised the target price to $135 from $115.

- Berenberg upped the target price to $111 from $103.

- RBC increased the target price to $120 from $110.

- Barclays upped the price objective to $135 from $115.

2. Leading Product in a Growing Market Supports Continued Rapid Growth.....

“Datadog has positioned itself as the leading observability platform for most modern cloud environments. Strong secular tailwinds towards modern performance monitoring with the re-platforming to the cloud creates an underpenetrated market that we estimate at >$30 billion, supporting our 30%+ annual revenue forecast through CY23,” Morgan Stanley’s Singh added.

3. Datadog’s Services.....

Datadog simplifies the process of installing software and services across a wide range of computing platforms, and monitoring the performance of all those applications, by breaking down silos and pulling all of that data onto unified performance-monitoring dashboards. Over 400 software platforms, including Amazon Web Services and Microsoft Azure, provide native support for Datadog's services.

And demand for its services is rising. Datadog ended 2020 with 1,253 customers generating over $100,000 in ARR (annual recurring revenue), up 46% from 2019. The number of customers with over $1 million in ARR rose 94% to 50.

4. High Retention Rate.....

Datadog has kept its net retention rate, which measures its year-over-year revenue growth per existing customer, over 130% for 14 consecutive quarters. It attributes that streak to its "land and expand" strategy, wherein it signs a customer up for a single service before cross-selling additional services.

At the end of the fourth quarter, 22% of Datadog's customers were using four or more of its products, up from 10% a year ago. More than 70% of its customers were using two or more products, up from about 60% a year ago.

5. Growing Margins.....

Datadog’s adjusted gross and operating margins either held steady or expanded in the fourth quarter and full year.

Datadog attributed the rising gross margin to its more efficient use of cloud hosting expenses and its higher operating margin to significantly lower sales and marketing expenses.

6. Rising Cash Flows.....

Datadog's soaring revenue and expanding margins, along with a convertible debt offering last June, boosted its free cash flow from just $791,000 in 2019 to $83.2 million in 2020. That massive jump explains why Datadog is buying up companies like Timber, which will improve its data observability features, and Sqreen, which blocks application-level attacks, to expand its ecosystem.

Summary.....

Datadog has a 1-year low of $28.88 and a 1-year high of $119.43. The business has a fifty day moving average of $104.62 and a 200 day moving average of $96.54. The company has a market capitalization of $32.40 billion, a PE ratio of -3,545.48 and a beta of 1.15. The company has a quick ratio of 6.49, a current ratio of 6.49 and a debt-to-equity ratio of 0.61.

Back to Weekly Options USA Home Page