TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, January 17, 2022

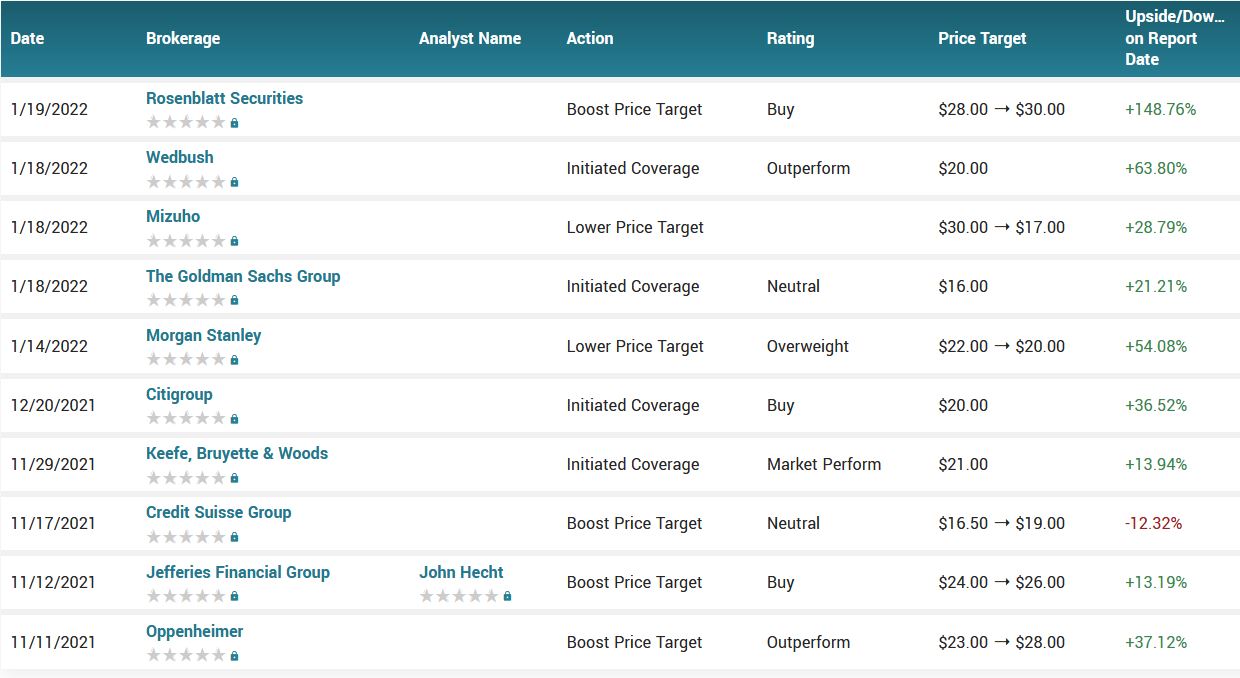

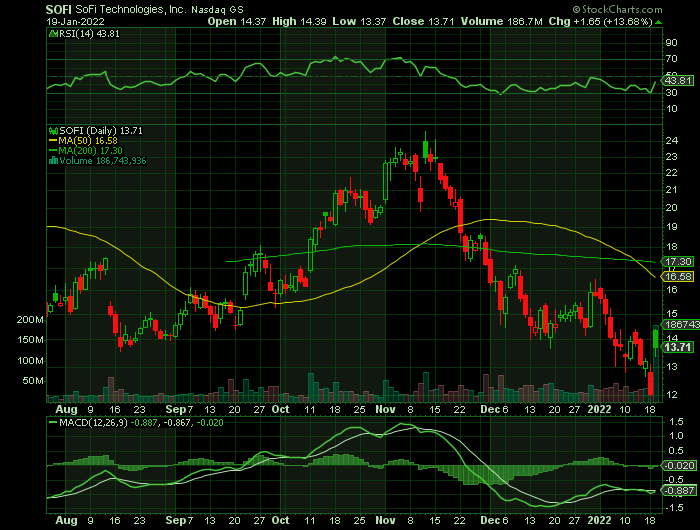

Weekly Options Trade – SoFi Technologies Inc (NASDAQ: SOFI) Calls

Thursday, January 20, 2022

** OPTION TRADE: Buy SOFI FEB 11 2022 14.000 CALLS at approximately $1.07. (price at last close)

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at $2.20. (100% Profit)

Include a protective stop loss of $0.45. (60% loss)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Like many of

its peers in the fintech sector, SoFi Technologies Inc (NASDAQ: SOFI) stock

has been taking a hammering over the past few months.

However, that all changed Wednesday with shares of SoFi on the move Wednesday after the company announced it received approval to become a Bank Holding Company.

The Office of the Comptroller of the Currency and the Federal Reserve approved SoFi's applications to become a Bank Holding Company through its proposed acquisition of Golden Pacific Bancorp.

The transaction is expected to close in February. SoFi said it plans to operate its bank subsidiary as SoFi Bank, National Association.

"Tell me where you can find a bank that's going to give you 40% to 50% revenue growth and expanding margins," Virtus Investment Partners' Joe Terranova said Wednesday.

When comparing SoFi to other banks, the company's prospects really stand out. Terranova said, and that he owns shares and has no plans to sell because SoFi offers the opportunity to own a bank that also has the characteristics of a growth stock.

The much-needed sentiment boost could help kick off a turnaround and Wedbush’s David Chiaverini believes the final hurdle cleared on the path to becoming a bank should “accelerate earnings growth.”

However, that is not the only thing the banking disruptor has going for it. “The company is a one-stop shop for financial services and this is a significant competitive advantage over neobank competitors who tend to focus on niche offerings rather than the full financial picture,” the 5-star analyst said.

SoFi is also well-positioned to compete with legacy consumer finance providers due to its “streamlined product offering,” while a younger age group are also more likely to be attracted to the company rather than traditional banks, who are seen as out of date, unfriendly fee-wise, and given their business segments often “operate in silos,” often have “friction” in the cross-selling process.

In contrast, SoFi has a competitive advantage, due to its integrated technology platform Galileo, which provides a “seamless cross-buying experience aimed at a digitally native younger cohort.”

Moreover, the company has been growing at a fast pace and is expected to continue doing so. In 4Q21, members crossed the 3 million thresholds, well above the 1.7 million notched a year ago and far above the 1 million of two years ago.

Likewise, revenue growth has been impressive; from $600 million last year and $450 million beforehand, the company has guided to almost $1 billion of revenue in FY2021E.

While SoFi has a five-year plan in place, which Chiaverini thinks might be “overly optimistic" (the revenue forecast for 2025 is $3.7 billion compared to Chiaverini’s $2.9 billion estimate), the analyst still anticipates a CAGR of 28% over the next five years, an “exceptional level of growth,” which should see the company attain revenue of $3.5 billion by 2026.

Accordingly, Chiaverini initiated coverage on SOFI shares with an Outperform (i.e. Buy) rating and $20 price target. Investors could be pocketing gains of ~46%, should the analyst's forecast hit the mark over the next 12 months.

2021 is already firmly in the past, but on Wall Street, the year won’t be truly over until companies report 4Q21’s financials. That said, when SoFi Technologies steps up to the earnings plate next month, Morgan Stanley’s Betsy Graseck believes all eyes will be on the outlook for 2022.

After showing ~60% top-line growth in 2021, Graseck believes the bears are “skeptical of strong revenue growth continuing, looking for a sharper slowdown in 2022.”

Graseck is no SOFI bear, but also anticipates growth will slow down, expecting around 40% growth in 2022e, with adjusted 2022e revenues hitting ~$1.42 billion. The analyst sees 2022e EBITDA reaching $164 million as EBITDA margins expand to 11.5% from 3.0% in 2021e.

The “forthcoming boost” for student loan refi originations will get another 3-month delay due to President Biden's extension of the federal student loan moratorium to May 1. To account for the delay, Graseck had already reduced her student loan refi forecast, and now predicts $5.1 billion of SLR originations in FY22. Graseck’s outlook presumes a return to a pre-COVID run-rate of $2 billion a quarter does not occur before early 2023.

Elsewhere, since SOFI last reported earnings in November, interest rate expectations have “risen,” which Graseck says puts a dampener on gain on sale margins from here on in.

Lastly, over each of the past 3 quarters, SOFI has managed to double its total member base on a year-over-year basis, which along with product growth, Graseck believes is an “important leading indicator for the forward revenue growth trajectory.” For the quarter, the analyst expects 10% sequential growth and a 74% uptick from the same period last year, with members reaching 3.2 million. Member engagement should also “continue to increase,” with products per member growing from 1.45x to 1.49x, exhibiting year-over-year total products growth of 90% and landing at 4.8 million.

To this end, Graseck reiterated an Overweight (i.e., Buy) rating for SOFI, although the shares get a new price target as the figure drops from $22 to $20.

“The moment we have all been waiting for has finally arrived,” wrote Rosenblatt Securities analyst Sean Horgan. He anticipates that consensus estimates will “move substantially higher” once analysts factor in the expected financial benefits of the charter.

“Specifically, we are incrementally bullish on 2022 top-pick SOFI given both the direct benefits (i.e., lower cost of capital, increased NIM [net-interest margin]) and indirect benefits (i.e., rising interest rates) of becoming a national bank,” he wrote.

SoFi shares have come under pressure in recent months, falling 31% over a three-month span as fellow newly public fintech players Robinhood Markets Inc. (down 65%) and Marqeta Inc. (down 45%) have suffered rough stretches as well. But SoFi could be in a position to separate from that crowd in time, Oppenheimer analyst Dominick Gabriele wrote, by winning more traction with institutional investors.

“Some investors were skeptical of SOFI’s ability to obtain this charter and thus this likely is an upside surprise,” he wrote. Gabriele called the charter “a significant and tangible checkpoint in achieving SOFI’s ultimate goals of further consumer engagement and the competitive advantages SOFI ultimately looks to obtain.”

On Wall Street, most back the Morgan Stanley analyst’s take; the stock has a Strong Buy consensus rating, based on 6 Buys vs. 2 Holds. The overall target remains at Graseck’s prior objective of $22.

SoFi Technologies Company Profile.....

SoFi

Technologies, Inc. provides digital financial services. The company operates

through three reportable segments: Lending, Financial Services, and Technology

Platform.

Its financial

services allow its members to borrow, save, spend, invest, and protect their

money. The company offers student loans; personal loans for debt consolidation

and home improvement projects; and home loans. SoFi Technologies, Inc. also

provides cash management, investment, and other related services. In addition,

it operates Galileo, a technology platform that offers services to financial

and non-financial institutions; and Apex, a technology-enabled platform that

provides investment custody and clearing brokerage services.

The company was incorporated in 2020 and is based in San Francisco, California.

On June 1, the company went public through a reverse merger with Social Capital Hedosophia Corp., a special purpose acquisition company (SPAC). SOFI stock ended its first day at $22.65. After trading between $20 and $25 for the first few weeks, SOFI shares plunged 20% in July.

Summary.....

SOFI has a debt-to-equity ratio of 0.65, a quick ratio of 17.57 and a current ratio of 17.58. The business has a 50 day simple moving average of $16.21 and a 200-day simple moving average of $16.69. SoFi Technologies has a 1 year low of $12.02 and a 1 year high of $28.26.

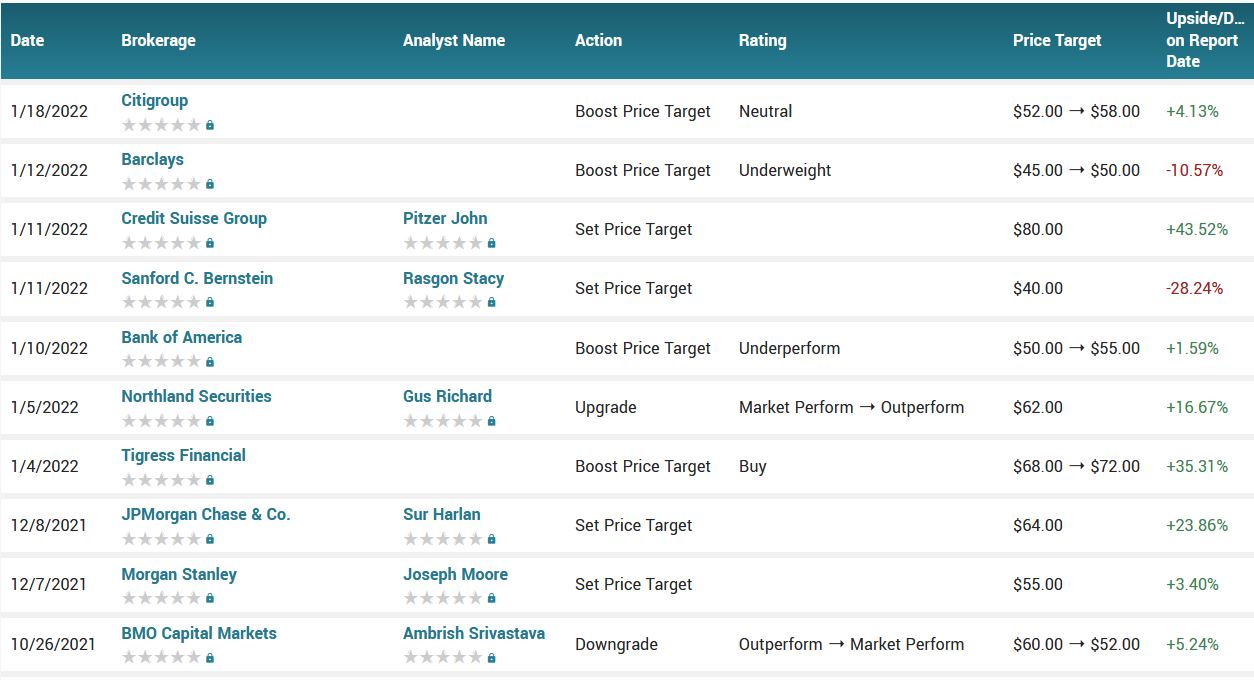

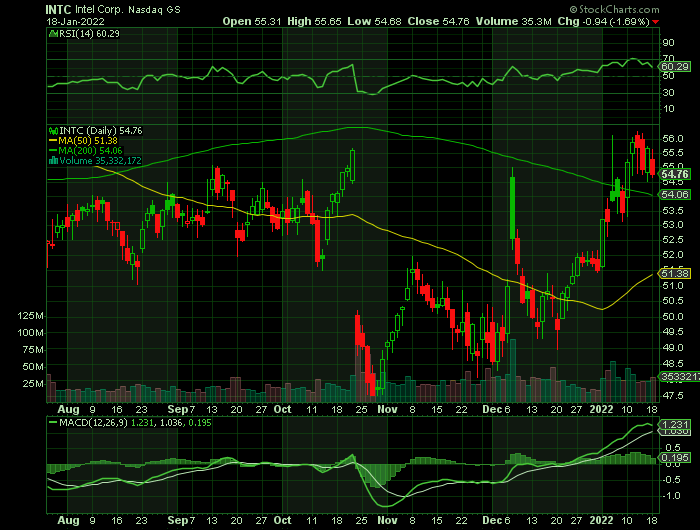

Weekly Options Trade – Intel Corporation (NASDAQ:INTC) Calls

Wednesday, January 19, 2022

** OPTION TRADE: Buy INTC FEB 11 2022 55.000 CALLS at approximately $2.00. (price at last close)

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at $4.00. (100% Profit)

Include a protective stop loss of $0.80. (60% loss)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Semiconductor companies offer a lot of highly liquid securities that encourage risk-taking in all time frames, from intraday scalping to monthly market timing. The sector also supports various profit strategies, including momentum trading, basket allocations and short selling. It acts independently in many market phases, going its own way while major indices push higher or lower. This divergent behavior brings additional opportunities, even in difficult macro conditions. There are many ways to trade the semiconductor space, from identifying particular stocks to investing in the sector as a whole using exchange-traded funds (ETFs).

Currency exchange rates (forex) impact broad sector performance, with just two of the top five highest capitalized components based in the United States: Intel (INTC) and Texas Instruments (TXN).

And, Intel Corporation (NASDAQ:INTC) stock has a bright near-term future, says Citi Research analyst Christopher Danely who likes the setup for the chipmaker’s stock in the weeks to come, given the potential for a positive earnings surprise and optimism heading into the company’s February investor day.

While Danely still has a neutral rating on Intel’s shares he added a “positive Catalyst Watch” designation to the name on Tuesday, which he said reflects expectations for near-term upside.

Intel's

latest turnaround efforts have caught Wall Street's attention, as the fallen

chip giant is showing signs that it could deliver on its promise of regaining

lost market share from rivals that have pulled ahead on the technology front in

recent years.

Wall

Street's newfound confidence in Intel stock isn't too surprising, as the

chipmaker has laid out an aggressive long-term plan to get back in the game.

About Intel.....

Intel Corp. engages in the design, manufacture, and sale of computer products and technologies. It delivers computer, networking, data storage, and communications platforms.

The firm operates through the following segments: Client Computing Group (CCG), Data Center Group (DCG), Internet of Things Group (IOTG), Non-Volatile Memory Solutions Group (NSG), Programmable Solutions (PSG), and All Other. The CCG segment consists of platforms designed for notebooks, 2-in-1 systems, desktops, tablets, phones, wireless and wired connectivity products, and mobile communication components. The DCG segment includes workload-optimized platforms and related products designed for enterprise, cloud, and communication infrastructure market. The IOTG segment offers compute solutions for targeted verticals and embedded applications for the retail, manufacturing, health care, energy, automotive, and government market segments. The NSG segment constitutes of NAND flash memory products primarily used in solid-state drives. The PSG segment contains programmable semiconductors and related products for a broad range of markets, including communications, data center, industrial, military, and automotive.

OTHER major CatalystS for This OPTIONS Trade.....

Analyst

Thoughts.....

The analysts

are bullish on Intel despite lingering legacy issues and plans to bring the

company into the new age of chipmaking.

Demand for personal computers is well above expectations, posing a significant opportunity for Intel, according to Citigroup. Analyst Christopher Danely placed Intel stock on a positive catalyst watch list for the next month, and raised his price target to $58 from $52. “Our checks indicate the recent surge in enterprise demand and notebook orders will drive upside to Intel 4Q21 and 1Q22,” Danely wrote in a research note.

Danely expects the stock to trade well into Intel's analyst day in mid-February.

Shares of

the world's largest chipmaker had gained 10.04% over the past month, outpacing

the Computer and Technology sector's loss of 2.99% and the S&P 500's gain

of 0.64% in that time.

Northland

Capital markets upgraded shares of the semiconductor giant in the first week of

January 2022 to outperform with a price target of $62, which implied an 11%

upside from the stock's closing price on Jan. 12. Northland analyst Gus Richard

cited Intel's coherent strategy and execution as the reason for upgrading the

stock.

As well, the

shares of Intel have received a $50 price target from Barclays. And Barclays

analyst Blayne Curtis increased the price target from $45 while maintaining an

“Underweight” rating on the shares.

Curtis sees

positive outlooks providing some relief for the semiconductor group in general.

According to

the issued ratings of 34 analysts in the last year, the consensus rating for

Intel stock is Hold based on the current 11 sell ratings, 14 hold ratings and 9

buy ratings for INTC. The average twelve-month price target for Intel is $56.80

with a high price target of $80.00 and a low price target of $40.00.

Last Earnings Call.....

Intel last

released its quarterly earnings data on Wednesday, October 20th.

Intel reported strong demand across all segments for the third quarter, with record results from data centers, autonomous driving solutions (Mobileye), and the Internet of Things. Revenue grew 5% year over year, with earnings per share advancing by 64%.

During the Q3 earnings call, CEO Pat Gelsinger said, "Demand remains strong across all of our segments, and I continue to believe that we're just starting a cycle of sustained growth, which we are well-positioned to capture."

Next Earnings.....

Intel will be looking to display strength as it nears its next earnings release, which is expected to be January 26, 2022. The company is expected to report EPS of $0.90, down 40.79% from the prior-year quarter. Meanwhile, the Consensus Estimate for revenue is projecting net sales of $18.39 billion, down 7.92% from the year-ago period.

New Leadership.....

Intel has lost considerable market share to rivals in recent years, but it still commands the lion's share of chip sales, and CEO Pat Gelsinger has a clear strategy to retake the throne.

Alder Lake Processors.....

Intel’s new

line of Alder Lake processors is reportedly doing well in independent

benchmarks, giving rival Advanced Micro Devices (NASDAQ:AMD) a run for its

money. Intel's Core i9-12900HK laptop processor has been reported to deliver

desktop-class performance and outperform AMD's Ryzen Threadripper 1950X.

What's more,

the 12th-generation Alder Lake processors have helped Intel regain the gaming

crown from AMD, according to independent benchmarks, with Chipzilla's offerings

coming out on top of AMD's chips in terms of price-to-performance. For

instance, the Core i9-12900K that's priced at $589 matches up to the

performance offered by the $799 Ryzen 9 5950X.

Raptor Lake Chips.....

Intel is expected to push the envelope further as the year progresses with its Raptor Lake chips expected to hit the market in the second half of 2022. The Raptor Lake processors will reportedly pack more efficiency into its cores, ideally leading to improved power efficiency and performance.

Intel's new processors are gaining favor among customers and boosting the company's market share. This could set the stage for Intel to start getting back at AMD in 2022. It is worth noting that Intel had managed to hold on to a 60% share of the central processing unit (CPU) market in 2021 in each of the four quarters, according to third-party estimates. That was a big improvement from 2020 when the company finished the year with 61.5% of the CPU market after starting the year with a 68.4% share.

Metaverse.....

Wall Street expects 2022 to be a banner year for the adoption of the metaverse, as several companies are expected to come out with hardware and software offerings that will help consumers work, play, or learn in the virtual three-dimensional world.

Crunchbase estimates that $10 billion was invested in virtual reality (VR)-related start-ups last year, while Meta Platforms reportedly spent an identical amount on its AR (augmented reality) and VR initiatives as well. Goldman Sachs estimates that the spending on metaverse-related technologies could hit $1.35 trillion over time, indicating that there's a long-term opportunity at hand for investors to take advantage of.

Intel is one of the stocks that could win big from the metaverse.

Intel management pointed out in December 2021 that the metaverse could be the "next major transition in computing" as more people will come to rely on digital technology to "communicate, collaborate, learn and sustain" their lives. Management added that this will create the need for major networking upgrades to support the creation of life-like environments and human-like avatars in the virtual world in real-time.

According to Intel executive Raja Koduri:

Truly persistent and immersive computing, at scale and accessible by billions of humans in real time, will require even more: a 1,000-times increase in computational efficiency from today's state of the art.

Intel is in a solid position to take advantage of this rapid growth as its share of the server processor market stood at a whopping 90.5% in the second quarter of 2021, according to Mercury Research.

Other Factors.....

Intel announced in December plans to take Mobileye public, which could unlock $50 billion in value. Intel will maintain majority ownership of the driverless solutions unit. That's just the beginning of upcoming strategic moves that could send the stock higher.

To regain industry leadership by 2025, Intel is changing how it manufactures chips. Intel has moved slower than AMD because it does everything in-house, including the design and manufacture of its products.

Going forward, Intel plans to source some components from TSMC, which should speed up its chip development. Intel is spending $20 billion to build new chip plants in Arizona. It also plans to set up its own foundry service to compete with TSMC in making chips for other companies.

Moreover, management has laid out a clear roadmap for its chip technology over the next four years. The current production schedule calls for moving from 10-nanometer (Intel 7) process nodes to 7-nanometer (Intel 4) production by late 2022. Intel 20A, previously known as 5-nanometer, will go into production by late 2024.

Intel is loaded with plenty of cash resources to reinvest in new technologies. Over the last four quarters, it generated $17 billion in free cash flow, and that's after spending $15 billion on research and development.

Free cash flow has increased 51% in total over the last five years, and Intel's return on invested capital -- a key measure of profitability -- has also improved from 12% to 18%.

Summary.....

Potential market share gains in CPUs could be a green flag for Intel this year and give the company's client computing group (CCG) a shot in the arm. The CCG is Intel's biggest business in terms of revenue and accounted for 53% of its top line in the third quarter of 2021, but sales were also down 2% year over year during the period. An improvement in this area could go a long way in boosting confidence in Chipzilla stock and accelerating its turnaround.

Also, Intel could turn out to be a top metaverse stock, in the long run, thanks to its dominant position in the data center processor market that's expected to witness solid growth. Given that Intel is trading at less than 10 times trailing earnings, now may be a good time for weekly options of this chip giant as it looks primed for a turnaround, with the metaverse set to act as an additional catalyst.

Intel has a market capitalization of $222.71 billion, a P/E ratio of 10.63, a PEG ratio of 2.03 and a beta of 0.53. Intel has a 1-year low of $47.87 and a 1-year high of $68.49. The company’s fifty day moving average price is $51.45 and its 200-day moving average price is $52.79. The company has a debt-to-equity ratio of 0.40, a current ratio of 2.07 and a quick ratio of 1.74.

Weekly Options Trade – Paypal Holdings Inc (NASDAQ:PYPL) PUTS

Tuesday, January 18, 2022

** OPTION TRADE: Buy PYPL FEB 04 2022 170.000 PUTS at approximately $4.20. (price at last close)

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at $8.40. (100% Profit)

Include a protective stop loss of $1.70. (60% loss)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Downtrends are multiplying across the land, and bears’ ranks are swelling. Despite the fact that the Nasdaq Composite still sitting a stone’s throw from its peak, some 40% of the index has been cut in half. There’s trouble beneath the surface, making for narrowing leadership and, ultimately, more vulnerability.

Markets tricked bottom fishers who bet that Paypal Holdings Inc (NASDAQ:PYPL) bottomed and would rally back to $200. Last week, PYPL stock lost almost 5% and revisited last months’ low.

Shares of digital payments behemoth Paypal ended 2021 down 19%, according to data provided by S&P Global Market Intelligence. This performance lagged behind the S&P 500, which produced a superb return of 27% for the year. Two straight quarters of decelerating revenue growth are causing investors to question the outlook for PayPal.

Markets signaled their disappointment in PayPal’s slowing growth when they speculated it would buy Pinterest (PINS). PayPal’s payment solution on e-commerce shopping sites faces increasing competition. Affirm and Square (SQ) are some of the firms pressuring PayPal. Incumbent credit card firms like Visa (V) and Mastercard (MA) will also invest to re-take lost market share.

PayPal might post strong operating profits in its next report. It had the flexibility to raise fees and widen spreads. Still, if the company posts weaker margins, it may increase customer fees in the next few quarters.

About PayPal.....

PayPal is the highest valued digital payments platform in the world. It enables global commerce across multiple platforms and devices, bringing new buying opportunities to consumers and businesses across the globe.

Established in 1998, PayPal's mission is to democratise financial services and empower people and businesses to join together and exchange value for better experiences.

The company allows individuals and merchants to get paid in more than 25 currencies in over 200 countries. It also has a wide range of services and products to make the process of payments easier, including online invoicing, credit card acceptance, and buy now pay later options, to name a few.

At the same time, PayPal is constantly looking to the future, developing new technologies to improve its services and stay ahead of the curve. Some of its latest innovations include cryptocurrency investing, bill splitting, and budgeting tools.

The company gave rise to four billionaires, including Elon Musk, Peter Thiel, Max Levchin, and Reid Hoffman. The role of this company as a catalyst for the entire fintech industry cannot be understated.

Furthermore, two of the world's most recognised brands, LinkedIn and Tesla Motors, founded by Reid Hoffman and Elon Musk, were born partially due to PayPal's success.

Having been around for longer than two decades, PayPal is now a well-established name in the global fintech industry, giving it a solid competitive edge. In fact, it is now worth more than $220bn.

Nevertheless, competition is heating up, and PayPal will need to continue innovating to stay ahead. It remains to be seen whether it will be able to retain its title as the world's most valuable fintech brand by this time next year.

OTHER major CatalystS for This OPTIONS Trade.....

Analyst

Thoughts.....

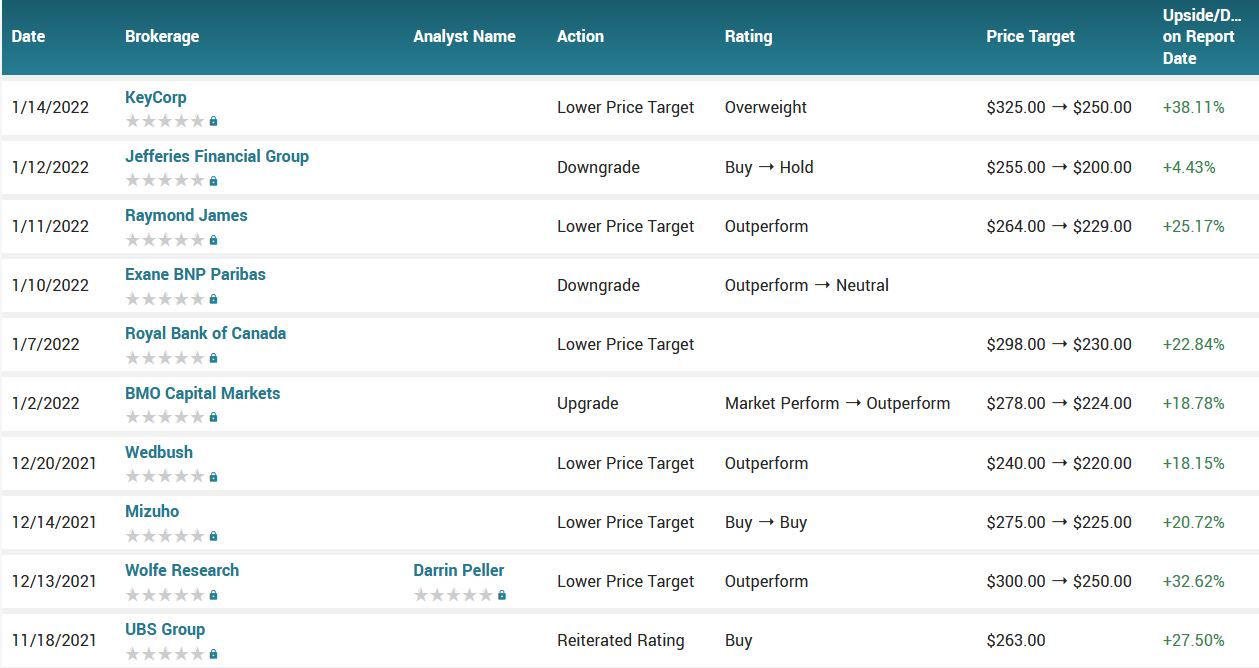

Jefferies downgraded PayPal last Wednesday, citing worsening e-commerce trends as shoppers return to bricks-and-mortar stores; warning that PayPal faces a "muted" setup for the year ahead.

Analyst Trevor Williams changed his rating to Hold, down from Buy, and lowered his price target to $200 from $255.

While RBC’s Daniel Perlin remains in the digital payments giant’s corner, the analyst thinks the company’s outlook necessitates a revision to his PayPal model. “We have better incorporated into our model management’s commentary around the difficult comps expected in FY22, given reserve releases in FY21, which should return to more normalized patterns in FY22,” the analyst explained.

As such, Perlin reduced his FY22 adj. EPS estimate from $5.42 to $5.07 and lowered the adj. EBITDA forecast from $8.42 billion to $7.95 billion.

PayPal’s share price decline is by no means unique in the payment space; most of its peers have seen “material multiple contraction,” while many growth stocks’ valuation have been hammered amidst the heightened fears of inflation and rising interest rates.

As such, alongside the reduced FY22 estimates, there is also a price target cut for the stock. The figure drops to $230 from $298.

According to the issued ratings of

42 analysts in the last year, the consensus rating for PayPal stock is Buy

based on the current 1 sell rating, 9 hold ratings and 32 buy ratings for PYPL.

The average twelve-month price target for PayPal is $269.92 with a high price

target of $350.00 and a low price target of $190.00.

Last Earnings Call.....

During the company's third-quarter 2021 earnings call, management provided sales guidance of $30 billion for 2022 that disappointed Wall Street. In October, the stock started trending down after rumors swirled that PayPal was in talks to acquire social media platform Pinterest in a possible $45-billion deal. PayPal came out and said that it was not pursuing a purchase of Pinterest.

Next Earnings.....

PayPal is estimated to report earnings on February 02, 2022. Analysts expect Paypal to post earnings of $1.12 per share. This would mark year-over-year growth of 3.7%. The reported EPS for the same quarter last year was $0.75.

After PayPal lowered expectations last quarter, Deutsche Bank’s Bryan Keane expects the digital payments giant to deliver “steady growth.”

Boosted by ~24% year-over-year TPV growth, the analyst anticipates PYPL will generate revenue growth of ~12.9% and EPS of $1.12.

That said, Keane does not foresee any unexpected fireworks. “Given the latest quarterly trends in eComm, continued supply-chain issues, delta/omicron, and eBay headwinds, we see relatively limited upside again this quarter,” said the analyst.

Looking at PayPal’s monthly users trends, Keane’s expected results appear in the same ballpark as the quarter’s action. Unique Visitors (UVs) rose by 14% sequentially from 676.8 million to 769 million and came in 11% above the figure reported during the same period last year.

Looking ahead to 1Q22, similar to 4Q21, given the “more difficult comps”

yet offset by “moderating eBay headwinds,” Keane thinks PayPal will

“potentially” guide to cc revenue growth of ~12-14%.

Effect of Pandemic.....

Digital payments certainly received a boost in 2020, but with the return of in-person shopping, PayPal is having problems getting back on track and produce the market-beating returns that investors expect of it.

If we take a step back and focus on the bigger picture, there's a lot to like about this business. As of Sept. 30, PayPal counted 416 million active accounts, up 15% year over year. The company processed $310 billion in TPV during the three-month period, which is an astronomical amount. The secular shift toward electronic payments is a real and sustainable trend, and PayPal is at the forefront.

CEO Dan Schulman one day hopes the company will have 1 billion active users, a feat that would entail people viewing PayPal as a one-stop financial shop. New upgrades to the flagship app, like bill pay, early direct deposit, shopping deals and rewards, and a savings account, make it more appealing.

It's hard not to believe that PayPal's stock, now trading at a nearly two-year-low price-to-earnings ratio of 46, will bounce back nicely in 2022. The business has a massive (and growing) customer base and is introducing new features to drive engagement, all of which should support healthy revenue and profit increases for the current year and beyond.

But, not quite yet!!

Lawsuit.....

Three PayPal users who've allegedly had their accounts frozen and funds taken by the company without explanation have filed a federal lawsuit against the online payment service. The plaintiffs — two users from California and one from Chicago — are accusing the company of unlawfully seizing their personal property and violating racketeering laws. They're now proposing a class-action lawsuit on behalf of all other users who've had their accounts frozen before and are seeking restitution, as well as punitive and exemplary damages.

PayPal has long angered many a user for limiting accounts and freezing their funds for six months or more. One high-profile case was American poker player Chris Moneymaker's who had $12,000 taken from his account after six months of being limited. Moneymaker was already in the process of asking people to join him in a class action lawsuit before his funds were "mysteriously returned."

Big Banks.....

Traditional finance and digital upstarts alike claim the other side has an unfair advantage.

Deep in Jamie Dimon’s 66-page letter to JPMorgan Chase & Co. shareholders last year lies a chart: 11 ways being a bank is costlier than being a fintech, from deposit insurance to higher capital and liquidity requirements. The longtime chief executive officer tallied tens of billions of dollars that he says such rules cost the bank over the past decade.

Dimon has for years griped about what he calls an unfair playing field. He isn’t alone: Big banks and the powerful lobbying groups representing them are readying a fight on multiple fronts, in what’s already shaping up as a definitive year for the rivalry between traditional banks and their tech competition.

Banks are bracing for tougher regulation from the Biden administration, but they hope stricter rules will apply to fintech as well.

Summary.....

PayPal could still fall a great distance despite getting cut nearly in half. Going into the 2020 pandemic, PYPL was sitting at $125, another $50 lower from here. Over the past six weeks, the daily downtrend has slowed and formed a sideways trading range. But instead of powering to the top side and building a compelling bullish breakout, it’s knocking heavily on the lower-end. The $177 support shelf has held long enough to where its failure would prove a significant breakdown.

If previous support breaks are any indication, we could see a swift move down to $160 if sellers press their bets.

PayPal’s 50-day moving average is $192.20 and its two-hundred day moving average is $245.36. PayPal Holdings, Inc. has a 52-week low of $175.40 and a 52-week high of $310.16. The company has a debt-to-equity ratio of 0.36, a current ratio of 1.30 and a quick ratio of 1.30. The stock has a market capitalization of $209.63 billion, a P/E ratio of 42.89, a PEG ratio of 2.28 and a beta of 1.16.

Back to Weekly Options USA Home Page