TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, JANUARY 04, 2021

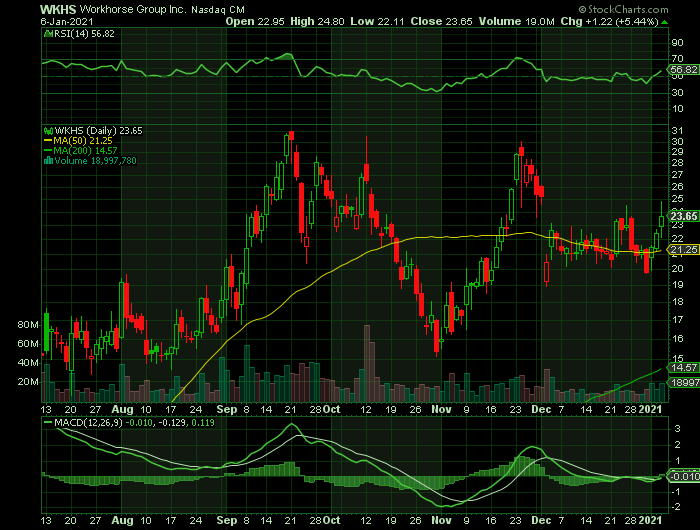

Weekly Options Trade – Workhorse Group Inc (NASDAQ: WKHS) Calls

Thursday, January 07, 2021

** OPTION TRADE: Buy WKHS JAN 22 2021 25.000 CALLS at approximately $1.50.

(Some members have asked for the following.....

Place a pre-determined sell at $3.00.

Include a protective stop loss of $0.60.)

EV stocks were among the best-performing consumer stocks last year, and it appears that this theme is to continue in 2021. Many were up several hundreds of percentage points since the beginning of 2020 and the gains have only just begun – look for this continuation into 2021. It’s easy to see the potential in EV (electric vehicle) companies, with carbon emissions a major environmental concern worldwide and numerous financial incentives for electric car buyers.

With EV accounting for only 2.6% of global sales this is more than just a consumer trend we are talking about. In terms of technology and its impact on society, this is a secular change. Eventually, most cars and trucks will be EV and, to some extent, autonomous. What this means for investors is a multi-billion multi-decade growth opportunity.

EV upstart Workhorse Group Inc (NASDAQ: WKHS) made big headlines last year when it went public. Workhorse Group’s flagship line is in production with new models on the way which will continue to reflect increased price action.

Workhorse Group’s flagship line is the C-Series of last-mile delivery trucks. The company is manufacturing both the 650 and 1000 models, named for the carrying capacity, and expected to dominate the industry. Over the past year, the company has garnered approvals from all 50 states making it the only EV delivery vehicle licenses for operation nationwide. That’s important for any EV fleet with a nationwide presence.

The Major Catalyst for This Trade.....

The Major Catalyst for This Trade.....Delivery Van Order.....

Workhorse Group booked its largest order of electric last-mile delivery vans to date.

Mississauga, Ontario, Pride Group Enterprises, a privately held commercial-vehicle wholesaler that operates in the U.S. and Canada, has placed an order for 6,320 of its new C-Series electric package-delivery vans, said Workhorse.

"This large order solidifies our first-mover advantage and indicates the heightened interest in our last mile delivery products," said CEO Duane Hughes in a statement. "Our new agreement with Pride marks our largest individual order to date and expand our sales channel internationally into Canada for the first time," said Hughes.

Workhorse's C-Series, designed with input from United Parcel Service (NYSE:UPS), is a short-range electric van designed for so-called "last-mile" service, such as deliveries to homes and businesses. The company received U.S. government approval to begin building the van last year.

It's a big order for Workhorse, which has told investors that it aims to build about 1,800 vehicles in 2021. Workhorse said that the deliveries to Pride Group "may begin by July 2021 and will run through 2026." Pride Group will distribute the vehicles to commercial-fleet customers through its dealer network.

Workhorse said that inventory financing — the cash to purchase parts and tooling to build the vehicles — will be provided by Hitachi Capital America (HCA), as per a previously announced partnership between Workhorse and HCA parent Hitachi (OTC: HTHIY).

"Our ongoing partnership with [Hitachi Capital America] continues to bear fruit as we gear up for scaled production in 2021."

Why Workhorse?

Slowed by a COVID outbreak at its factory in Union City, Indiana, Cincinnati-based Workhorse expects to build 1,800 vans this year, gradually reaching production of 200 vans a month. It built just seven vans in the third quarter, two of which were delivered to Ryder System Inc. R 0.06% for use in its COOP short-term rental program.

Workhorse plans to begin fulfilling a pending order from United Parcel Service for 950 C-Series vans this year. It had a total backlog of about 1,100 vans at the end of the third quarter of 2020, not counting a 500-truck order from commercial vehicle distributor Pritchard Cos.

Workhorse may have a slight lead in building last-mile delivery vans over market startups Arrival and Rivian.

Workhorse Company Profile.....

Workhorse Group Inc designs, manufactures, builds, sells, and leases battery-electric vehicles and aircraft in the United States.

It operates through two divisions, Automotive and Aviation. The company also develops cloud-based and real-time telematics performance monitoring systems that enable fleet operators to optimize energy and route efficiency.

Workhorse stock has been trading for the past decade or so. But it did not get much attention until last year. Consider that WKHS stock has soared from $1.32 to a high of $30.99 in 2020.

Workhorse is the developer of electric vehicles for last-mile delivery. The company got its start back in 2007 and was called AMP Electric Vehicles. At first, the focus was on developing EVs for two-seat roadsters. But the company would eventually pivot to create trucks and vans for commercial purposes.

A big part of this involved a merger with Workhorse Custom Chassis, which was founded in 1998. The company was the developer of General Motors’ (NYSE:GM) chasses. As a result, the merger allowed for the new entity — Workhorse — to become a full-blown manufacturer.

Summary.....For months now the story surrounding Workhorse has been the imminent contract announcement from the US Postal Service to replace its fleet of aged vehicles. While this is certainly still on investors’ minds, it is promising to see that Workhorse has secured contracts on its own, proving that the company is able to support itself without having to rely on the USPS contract as previously believed.

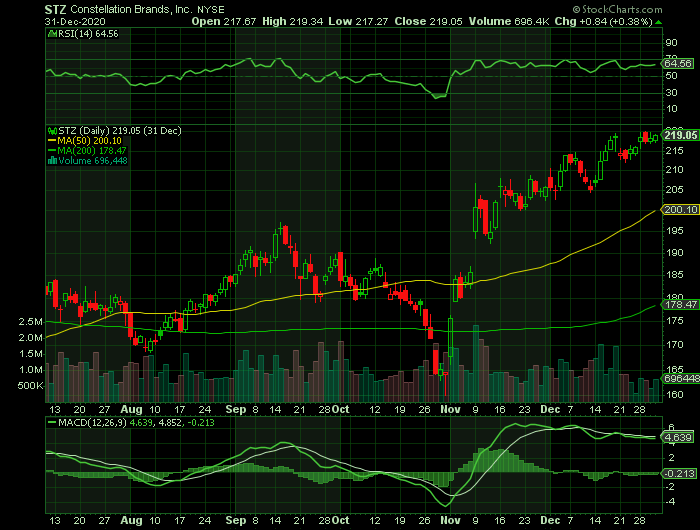

Weekly Options Trade – Constellation Brands, Inc. Class A (NYSE: STZ) Calls

Monday, January 04, 2021

** OPTION TRADE: Buy STZ JAN 08 2021 222.500 CALLS at approximately $4.40.

(Some members have asked for the following.....

Place a pre-determined sell at $8.80.

Include a protective stop loss of $1.75.)

Prelude.....

The beer and spirits specialist, Constellation Brands, Inc. Class A (NYSE: STZ), could grow more than 12% year-on-year to $2.26 billion.

“We believe the focus of Constellation Brands’ FQ3 EPS will be on accelerating and above consensus beer depletions to +8.3% y-o-y in FQ3 (vs. 5% in F1H21) with improving beer out-of-stocks, as well as a beer shipment recovery after the under-shipment in F1H21. We also expect an update on beer depletion trends in December, with solid U.S. scanner data trends but likely weakening on-premise trends with more on-premise restrictions, particularly in California (about a quarter of Constellation Brands’ volumes),” said Dara Mohsenian, equity analyst at Morgan Stanley.

“Additionally, we believe investors will focus on beer margins, which we believe could surprise to the upside in FQ3 (we are 20 bps above consensus on beer margins and 2.3% above consensus on beer profit) and in F2H21, with Constellation Brands full year FY21 guidance of flat beer margins implying -160 bps of y-o-y margin declines in H2, with our estimates above guidance at -20 bps y-o-y,” Mohsenian added.

The Major Catalyst for This Trade.....

The Major Catalysts for This Trade.....

Earnings Report.....

Constellation Brands will report earnings at approximately 7:30 AM ET on Thursday, January 07, 2021, and Wall Street expects a year-over-year increase in earnings on higher revenues for the quarter ended November 2020. The consensus earnings estimate is for $2.39 per share on revenue of $2.22 billion; but the Whisper number is a bit higher at $2.45 per share.

Consensus estimates are for year-over-year earnings growth of 11.68% with revenue increasing by 1.76% in the past seven days.

The consensus mark for revenues is pegged at $2,257 million, suggesting a 12.9% increase from the prior-year quarter’s reported figure.

For the last reported quarter, it was expected that Constellation Brands would post earnings of $2.51 per share when it actually produced earnings of $2.76, delivering a surprise of +9.96%. Its bottom line beat estimates by 16.7%, on average, over the trailing four quarters.

Over the last four quarters, the company has beaten consensus EPS estimates four times.

Short interest has decreased by 37.7% and overall earnings estimates have been revised higher since the company's last earnings release.

Why Constellation Brands?

Constellation last reported a 5% uptick in its overall beer business, which kept it ahead of larger rivals such as Anheuser-Busch InBev but behind Boston Beer.

The company's recent entry into the hard seltzer segment aims to close that growth gap with Boston Beer, the owner of the blockbuster Truly franchise. We'll get updates on how well Constellation's Corona Hard Seltzer fared in its third quarter of availability.

Two of the biggest reasons to like this stock involve such as investments in recreational marijuana products and Constellation's massive investment in its brewery network.

Constellation Brands Company Profile.....

Constellation Brands, Inc, together with its subsidiaries, produces, imports, and markets beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy. The company sells wine across various categories, including table wine, sparkling wine, and dessert wine.

It provides beer primarily under the Corona Extra, Corona Light, Modelo Especial, Modelo Negra, Modelo Chelada, Pacifico, and Victoria brands, as well as Funky Buddha, Obregon Brewery, and Ballast Point brands.

Influencing Factors.....

Constellation Brands said last week that the U.S. Federal Trade Commission approved the sale of the company’s lower-price wine and spirits portfolio to E. & J. Gallo Winery. The deal is slated to close the week of January 4, 2021.

Despite the impacts of the coronavirus outbreak, Constellation Brands has been gaining from robust depletions and strength in the off-premise channel. The depletion volume for the beer business has been benefiting from strength in the Modelo and Corona Brand Families. Also, depletion gains from robust off-premise channel sales have been offsetting the declines in the on-premise channel due to the coronavirus outbreak. Continuation of these trends in the off-premise business is expected to have aided depletions and the top line in the fiscal third quarter.

As well, continued strength in the Modelo and Corona brand families and constant innovation have been driving portfolio depletions and market share gains.

The company’s wine & spirits premiumization strategy has been yielding results, as evident from the recent acceleration in depletions for the power brands, namely Kim Crawford, Meiomi and The Prisoner Brand Family.

Also, investments in e-commerce and increased hard seltzer market share have been acting as growth drivers. The Corona Hard Seltzer, launched earlier last year, has achieved the number four position in the category and is currently the second-fastest-moving hard seltzer. Market share gains in the fast-growing hard seltzer market are likely to have boosted the top line in the to-be-reported quarter.

In the last reported quarter, e-commerce for beverage alcohol has expanded significantly, increasing three to four times in volume from the prior year. Two-thirds of consumers plan to continue their e-commerce purchases even in the post-COVID situation.

The digital business has been gaining share through platforms like Instacart, Drizly and other retailer online sites as consumers look for the convenience offered by these channels, which should bolster the results for the to-be-reported quarter.

Analysts Thoughts.....

Fourteen analysts who offered stock ratings for Constellation Brands Sciences in the last three months forecast the average price in 12 months at $224.29 with a high forecast of $250.00 and a low forecast of $154.00. The average price target represents a 2.79% increase from the last price of $218.21. From those 14 equity analysts, ten rated “Buy”, three rated “Hold” and one rated “Sell.”

Morgan Stanley gave a base target price of $240 with a high of $280 under a bull scenario and $138 under the worst-case scenario. The firm currently has an “Overweight” rating on the beverage alcohol company’s stock.

Other equities research analysts have also recently issued research reports about the stock......

- Constellation Brands had its price target increased by stock analysts at JP Morgan to $248 from $218. The firm currently has an “overweight” rating on the stock.

- UBS Group increased their price objective to $238 from $220 and gave the company a “buy” rating.

- Citigroup increased their price objective to $209 from $200 and gave the company a “neutral” rating in October.

Summary.....

With improving beer category growth trends, the STZ beer market share should see plenty of upside, have greater innovation incrementality (eg Corona Hard Seltzer), more beer margin upside, and upside from STZ’s Canopy stake.

Back to Weekly Options USA Home Page