TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, January 03, 2022

Weekly Options Trades – Taiwan Semiconductor Mfg. Co. Ltd. (ADR)(NYSE: TSM) Calls

Wednesday, January 05, 2022

** OPTION TRADE: Buy TSM JAN 14 2022 130.000 CALLS at approximately $4.00. (price at last close was 6.05 – but futures at 6:15 shows the price down $2.64)

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at $8.00. (100% Profit)

Include a protective stop loss of $1.60. (60% loss)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Taiwan Semiconductor Mfg. Co. Ltd. (ADR)(NYSE: TSM) is arguably the most important chipmaker in the world. It uses the most advanced semiconductor technology and is a contract manufacturer for many leading chip designers.

Taiwan Semiconductor has demonstrated considerable growth through 2021, with a +17.2% y/y increase in revenue over 2020 through November YTD. This strong growth is likely to carry over into 2022, with CEO C.C. Wei confirming on the 3Q21 earnings call:

“We are entering a period of higher structural growth. The multiyear megatrend of 5G and HPC-related applications are expected to fuel a massive requirement for computation power.

TSMC has reported strong demand across all of the major subsectors which it operates in: Smartphones, HPC (high performance computing), IoT and automotive-related applications. And while the smartphone market may be in a more mature state, there is a real opportunity for multi-year growth across the other three end markets.....

- HPC end markets will continue to grow at a ~8% CAGR through 2025 to a >$40bn market, according to Hyperion Research - this is inclusive of multiple sub-markets across servers, data storage, middleware, and applications

- 5G will continue to spur IoT growth in this coming decade - McKinsey projects that 5G IoT units will increase from 3mln in 2022 to 248mln by 2030. Applications range from automated systems in factories to medical devices, cameras, and other B2B applications

- Rapid changes in the automotive industry over the past few years now require more advanced semiconductors to support the emergence of electric vehicles and automation of automobiles. With increased demand for sensors, memory devices, and other advanced technologies, Mordor Intelligence expects this $37bln market to grow at ~17% CAGR through 2026.”

Despite TSMC's dominance in the chip space, at 54% of total foundry

market share and >90% market share of advanced chips (7nm and below), there

are untapped opportunities. In the latest earnings report, TSMC notes that the

company only participates in 15% of the global automotive IC market, and IoT

currently only accounts for 9% of TSMC's total revenue.

About TSM…..

Taiwan Semiconductor Manufacturing's has obtained lead in advanced semiconductor manufacturing over the past few years, and that lead only seems to be getting bigger. Last month, rival Intel, one of the last chipmakers that manufactures its own chips, admitted that it had run into a design flaw for its 7 nm manufacturing process, and would be falling some 12 months behind schedule. Intel had already ceded the leading-edge node lead to TSM in 2018, and that lead only seems to be getting bigger.

Advanced chip manufacturing is hard, but TSM's years of experience making a wide variety of semiconductors has given it a knowledge and process lead that other manufacturers are struggling to match. In fact, rival GlobalFoundries threw in the towel on competing with Taiwan Semi on the leading edge back in 2018. Intel itself even hinted that it may outsource some manufacturing going forward, likely to TSM. The U.S. government also recently subsidized TSM to build a new fabrication plant in Arizona on national security grounds.

It seems TSM has built itself a formidable moat in chip manufacturing.

major CatalystS for This OPTIONS Trade.....

Earnings Report.....

Taiwan Semiconductor Manufacturing Company Ltd. is estimated to report earnings on Thursday, January 13, 2022.

Based on analysts' forecasts, the consensus EPS forecast for the quarter is $1.14. The reported EPS for the same quarter last year was $0.97.

With TSMC guidance of revenue and gross margin for 2022 from the proposed 20% price hike, there is still ~13% upside over current share prices

TSMC's

revenue guidance could be conservative, given the 20% price hike and increased

demand that will keep fab utilization rates high. Plus, TSMC's AA-/Aa3 credit

rating allows for a substantially low cost of borrowing, which they could use

to tap the debt markets to fund its capex plan if it needs (and lower its total

cost of capital).

Previous Report.....

Taiwan

Semiconductor Manufacturing last issued its earnings results on Thursday,

October 14th.

The

semiconductor company reported $1.08 earnings per share (EPS) for the quarter,

beating the Thomson Reuters’ consensus estimate of $1.05 by $0.03. The firm had

revenue of $14.88 billion for the quarter, compared to analyst estimates of

$14.89 billion. Taiwan Semiconductor Manufacturing had a return on equity of

29.08% and a net margin of 37.93%.

On average,

sell-side analysts forecast that Taiwan Semiconductor Manufacturing Company

Limited will post 4.16 earnings per share for the current year.

Great Moat.....

TSM has one of the largest moats in the market right now. TSMC is the largest chip manufacturer in the world. Basically, every electronic thing that you touch, whether you're talking about changing your thermostat up or down, you're talking about your iPhone, your laptop that you're using, everything has been touched by TSM in some form or way because there are so many semiconductor chips and everything that we're using every single day that's electronic.

Some of their largest customers include NVIDIA (NASDAQ: NVDA), AMD (NASDAQ: AMD), and Apple (NASDAQ: AAPL), and they have over 500 employees and 10,000 different chips that they're making.

They have a lot of variety, and they also have a ton of pricing power because they are pretty much the only one that has the infrastructure to build out a lot of these chips.

November Sales.....

A weekend report from the Semiconductor Industry Association showed November sales of $51.7B. Additionally, a report from Euler Hermes showed expected semi sales growth of 9% for 2022.

Other Factors.....

Taiwan is full of a lot of

engineers. TSMC has amazing engineers, and a lot of them have been working for

years on end.

TSM also have 56 percent market

share in global chip manufacturing. They have a ton of pricing power, and nobody's

going away from TSM. They're not leaving because their customers love them.

Oversupply

should not be a concern, particularly for a leading semiconductor foundry like

TSMC. From a geopolitical perspective, the situation appears more contentious,

as Taiwan is stuck in a tug of war between China and the US.

Despite

China's increasing military presence and confidence, an invasion is unlikely in

the near future. One reason is the difficulty of such a military advance -

Taiwan's "highly defensible" terrain includes a lack of decent

landing spots for ships given the rocky, mountainous east coast and just 14

potential beach landings. Taiwan's entire national defense strategy is

specifically targeted at defeating such an invasion.

But an even

greater deterrence is the prospect of the United States intervening in response

to a move that would shake up a global supply chain. Both the US and China are

heavily dependent on TSMC for chip manufacturing, and an acute move from either

country is likely to draw serious political consequences.

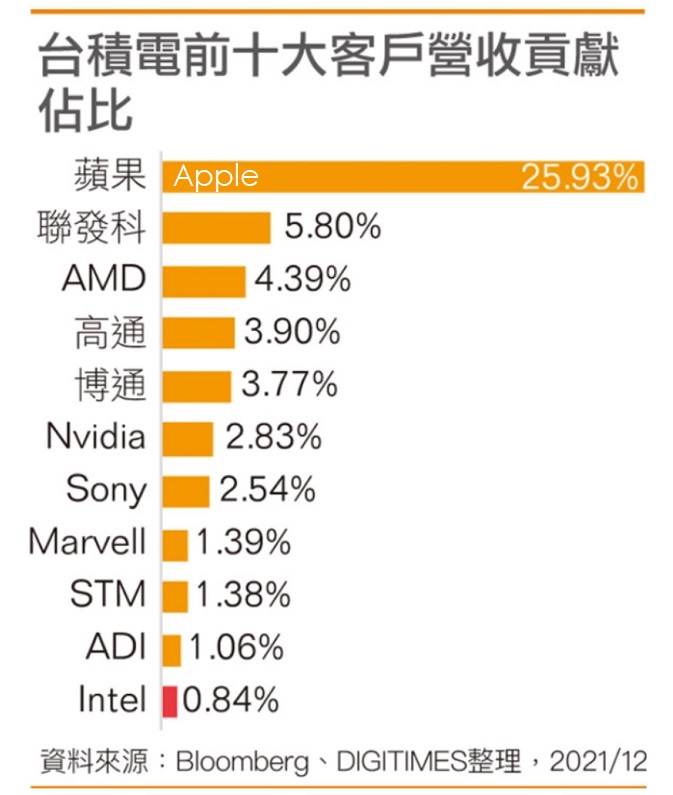

TSM Major Customers…..

Here are TSMC‘s top 10 revenue contributors with Apple shown as their number one customer by a wide margin.

The graph below reveals that Apple is the main source of revenue for the semiconductor manufacturing company, accounting for over 25% of the revenue.

Further Growth.....

TSM has plans to increase its manufacturing capacity. Taiwan Semiconductor is planning to spend $10 billion in the next three years to make this happen. And that’s on top of the $28 billion the company has spent this year to meet the rising demand. This included building a plant in Arizona.

Some investors may be concerned that such a dramatic increase in capital expenditures may impact profitability, particularly as the company has just closed what is typically its strongest quarter in terms of revenue. But with the chip shortage likely to last through 2021 at least, it makes sense to continue to bet on the quality that comes from a leader in the sector.

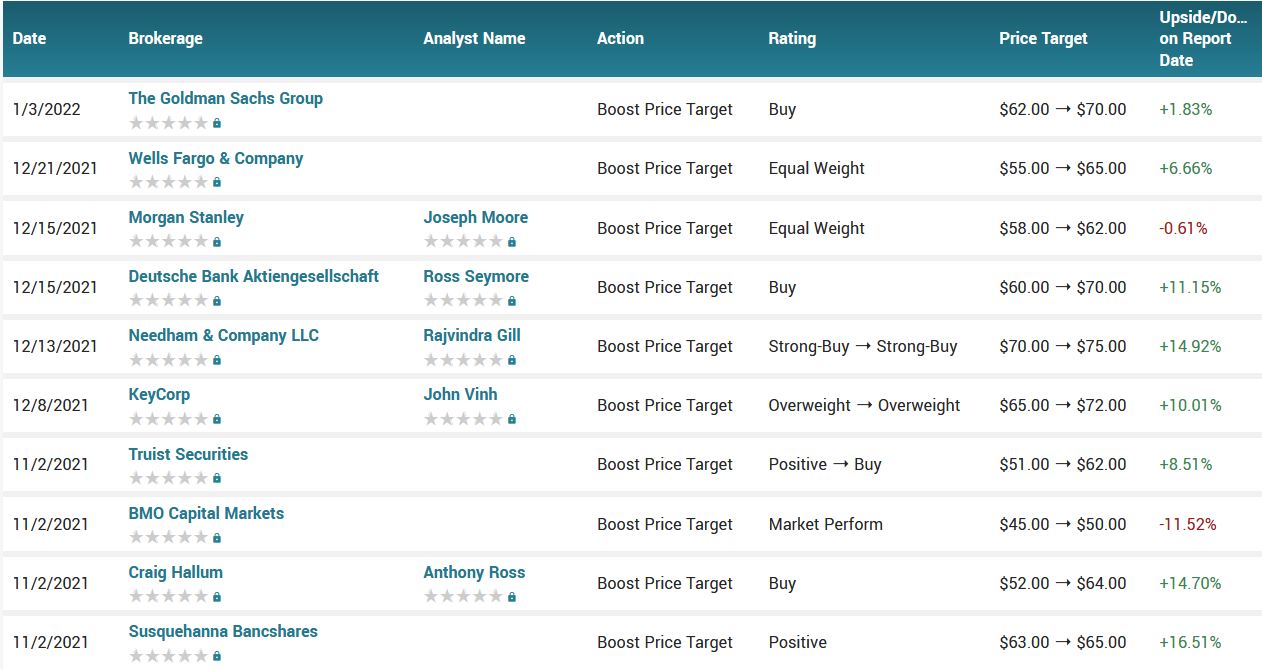

Analyst Thoughts.....

According to the issued ratings of 8 analysts in the last year, the consensus rating for Taiwan Semiconductor Manufacturing stock is Hold based on the current 5 hold ratings and 3 buy ratings for TSM. The average twelve-month price target for Taiwan Semiconductor Manufacturing is $133.15 with a high price target of $150.00 and a low price target of $120.00.

Summary.....

Taiwan Semi is positioned well to capitalize on the growing markets mentioned earlier, as it continues to consistently lead the pack in the latest chip technology. Against its largest competitor, Samsung, TSMC was able to mass produce 7nm and 5nm chips earlier with higher chip yields. On top of a $100bln capex commitment across the next three years, TSMC is poised to continue its technological advantage.

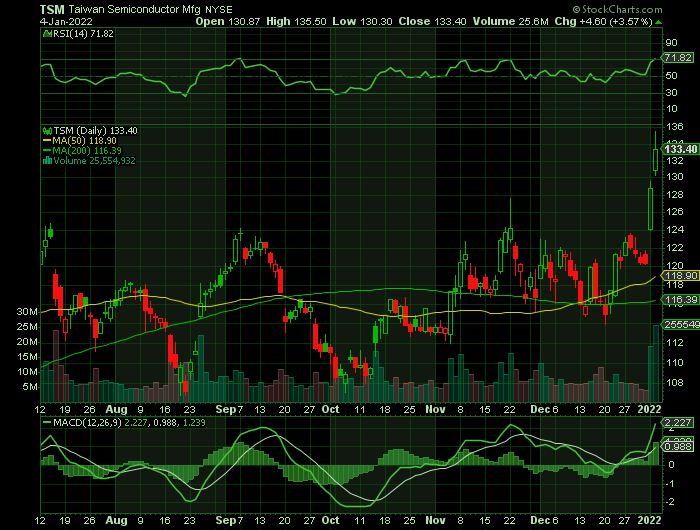

TSM’s fifty day simple moving average is $119.15 and its 200 day simple moving average is $117.45. The firm has a market capitalization of $681.04 billion, a PE ratio of 32.69, and a P/E/G ratio of 1.80 and a beta of 0.90. Taiwan Semiconductor Manufacturing Company Limited has a one year low of $107.58 and a one year high of $142.20. The company has a quick ratio of 1.81, a current ratio of 2.09 and a debt-to-equity ratio of 0.23.

Weekly Options Trade – ON Semiconductor Corp (NASDAQ: ON) Calls

Tuesday, January 04, 2022

** OPTION TRADE: Buy ON JAN 14 2022 70.000 CALLS at approximately $2.00. (price at last close was 2.07)

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at $4.00. (100% Profit)

Include a protective stop loss of $0.80. (60% loss)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

The semiconductor industry has been consistently growing in spite of the coronavirus pandemic-induced macroeconomic crisis, thanks to the increasing adoption of consumer electronics, automotive, industrial tools & equipment, and networking & communication products.

The broader iShares PHLX Semiconductor ETF (SOXX), which measures the performance of the semiconductor industry of the U.S. equity market, has increased 21.6%, while SPDR S&P Semiconductor ETF (XSD), which tracks the S&P Semiconductor Select Industry Index, has gained 22.8% year to date.

Per the latest report from the Semiconductor Industry Association, global semiconductor industry sales were $48.8 billion for the month of October 2021, with a year-over-year and sequential increase of 24% and 1.1%, respectively.

The increasing growth in semiconductor sales is attributed to the growing popularity of recent technologies like Internet of Things, artificial intelligence and virtual reality. Semiconductor acts as a key ingredient in developing these advanced technologies.

Various industries including healthcare, defense, retail and agriculture rely on these technologies for digital transformation amid the pandemic. The pandemic also compelled the organizations to adopt a remote-working environment, which has driven the demand for online services and the usage of cloud storage services. This, in turn, has boosted the demand for data centers, thereby creating growth in the semiconductor space.

ON Semiconductor Corp (NASDAQ: ON) has been riding on the strength of the automotive segment. Growing investments in advanced driver-assistance systems and wireless charging in the automotive business remain a positive. Further, it is continuously gaining traction among electric vehicle manufacturers for silicon carbide and insulated-gate bipolar transistor-based products.

ON

Semiconductor Corp has returned

107.9% over a year.

ON Semiconductor Company Profile.....

ON Semiconductor spun off from Motorola in 1999 and has since become a leading supplier of chips into automotive and industrial markets, with products in analog, discrete, power management, and image sensing. The firm has made several acquisitions in the past few years to solidify share in its key markets. The largest of these was the 2016 purchase of Fairchild Semiconductor for $2.4 billion, which greatly increased the firm's strength in the discrete chip market.

The Netherlands-based company earns its revenue from selling chips to the automotive industry. Additionally, it makes chips for industrial uses, Internet of Things (IoT), as well as chips for infrastructure applications. It boasts approximately 31,000 employees in more than 35 countries.

major CatalystS for This OPTIONS Trade.....

Stephen Weiss Pitch.....

The stock price of ON Semiconductor Corp increased yesterday after Stephen Weiss had pitched on CNBC that he sees the stock gaining by 50% this year.

Earnings Report.....

Wall Street will be looking for positivity from ON Semiconductor Corp. as it approaches its next earnings report on February 07, 2022. The company is expected to report EPS of $0.94, up 168.57% from the prior-year quarter. The most recent consensus estimate is calling for quarterly revenue of $1.79 billion, up 23.84% from the year-ago period.

For the full year, the Consensus Estimates are projecting earnings of $2.80 per share and revenue of $6.68 billion, which would represent changes of +229.41% and +27.21%, respectively, from the prior year.

Strategic Partnership.....

In December,

NXP announced a strategic partnership with Foxconn Industrial Internet (FII), a

subsidiary company of Foxconn Technology. The partnership between the two

companies aims to accelerate automotive innovation by NXP providing Foxconn

Industrial Internet with its comprehensive portfolio of automotive

technologies.

Namely, the joint project will focus on the development of a fully digital cockpit solution based on the NXP i.MX 8 QuadMax. NXP claims that this will enable global automotive companies to deliver a vivid in-vehicle experience for their customers. Essentially, the cockpit will include digital clusters and a head-up display (HUD) system. The digital cockpit solution is expected to start mass production in 2023.

Acquiring GT Advanced Technologies.....

ON recently made an agreement to acquire GT Advanced Technologies in exchange for $415-million cash. With this acquisition, ON Semiconductor aims to increase the supply of silicon carbide (SiC) to meet the growing customer demand for SiC-based solutions. Further, the acquisition will bode well for the company’s growing efforts to create intelligent power and sensing technologies.

Other Factors.....

The growing usage of electronic products such as wearables, smartphones and laptops is also driving the demand for integrated chips. Also, the increasing demand for autonomous and electric vehicles is proliferating the semiconductor industry.

According to the World Semiconductor Trade Statistics, annual global semiconductor sales are expected to register 25.6% growth in 2021, with a market size of $553 billion, driven by strength in memory, analog and logic. Further, the organization expects growth of 8.8% in 2022.

In addition, the Precedence Research report indicates that the semiconductor market is likely to reach $808.5 billion by 2030 from $430 billion in 2021, witnessing a CAGR of 6.6% between 2021 and 2030.

Driving Semiconductor Sales…..

The COVID-19 pandemic has brought about a rapid shift to digitization, spurring demand for various products and devices dependent on chips for their functioning.

The global health crisis has necessitated the use of PC systems, be it for remote work, web-based learning, video conferencing, video gaming, social media, consumer entertainment and streaming, or online shopping.

Meanwhile, over the years, the automotive sector has also evolved to include more electronic components in vehicles that rely on semiconductors. Markedly, following a dip in sales last year due to the pandemic, auto sales have made a remarkable comeback in 2021. Furthermore, IHS Markit predicts global light vehicle production to increase 10.6% year over year in 2022.

Additionally, robust recovery in smartphone sales is boosting demand for semiconductors. According to the latest forecast by International Data Corporation (“IDC”), worldwide shipment of smartphones will likely be up 5.3% year over year to 1.35 billion units in 2021. This suggests a sharp improvement from the 10.5% decline registered in 2020. Moreover, IDC predicts global smartphone shipment to grow 3% in 2022.

Further Growth.....

Semiconductors are the backbone of the current-day technology-driven economy. The digitization across industries, adoption of cloud computing, and the integration of artificial intelligence and machine learning are likely to fuel demand for semiconductors.

The accelerated deployment of 5G technology — the next-generation wireless revolution — is likely to propel further growth. Apart from this, blockchain, Internet of Things, autonomous vehicles, augmented reality/virtual reality and wearables are other growth prospects.

Per the latest WSTS data, the global semiconductor market is predicted to improve 25.6% in 2021, based on double-digit growth across all major product categories, except Optoelectronics. The organization predicts global semiconductor sales to grow 8.8% in 2022.

The boom in sales will be driven by "unusually strong" demand for consumer electronics, according to a new study from Euler Hermes, a subsidiary of German financial services company Allianz.

The industry is expected to grow 9 per cent in 2022, leading it to surpass the $600bn mark, Euler Hermes predicts.

"The current semiconductor cycle has been firing on all cylinders since the industry emerged from its worst recession in 2019 [minus 12 per cent]. Volumes have been driven by unusually strong demand for consumer electronics, prices have increased because of a tight supply/demand equilibrium and the product mix has improved with the introduction of higher-priced, new-generation chips using the 5nm manufacturing node," the credit insurance company said.

Personal computers, smartphones, and audio and video equipment accounted for 80 per cent of final semiconductor sales and were the three main factors driving the industry's growth.

Analyst

Thoughts.....

Goldman Sachs analyst Toshiya Hari revealed Monday, in a new research note, that ON Semiconductor is one of his top picks in the chip space.

Hari warns, however, that stock selection in chips will take on greater importance this year after a strong run-up across the sector in 2021.

"Despite the cyclical concerns, we believe 2022 will offer ample single stock opportunities given the dispersion in price performance we have witnessed over the past several years. Similar to our approach heading into 2021, we recommend investors own companies/stocks with idiosyncratic drivers that can augment growth in a sustained upturn or at least partially offset broader industry weakness should a downturn kick in," said Hari.

Hari reflects on several factors.....

First, there are sector specific catalysts such as expanding budgets by companies for data centers, ongoing 5G smartphone adoption and infrastructure rollout, and a rebound in auto and industrial production.

Explained Hari, "An acceleration in a wide range of secular trends (e.g. transition to the cloud, proliferation of AI/ML, EV/ADAS, and FA, among others) that are enabled by semiconductors has driven or is driving a fundamental shift in the industry’s trend-line. All in, while we enter 2022 with a somewhat guarded posture, we expect fundamentals to remain strong through 1H22, and for any signs of cyclical moderation/weakness to show up in the latter part of the year, at the earliest."

Also, Hari believes sticky inflation is good and relative valuation remains attractive.

"Following its third consecutive year of outperformance vs. the S&P 500, the SOX [Index] is trading at a ~21% premium to the SPX on NTM P/E [multiple] and near its highs since 2010. The valuation picture, however, is less acute for the median stock in our coverage universe. In fact, the median stock in our coverage is currently trading at a ~7% discount to the SPX. While we are clearly cognizant of the cycle and the tendency for multiples to compress as we approach the peak of a cycle, we believe the sector deserves to trade at a premium to the broader market for its above-average.....

- revenue growth profile,

- margin profile,

- FCF generation,

- shareholder return profile, and

- barriers to entry," Hari added.

According to the issued ratings of 28 analysts in the last year, the consensus rating for ON Semiconductor stock is Buy based on the current 1 sell rating, 7 hold ratings, 19 buy ratings and 1 strong buy rating for ON. The average twelve-month price target for ON Semiconductor is $59.22 with a high price target of $75.00 and a low price target of $3.75.

Summary.....

ON Semiconductor is riding on the growing demand for power and sensing products in the automotive and industrial end markets. Further, it is continuously gaining traction among electric vehicle manufacturers for silicon carbide and insulated-gate bipolar transistor-based products. Solid demand for high-end graphic cards, which is driving computing growth, remains another tailwind.

On Semiconductor, which is an original equipment manufacturer of a broad range of discrete and embedded semiconductor components, is persistently putting strong efforts toward expanding its presence in the automotive end market on the back of its robust intelligent sensing solutions. This remains a major positive.

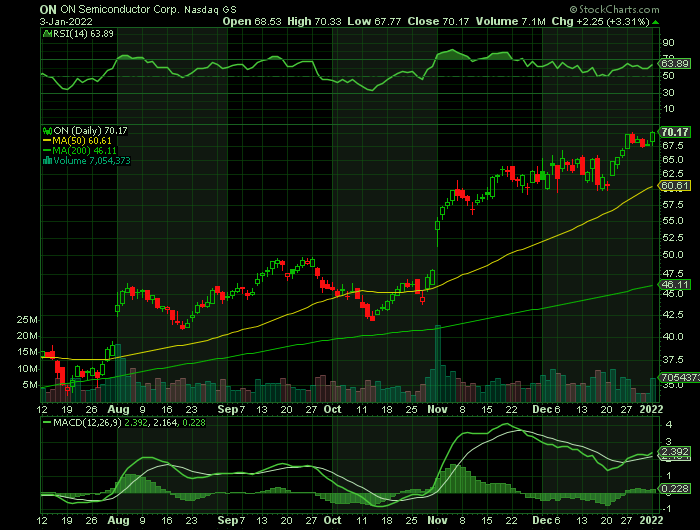

On Semiconductor has a market capitalization of $30.23 billion, a P/E ratio of 45.86 and a beta of 1.75. The company has a 50-day simple moving average of $61.35 and a 200 day simple moving average of $49.16. ON Semiconductor Co. has a fifty-two week low of $32.32 and a fifty-two week high of $70.33. The company has a quick ratio of 1.60, a current ratio of 2.52 and a debt-to-equity ratio of 0.70.

Weekly Options Trade – Micron Technology, Inc. (NASDAQ: MU) Calls

Monday, January 03, 2022

** OPTION TRADE: Buy MU JAN 14 2022 95.000 CALLS at approximately $1.80. (price at last close)

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at $3.60. (100% Profit)

Include a protective stop loss of $0.75. (60% loss)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

We have had great success in the past with Micron Technology, Inc. (NASDAQ:

MU) weekly options trades;

and now, it appears that the stock is carrying impressive momentum into

2022, thanks to the memory specialist's outstanding fiscal 2022 first-quarter

results, released on Dec. 20.

The chipmaker reported robust top- and bottom-line growth, while its second-quarter guidance was also better than what Wall Street was looking for. This led to a surge in Micron's stock following its quarterly report, as the company indicated that there's a healthy demand for memory chips from several verticals, and vanquished any concerns about a memory supply glut.

Micron expects DRAM (dynamic random-access memory) bit demand to increase in the mid- to high teens this year. Meanwhile, NAND (short for "not and") flash memory demand is expected to accelerate 30% in 2022. Micron anticipates the long-term bit demand for DRAM and NAND flash memory to increase at a pace that would be identical to 2022.

Micron shares have gained +27.9% over the past year

against the S&P 500’s gain of +28.4%.

About Micron Technology.....

Micron

Technology, Inc. engages in the provision of innovative memory and storage

solutions.

It operates

through the following segments: Compute & Networking Business Unit (CNBU),

Mobile Business Unit (MBU), Storage Business Unit (SBU), and Embedded Business

Unit (EBU). The CNBU segment includes memory products sold into cloud server,

enterprise, client, graphics, and networking markets. The MBU segment offers

memory products sold into smartphone and other mobile-device markets. The SBU

segment comprises of SSDs and component-level solutions sold into enterprise

and cloud, client, and consumer storage markets, and other discrete storage

products sold in component and wafer forms. The EBU segment consists of memory

and storage products sold into automotive, industrial, and consumer markets.

The company was founded by Ward D. Parkinson, Joseph Leon Parkinson, Dennis Wilson, and Doug Pitman on October 5, 1978 and is headquartered in Boise, ID.

OTHER major CatalystS for This OPTIONS Trade.....

Robust Memory Demand.....

Micron is counting on robust memory demand to help it deliver record revenue and solid profitability in the current fiscal year. The company points out that memory demand remains strong across all its end markets. For instance, in personal computers (PCs) and graphics, Micron believes that inventory adjustments at most customers are already done. As a result, Micron sees stable demand for memory chips from the PC market in 2022.

Micron management anticipates PC sales in 2022 to remain consistent with 2021 levels and adds that more PCs are now using low-power DRAM. More specifically, low-power DRAM accounts for 20% of the PC industry's DRAM bit demand at present, and that number is expected to head higher in 2022 and beyond.

On the other hand, more and more PCs are now turning to solid-state drives (SSDs) for faster storage. Around 100 million SSDs were shipped in the first quarter of 2021 as compared to 64 million hard-disk drives (HDDs). Technavio estimates that global SSD sales will continue to increase in the long run, clocking an annual growth rate of 23.6% through 2025. Given that Micron's latest generation of client SSDs have been qualified for use by several PC original equipment manufacturers (OEMs) and are already in volume production, it looks well-placed to capitalize on growing SSD demand.

Given that 5G smartphones are using 50% more DRAM and double the NAND flash content as compared to 4G smartphones, and their shipments are expected to increase 40% in 2022, it's easy to see why Micron expects a healthy demand environment to prevail in 2022. Additionally, the increasing adoption of SSDs in data centers is another tailwind for the memory market. Micron's data center revenue was up 70% year over year in the fiscal first quarter, and the company sees further growth in this segment as data centers deploy more SSDs instead of hard-disk drives.

So, rising memory demand will be Micron's biggest growth driver in 2022.

Earnings Report.....

Micron Technology delivered

a knockout earnings report on Monday, December 20th, that not

only resulted in a 14% weekly gain but revitalized the entire semiconductor

space. The nation’s leading memory chip company posted a 33% jump in fiscal Q1

revenue and a 59% surge in adjusted EPS thanks to strong broad-based demand for

its DRAM, NAND, and NOR chips. This prompted management to raise its full year

outlook sending Micron shares on a high volume run to within $1.17 of its

52-week high.

5G Smartphone Tailwind.....

Micron's revenue from the mobile business unit (MBU) increased 27% year over year to $1.9 billion in the fiscal first quarter. The segment produced nearly a quarter of the company's top line and was its second-largest source of revenue.

Micron pointed out that smartphones nowadays are using more DRAM (dynamic random-access memory) and NAND (short for "not and") flash memory. Management estimates that 5G smartphones are using 50% more DRAM to enable faster processing compared to 4G devices. Meanwhile, the amount of flash storage in 5G smartphones has doubled in comparison to 4G smartphones.

What's more, Micron management anticipates that the amount of memory and storage used in 5G smartphones will increase further thanks to the increasing adoption of data-intensive applications, which should create the need for more bandwidth and computing speed. Management pointed out that smartphone applications powered by artificial intelligence, 5G wireless technology, and emerging tech trends such as the metaverse will drive secular growth in the memory and storage demand.

So 5G smartphones are expected to create an additional content opportunity for the likes of Micron Technology -- but that is just one side of the coin. The sales of 5G smartphones are also expected to grow rapidly in the coming years, thereby creating a huge volume opportunity for memory manufacturers to tap into.

Micron estimates that 700 million 5G smartphones could be shipped in 2022, up significantly from this year's shipments of 500 million units. By 2025, annual 5G smartphone shipments are expected to hit 1.5 billion units as per third-party estimates, indicating that Micron's mobile revenue opportunity is all set to expand rapidly in the coming years.

As such, Micron's mobile business could keep growing at an impressive pace for a long time to come, especially considering its standing in the industry and the efforts it is undertaking to capture a bigger share of the market.

MediaTek.....

Micron's low-power double data rate 5X (LPDDR5X) DRAM was recently validated by Taiwanese chipmaker MediaTek for use with its Dimensity 9000 5G flagship smartphone chipset. According to Micron, its LPDDR5X DRAM can deliver a peak performance that's 33% faster than the previous generation LPDDR5 memory.

The good part is that Micron's validation by MediaTek could open an opportunity for the company to increase its mobile DRAM market share. That's because MediaTek commands a 40% share of the smartphone application processor market, according to Counterpoint Research. One of the reasons why MediaTek dominates the smartphone processor market is because of its 5G chips, which is a positive sign for Micron.

All of this indicates that Micron could keep benefiting from the 5G smartphone market in the long run, and that could help it remain a top growth stock for a long time to come.

Other Factors.....

As well, analysts believe that Micron is witnessing

growing demand for memory chips from cloud-computing providers and acceleration

in 5G (fifth-generation) cellular network adoptions. Rising mix of high-value

solutions, enhancement in customer engagement and improvement in cost structure

are growth drivers as well. Further, 5G adoption beyond mobile is likely to

spur demand for memory and storage, particularly in (Internet of Things)

devices and wireless infrastructure.

Micron is seeing rising demand from the automotive and industrial markets as well. Micron's automotive revenue was up 25% year over year in Q1 as demand for driver-assistance systems and in-vehicle infotainment is driving the need for more memory chips.

Additionally, growing electric vehicle (EV) adoption and the automation of cars will increase Micron's addressable market. The company points out on its earnings conference call:

New EVs are becoming like a data center on wheels, and we are already

seeing examples of 2022-model-year EVs supporting level 3 autonomous capability

with over 140 GB of DRAM and also examples with over 1 TB of NAND.

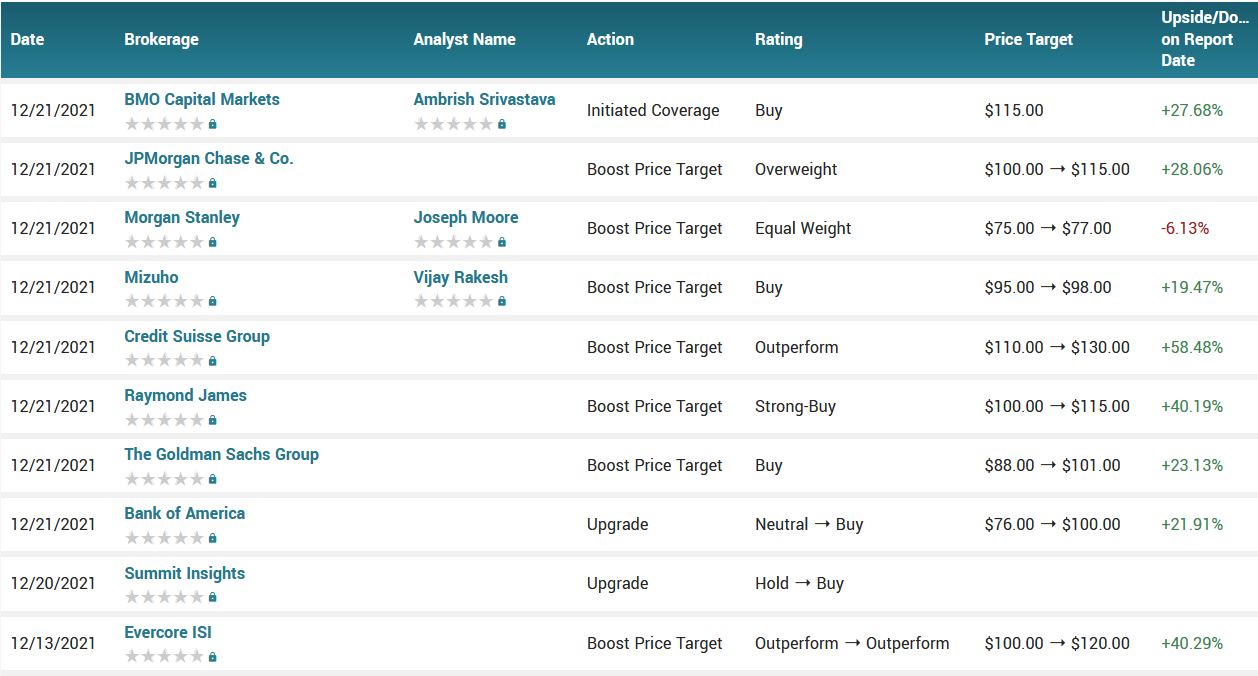

Analyst

Thoughts.....

Despite the stock’s 37% surge since the end of October, analysts are bullish on Micron’s growth prospects. The vast majority called the stock a buy in the wake of the Q1 report and many see at least 20% more upside. Rosenblatt Securities is a clear outlier with a wildly optimistic $165 price target.

According

to the issued ratings of 31 analysts in the last year, the consensus rating for

Micron Technology stock is Buy based on the current 1 sell rating, 5 hold

ratings, 24 buy ratings and 1 strong buy rating for MU. The average

twelve-month price target for Micron Technology is $107.86 with a high price

target of $165.00 and a low price target of $58.00.

Summary.....

With Wall Street playing catch up with its 2022 earnings forecast for Micron, the latest consensus is up to $11.51. So, at 8x forward earnings and a reinstated quarterly dividend, it’s easy to see why putting another weekly options trade on this chipmaker should be a sound move.

Micron stock has shot up more than 25% in the past three months, but the stock is still dirt cheap. It trades at just 14 times trailing earnings and 10 times forward earnings. These multiples are way lower than the NASDAQ 100 Index's earnings multiple of 34.7.

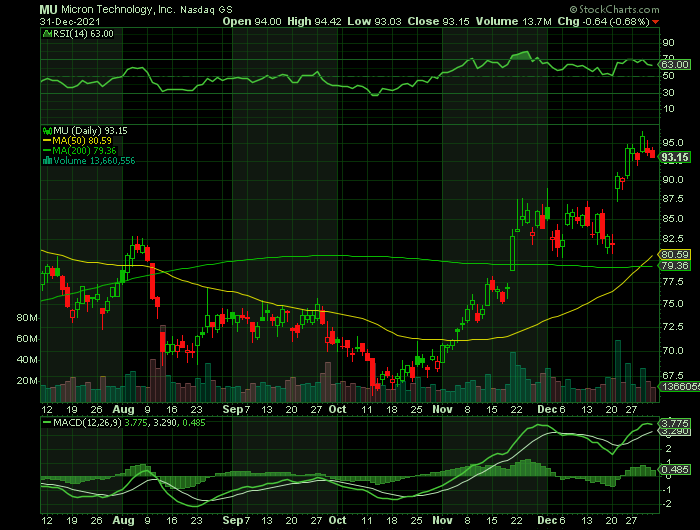

MU has a current ratio of 3.10, a quick ratio of 2.36 and a debt-to-equity ratio of 0.15. The stock has a market capitalization of $104.34 billion, a P/E ratio of 14.38, and a price-to-earnings-growth ratio of 0.45 and a beta of 1.15. The firm’s fifty day simple moving average is $81.56 and its two-hundred day simple moving average is $77.09. Micron Technology, Inc. has a 12 month low of $65.67 and a 12 month high of $96.96.

Back to Weekly Options USA Home Page